Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2022-08-26 • Updated

Information is not investment advice

Currencies, gold or indices… What to trade first?

You’ve already learned how to use some trading tools and strategies and when to enter/exit the market. However, you might be confused what asset to choose for trading at first. This article will help you to find out which trade instrument is best for you! Jump in!

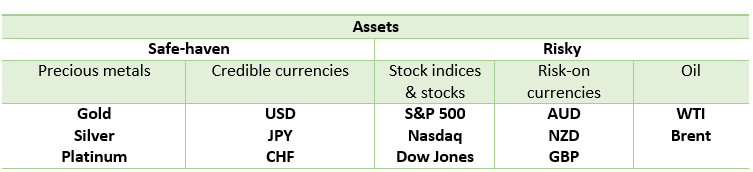

First, we can roughly divide all financial assets into two groups: safe-haven and risky. As a rule, safe-haven assets tend to rise in times of economic uncertainty and instability. In this case, traders usually say something like: “market sentiment is risk-off” or “risk-aversion prevails in the market”. When this happens, investors usually look for the safest places to park their capital. Therefore, they favor safe-haven assets such as precious metals: gold, silver, platinum, and the most trusted currencies: the US dollar (USD), the Japanese yen (JPY), and the Swiss Franc (CHF). Why this happens? Precious metals have a long history and traders believe that they will retain their high value in the future. The JPY and the CHF are considered reliable due to the stable financial positions of Japan and Switzerland. The USD is an occasional safe haven due to the strength of the US economy.

Let’s move on to risky assets. They are the Australian dollar, the New Zealand dollar, the British pound, oil, and stock indices such as S&P 500, NASDAQ, and Down Jones. Investors favor riskier assets when economic indicators in advanced nations are exceeding expectations, key banks and organizations release optimistic forecasts and other good news lighten up everyone’s mood. When things like that happen, traders and investors want to make money work, so they pursue higher yields and, as we know, higher yields always go hand in hand with higher risks, that’s why they buy higher-yielding riskier assets.

Well, it’s clear what currencies are, but what are indices like? Let’s figure it out. Indices are baskets of individual stocks, which are often ranked by independent institutions like major banks or financial companies. The most well-known stock index is S&P 500. It includes stocks of 500 large US companies. This index reveals the performance of the stock market by risks and revenues of these companies. Most traders use it as a barometer of market sentiment.

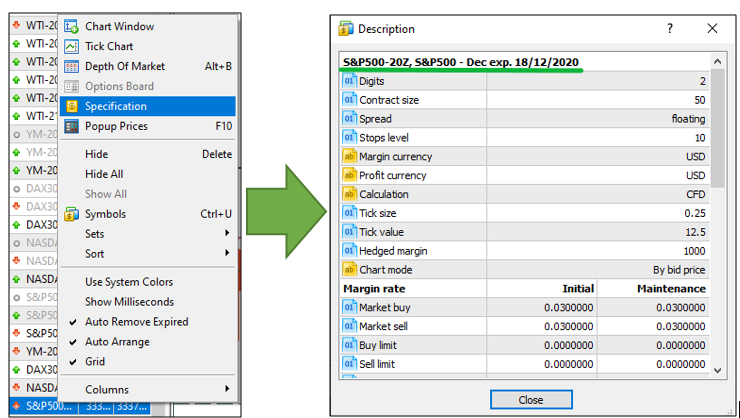

Here’s one thing you should remember: to trade indices mentioned above, you should choose contracts for difference (CFDs). For example, to trade the S&P 500 in September, you need to pick a CFD, which is named S&P 500-20U. Notice that this contract will expire on September 18. Thus, to trade this stock index further starting from September 18, you will need to choose another CFD: S&P 500-20Z, which expires on December 12. So, its first trade may be done on September 8, and the last trade – on December 18. You can check the expiration dates in MetaTrader by clicking the right mouse button at the CFD in question and choosing ‘Specification’.

Now, you have the basic knowledge of financial assets on Forex. Let’s discuss some market rules that every trader should know.

Trading tips for 2020: why is this year special?

It’s good to know that gold (XAU/USD) is likely to outperform the USD and the JPY during a recession. Why? Central banks generally cut interest rates to stimulate economic activity during a downturn. It gives an opportunity to those, who borrow money, as they will have to return less. At the same time, falling yields are unbeneficial for those, who want to make a deposit, as they would get less money.

Actually, the coronavirus added new rules to the market. One of them is that gold price has started moving along with stock prices. Analysts give the following explanation: traders try to protect their risky investments in stocks by buying safe-haven gold at the same time. Indeed, the current situation is mixed. On the one hand, there is some uncertainty in the market due to the Covid-19. On the other hand, vaccine hopes and positive economic releases improve the market sentiment. Also, the market is unpredictable and volatile these days. Therefore, investors have adapted to the new environment and unwittingly changed the rules. As a result, gold tends to move in the same direction with the stock market, especially the S&P 500, that we mentioned before. Remember that the market is quite changeable. You should always follow latest news to stay on track!

It’s important to follow significant economic releases, speeches from the central banks and governments and others market events. Why? They tend to drive prices. For example, if the British GDP comes out better than the forecasts, the British pound (GBP) will rise. Otherwise, the GBP will fall. Be aware that it works generally in most of the cases, but still not always. Sometimes, the market reaction is quite modest. So, here’s another tip: catch the overall market movement and join the flow!

What’s interesting is that some assets are highly correlated due to their economies or locations, for instance, the AUD and the NZD when they are traded against the USD or the EUR. Moreover, it’s essential to understand the country’s economic background. The best example is the Canadian dollar. It is really sensitive to the oil prices. The CAD and oil prices usually move in the same directions as the Canadian economy is one of the largest oil producers. Also, Chinese and Australian economies are highly connected due to the countries’ active trade relations. Therefore, Chinese economic releases have a huge impact not only on the Chinese yuan, but also on the Australian dollar.

The Forex world is really huge and diversified. It’s so interesting to explore and analyze it. If you understand how everything is interconnected on Forex, it will give you greater confidence in trading!

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later