Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2022-08-26 • Updated

Information is not investment advice

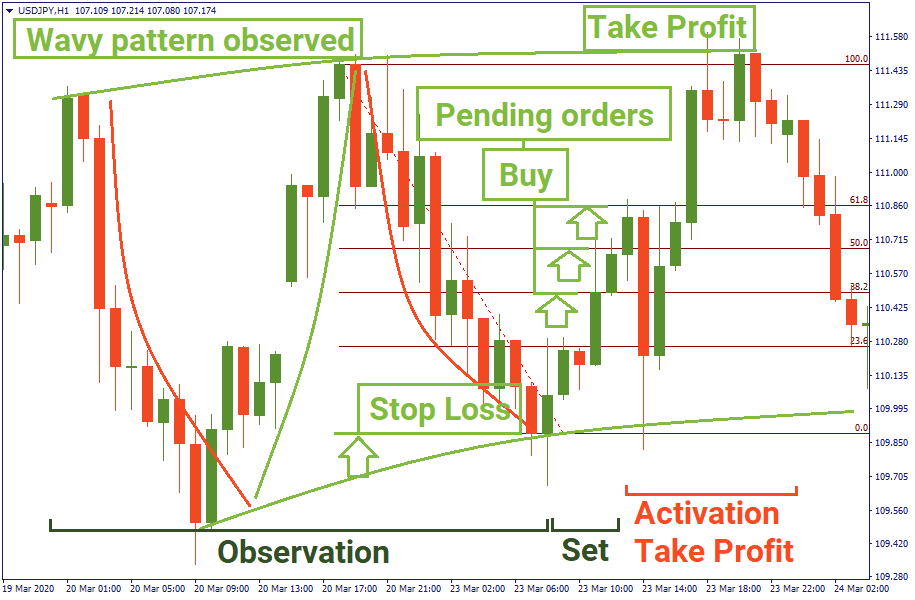

This strategy is called “Cherry-Blossom” because it suggests trading both American and Asian sessions. The idea proposed by this strategy is the following: American session is normally the one that shows the way, and the Asian session is the one that follows. So the approach here is to watch what happened during the American session and to open positions during the Asian session in the direction indicated by the American one. Opening positions is based on Fibonacci retracement levels as indicated below.

Practically, the American and the Asian sessions often do not trade in the same direction – in fact, it is very common that one trades against the other or goes into consolidation. Finally, in terms of time, it is the Asian session that opens the day, with the American session either confirming the moves or “disproving them”. For these reasons, a wider understanding of this strategy is suggested to make it more useful. Activating pending orders as in the image above requires the price to go into a retrace first, and then to fall into the observed direction. This relies on a wavy sideways pattern more than just on a trend continuation assumption. Therefore, it appears more practical to find a sideways pattern with a clear bottom or upper border, and apply the same steps.

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later