Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2022-11-18 • Updated

Information is not investment advice

30-pips-a-day is a trading strategy used with the volatile currency pairs like GBP/JPY. That is because this approach requires a wide space for trading maneuvers to obtain the required profit margin. Also, volatile currencies often provide clearer market reversal points. The timeframe used in this approach is 5 min.

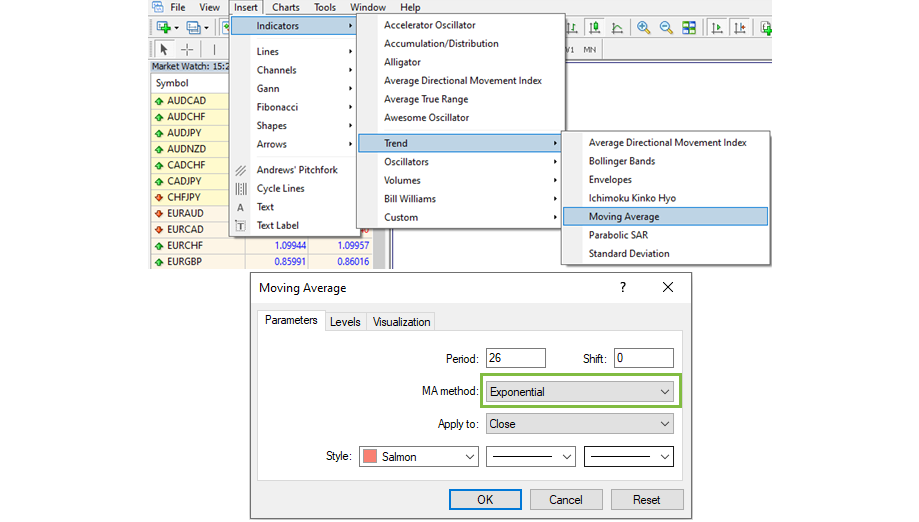

Below you will see how you can find the Moving Average indicator in the MetaTrader menu and where to set the Exponential method for it.

The EMAs crossings are used to define the trend.

If the 10-EMA crosses the 26-EMA bottom-up and continues rising, it is a sign of an uptrend.

If the 10-EMA crosses the 26-EMA upside-down and continues falling, there is pressure down on the price.

You wait for the 10-EMA to cross the 26-EMA. That will give you an indication to prepare for opening a position. Moreover, the way the 10-EMA crosses the 26-EMA defines the direction of trade opening, as will be explained in the scenarios below.

You wait for the price to follow the direction indicated by the EMAs to confirm your market interpretation.

You wait for a local correction against the observed trend. You will open a position at the high/low of this retrace. Your intention here will be to catch the range that the price will go through after getting out of the correction and following the observed trend again.

Below are the examples.

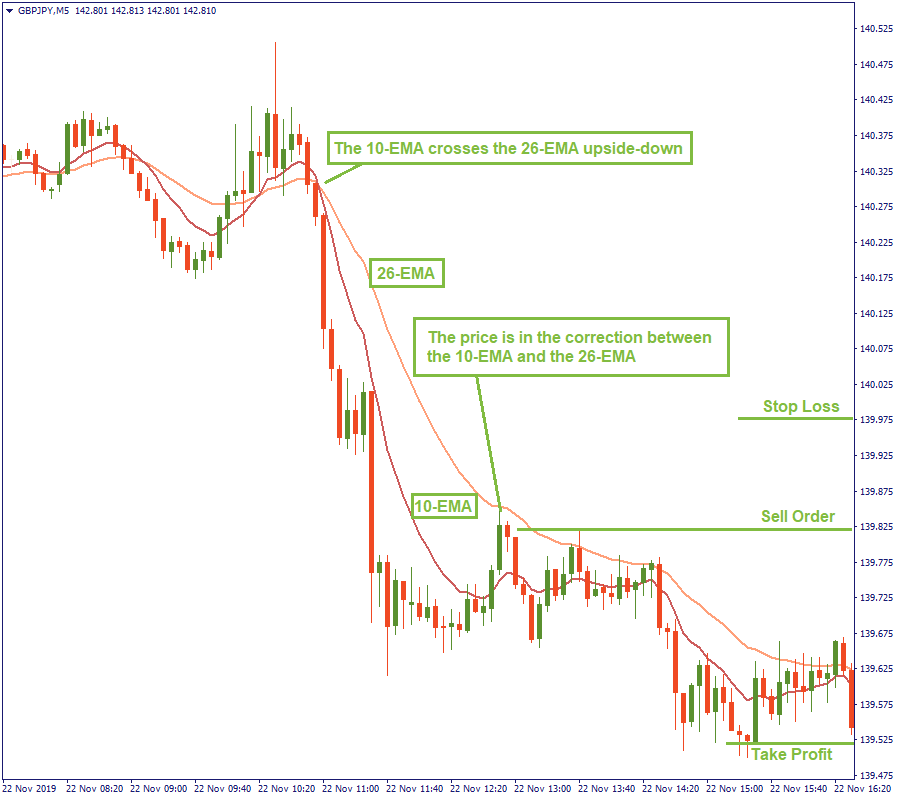

On the M5 chart of GBPJPY, we observe a downtrend. In addition, we see that the 10-EMA has crossed the 26-EMA upside-down and continued going down. Therefore, we decide to sell on the falling trend.

However, we do not sell immediately. Instead, we wait until the price moves up in a correction to reach at least the middle point between the two EMAs. Now we place a sell order.

The stop loss should be placed 15-20 pips above the sell order level. The take profit is 30-40 pips.

The same logic is applied to the rising market.

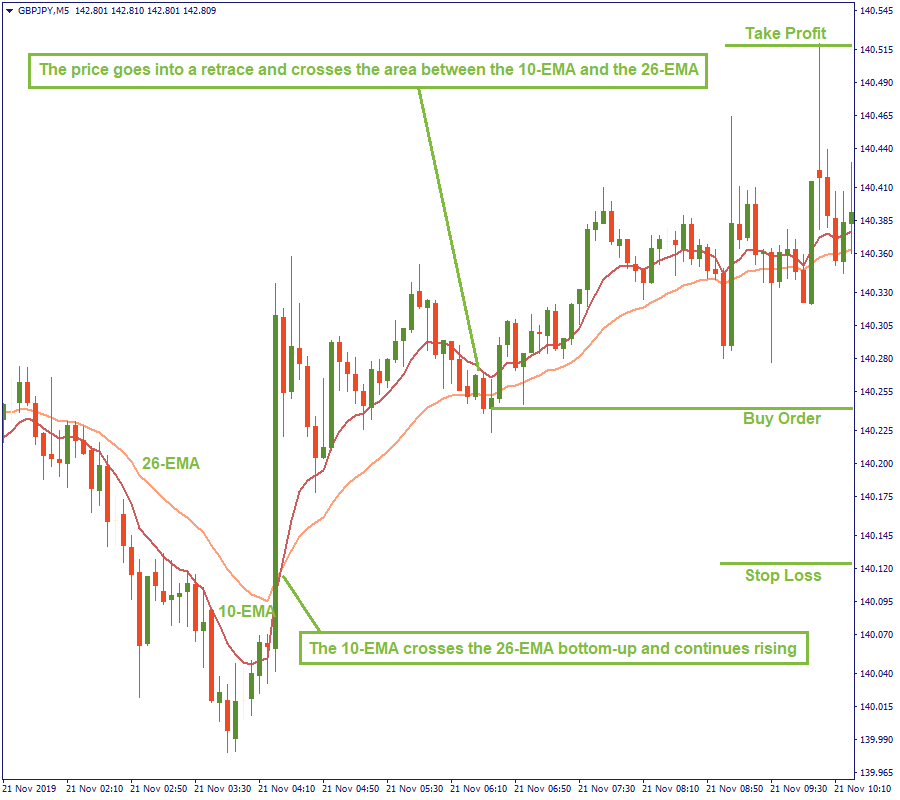

On the M5 chart of GBPJPY, we observe an uptrend. Also, we see that the 10-EMA has crossed the 26-EMA bottom-up and continued rising. Therefore, we decide to buy on the rising trend.

However, we do not buy immediately. Instead, we wait until the price moves down in a correction to reach at least the middle point between the two EMAs. Now we place a buy order.

Note: in this scenario, the price not only moved down to the middle point between the EMAs but dropped even lower – that is also acceptable. The idea here is to confirm that the retrace is significant enough to give maximum gain until the take-profit is activated.

The stop loss should be placed 15-20 pips below the buy order level. The take profit is 30-40 pips away.

As you can see, the Take Profit and Stop Loss levels are fairly far away from the position opening level. That is why the volatility of the currency is required to reach these levels and make the strategy work. On the other hand, this approach may be considered relatively risky for the same reason. The Stop Loss (15-20 pips) to Take Profit (30-40 pips) ratio is 1 to 2. The traders need to weigh this against the available equity and risk-management in use.

Making a conclusion, we can say that 30-pips-a-day is an interesting and aggressive strategy to make good profit with each trade. It is easily used but requires a good nerve. Cross-checked with standard trend analysis, it may be a good tool in a trader’s arsenal.

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later