Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2022-08-26 • Updated

Information is not investment advice

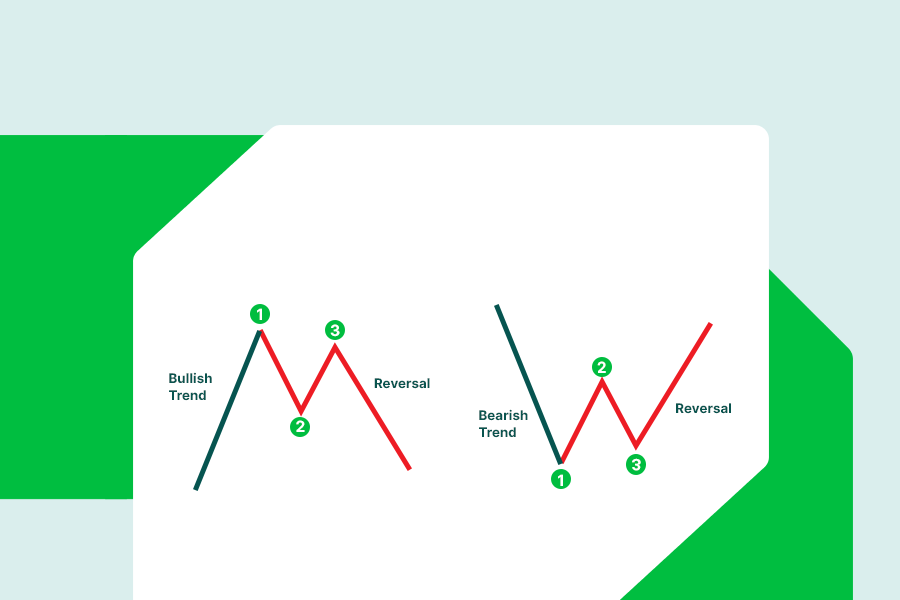

123 reversal setup is a basic on-chart formation, that warns about upcoming trend reversal.

The 123-chart pattern is a three-wave formation, where every move reaches a pivot point. This is where the name of the pattern comes from, the 1-2-3 pivot points.

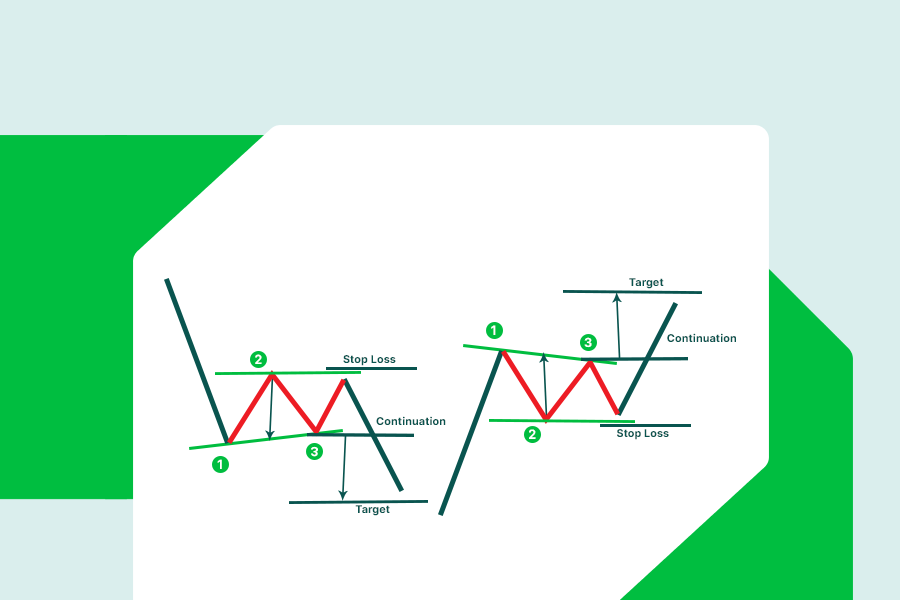

Here is how the pattern looks like:

123 pattern works in both directions. In the first case, a bullish trend turns into a bearish one. And the second picture presents the opposite, a bearish trend turns into a bullish one.

The pattern appears after three price movements, which form three pivot points and a confirmation level.

Pivot point 1.

This is a turning point that the price formed during the trend. If a price breaks the previous trendline after it formed pivot point 1, the pattern will be more reliable.

Pivot point 2.

The next turning point is very likely to form outside of the previous trendline or channel. This is a good indication that the trend might be ready to end and reverse.

Pivot point 3.

Pivot point 3 is crucial for 123 reversal chart patterns. The point must not exceed the pivot point 1 (in the worst case it might be on the same level) for the pattern to be valid.

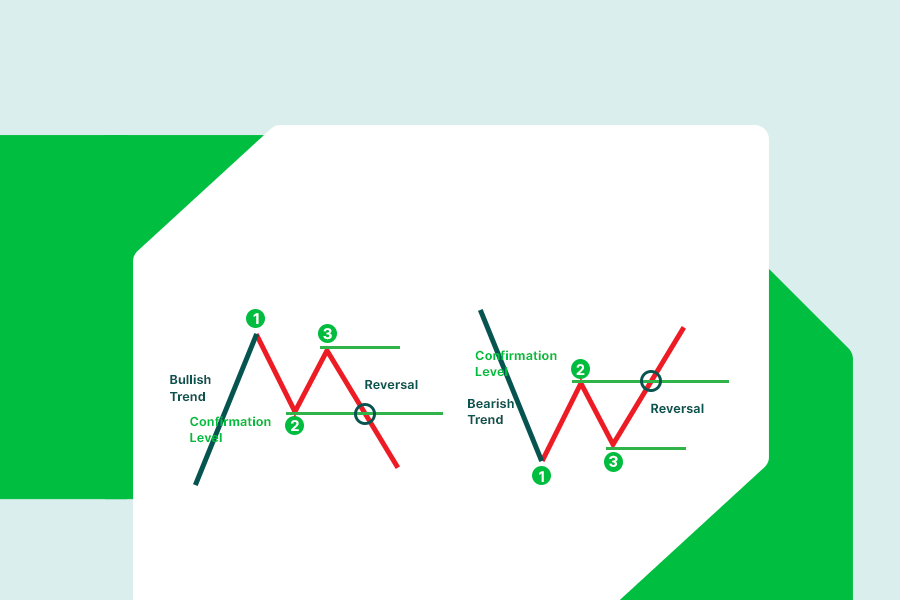

Confirmation level

The confirmation level is our entry point in the market. It is located at the same level as pivot point 2. When price breaks through this level open the trade.

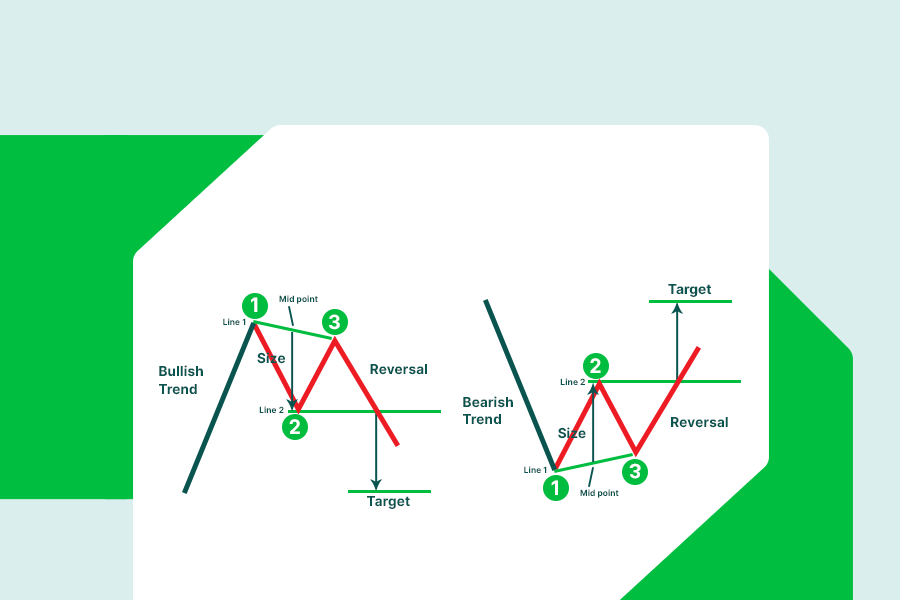

To set the target trader needs to connect 1 and 3 pivot points with a line. The size of your 123 pattern equals the vertical distance between Line 2 (which is a horizontal line at the level of 2 pivot point) and the midpoint of Line 1.

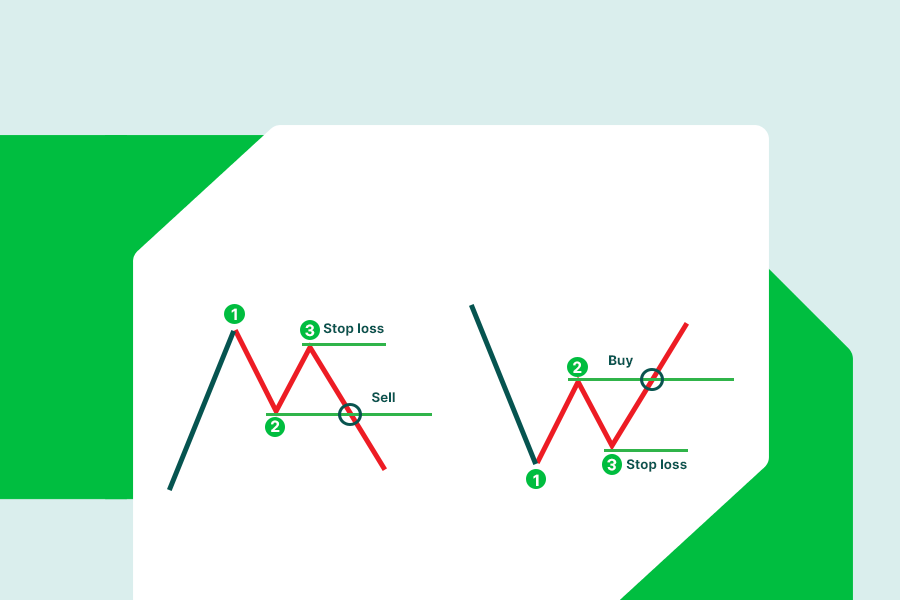

It is highly important to use stop loss when trading the 123 chart pattern. The stop loss should be set under pivot point 3 in the bullish trend reversal, and above in the bearish one. In the condition of high market volatility, the price might get pushed beyond the 2 pivot point for a while. That’s why it will be a good idea to set stop-loss slightly beyond the 3 pivot point, as this will prevent stop loss from being activated.

123 pattern also might work as a continuation pattern. In other words, it could give a signal that the trend is not going to reverse.

In this case, the price does not break the “confirmation level” at pivot point 2. On the contrary, it returns to the pivot point 3 level and breaks it through. This setup gives a signal that the trend will continue.

Stop-loss in continuation pattern formation

If you are trading the 123 pattern as a continuation formation, then your stop-loss order should go beyond Pivot Point 2.

The target of the “continuation 123 pattern” measures the same way as usual. The only exception is that in this case, you should take pivot point 3 as a starting one of your target.

If you would only know about 1-2-3 patter in May 2021. That would be the greatest short trade ever! Let’s look at the perfect example of this pattern!

Daily Bitcoin chart

After the Bitcoin chart has formed 1 pivot point the price dropped behind the trend line, where the 2 pivot point occurred. Then the price bounced back and the 3 pivot point and a potential stop loss level appeared. After the price broke the confirmation level it dropped and reached the pattern target.

Conclusion

123 pattern is a common pattern that usually appears at the beginning of many price reversals. Sometimes, it might give a signal about trend continuation as well. To get higher quality signals it is better to use the 123 pattern in a tandem with an oscillator (for example RSI). At the moments of RSI extremes, 123 pattern will provide the most accurate signals.

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later