The Us Bureau of Labor Statistics will release monthly average hourly earnings, non-farm employment change (NFP), and unemployment rate on June 3, 15:30 MT time (GMT+3).

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

As we have observed in the previous article, the escalation of the chronic US-Iran conflict put the Middle East unrest into the focus of the world’s political and economic news. Since the death of the Iranian military commander, general Soleimani, the countries only exchanged mutual threats. That pushed the markets away from the outright positive moods to the risk-aversion scenarios with the corresponding currencies and commodities.

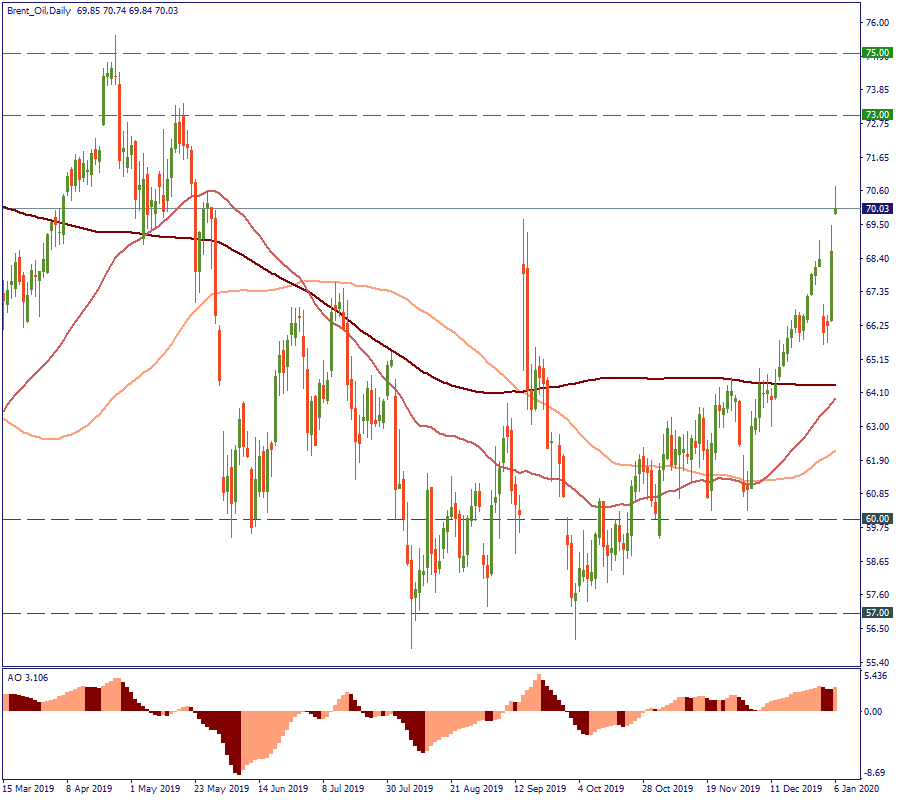

Brent is already trading at $70 per barrel. We mentioned this level as the expected maximum of the price movement for this year in the 2020 forecast for oil. On the daily chart below, the price reached this high with confidence, having now $73 as the next target. If no better news comes from the US-Iran front, there will be a high probability of the price getting there quite soon.

In general, the oil will be the first item to react to any Middle East news. As it is produced in this region, any shaky movement will push its price upwards (to the joy of OPEC+ and other oil-exporting countries, including the US, by the way).

Gold rose to where it has not been since 2013. On the weekly chart, it broke the August-2019 high of $1530 per ounce to the levels of $1570. The next resistance lies at $1610 at the level of the March-2013 high. The supports may be kept at $1483 and $1453. However, these are likely to stay untouched if the situation in the Middle East keeps evolving in the same direction.

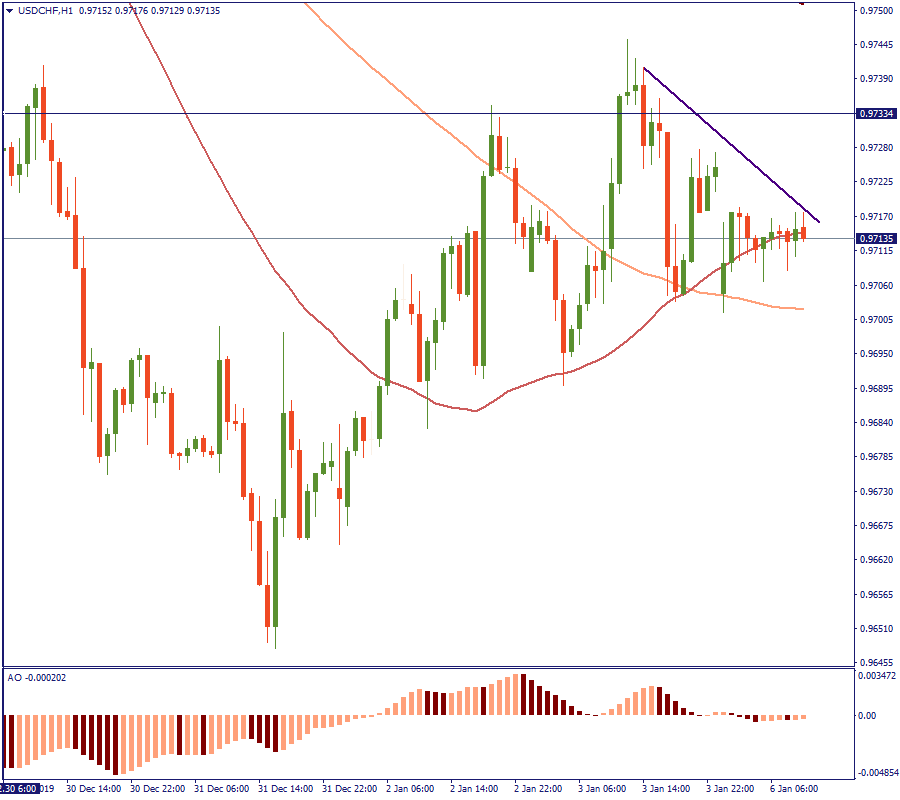

On the H1, January 3 is where the local downtrend starts – that’s when the news about the Iranian military commander was released. Before that, the USD/CHF was mostly rising. Now, the currency pair is traded at 0.9713, going into consolidation at the 50-period Moving Average level. That reflects the inner logic of the situation: the otherwise positive market mood waiting to see the US-China deal signed tripped at the sudden Middle East tension surge. If things go the same direction, the Swiss franc will keep gaining strength as the primary safe-haven currency, in line with the other ones.

No one expected the US-Iran relations to receive this sudden blow, but this is how things work. However, it would be an overstatement to say that the market seriously trembled. Yes, we saw related currencies and commodities react to the US-Iran worrying news, but nothing extraordinary happened so far. Now, it will be safe to assume that the market shrugs off an openly positive mood and enters a more cautious mode to receive more news about the Middle East situation and weigh them against the US-China trade deal confirmations.

The Us Bureau of Labor Statistics will release monthly average hourly earnings, non-farm employment change (NFP), and unemployment rate on June 3, 15:30 MT time (GMT+3).

The Organization of Petroleum Exporting Countries will hold a meeting on June 2.

Organization of the Petroleum Exporting Countries (OPEC) is scheduled to meet on January 4.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later