The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The New Year just started but risks are already in the arena. The US airstrike at the direction of Donald Trump killed a top Iranian commander Qassem Soleimani who extended his country’s power across the Middle East. Not surprising, Iran’s supreme leader, Ayatollah Ali Khamenei promised to retaliate.

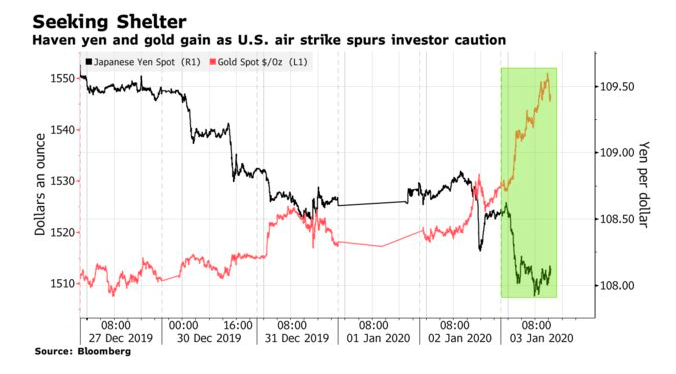

The global financial markets’ sentiment turned out to be cautious. As a result, markets reacted with the surge of the oil and the safe-haven assets such as gold and the Japanese yen.

Spike of the Japanese yen and gold against the USD

The surge of Brent at highs compared to levels after a drone strike on a Saudi Arabian oil facility in September 2019

Usually, such events cause a short-term market spike. However, this time, the effect may expand. There are clear risks of direct military confrontation between the two countries. Moreover, such anxieties can dominate markets during the whole year.

The escalation of the conflict is expected as Iran is ready to retaliate targeting US military installations and bases in the Middle East and mobilize its network of militias through the region.

DWS Group declares that the geopolitical tensions are supposed to become the major factor that may impact the market and make it move around especially in the election year.

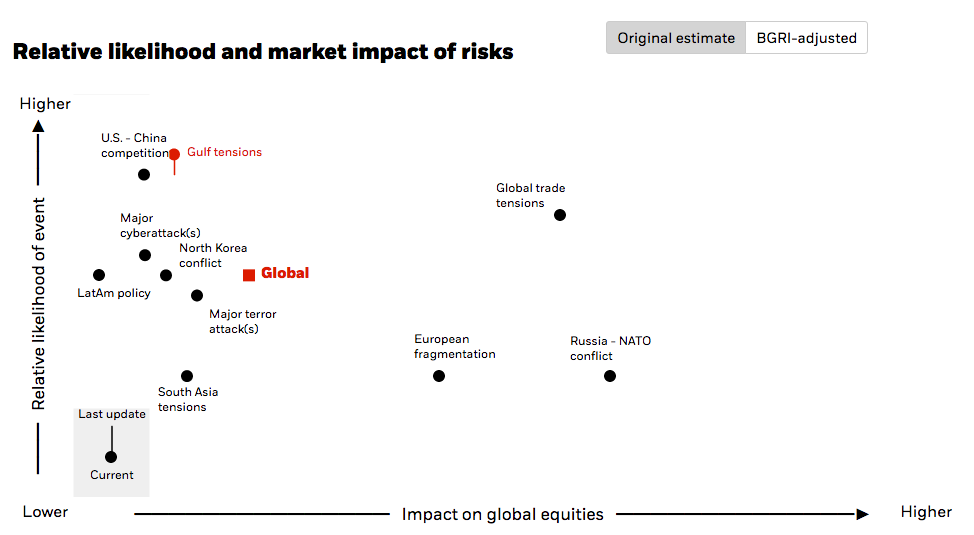

BlackRock Investment Institute believes the attention to geopolitics will remain high in 2020. The institute raised the likelihood of Gulf tensions from its already-elevated level. The tensions between the US, Iran and European parties about the nuclear deal are likely to continue. The possibility of additional incidents is high.

In the near term, there are risks of the attack on important energy facilities with the low probability of the US-Iran negotiations.

As a result, although the economic growth of 2020 is considered to be higher, any escalation of geopolitical risks could lead to a deeper slowdown.

Source: BlackRock Investment Institute

Recently, Bloomberg Global Business Forum accepted that politics may surpass the economical problems this year. Leaders of Goldman Sachs Group Inc., Blackstone Group Inc, and UBS Group AG determined insecurity on the geopolitical issue as a top of concerns.

Although the conflict is rising between Iran and the US, Iraq is supposed to be the first region under the risk. Iraq is the second-largest producer of the OPEC. Saudi Arabia, Kuwait, and Iran produce a big share of the world oil. Mostly the countries export the oil through the Strait of Hormuz in the Persian Gulf. Iran threatened to shut it down if there’s a war.

The negative impact on oil production and the rise of the oil prices are visible. But what about other markets?

Strategies of different authoritative institutions forecast the reaction of the markets.

Talking about the worries of the investors due to the situation in Iran, UOB recommends taking profit at the stock market. Stocks rallied a lot and currently, any bad news flow is a reason to fall.

According to ING Groep NV, the situation has not resulted in material escalation but the bid in US treasuries should prolong at least until the next week.

Colombo Wealth SA recommends using the possible retaliation to increase equity exposure as sentiment and positioning are possibly too high.

Societe Generale SA sees the Japanese yen as a winner among other assets such as gold and oil that appreciated due to the escalation. At the same time, bond yields are lower, the equity surge has stopped but there is no dramatical reverse. At the same time, “given the scope for tension to persist in the Strait of Hormuz, a protracted period of higher oil prices has to be a risk.”

Credit Agricole SA talks about the fragile risk sentiment because of the US-Sino trade war and the inability of the central banks to respond appropriately. The company calls the Japanese yen and Swiss Franc as the most attractive currencies mentioning risks for the “risk-correlated oil-importing currencies.”

Making a conclusion, we can say that the US-Iran tensions may accelerate. However, the reaction of the market may be limited until the new stage of the escalation. Moreover, we should remember about the oversupply concern that is always a risk for the oil prices. The OPEC supply cut program works well but the increase in the production may pull prices down again.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later