Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2023-02-02 • Updated

Information is not investment advice

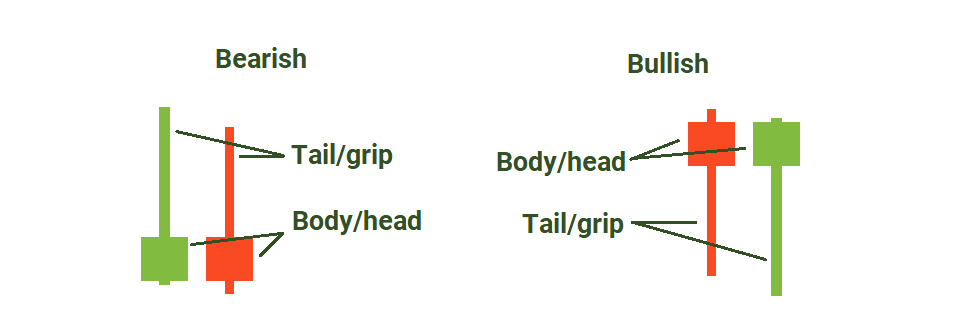

A pin bar is a typical hammer candlestick. It has a body (hammer head) and a tail (hammer grip). Its color doesn’t matter – it’s composition does as it defines whether it comes as a bullish or a bearish signal.

If the body is in the upper part of the candlestick – it’s a bullish sign, and a precursor of an upward reversal if there was a downtrend.

If the body is in the lower part of the candlestick – it’s a bearish sign, and it often precedes a downward reversal if there was an uptrend.

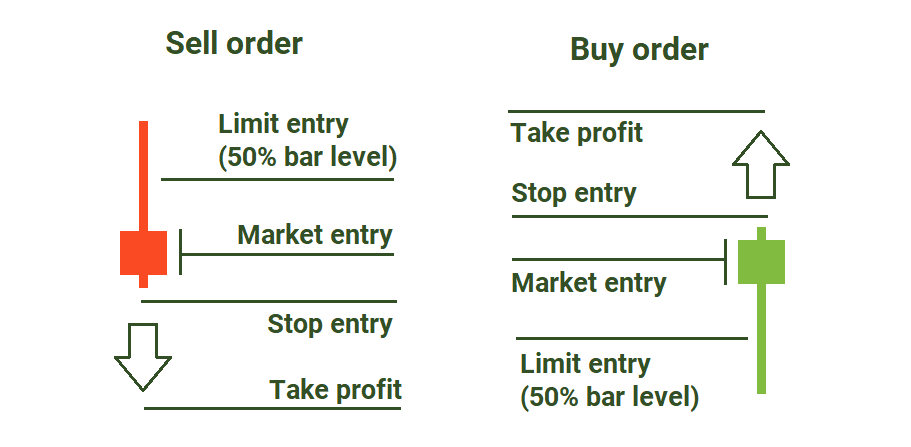

There are three easy ways to enter the market with the help of the pin bar/hammer.

Market entry: you just open position at the current price at a level that falls inside of the candle body/hammer head.

Limit entry: you place a limit order at a level that would be approximately 50% of the candle’s tail/hammer grip.

Stop entry: you put a sell/buy stop order just below/above the tip of the candlestick.

The image below shows where the levels of each entry type have to be located.

Important: make sure the pin bar/hammer is completed before you enter the market.

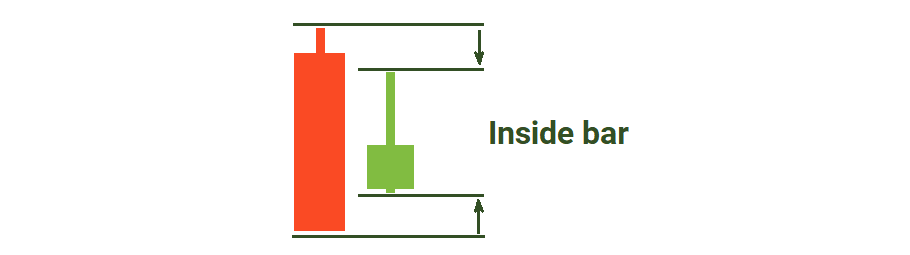

An inside bar refers to a two-candlestick formation when the body and the shadow of one bar are entirely within the limits of another bar. See the image below: the second bar is completely “overshadowed” by the first one.

Ideally, you will find an inside bar either below the tactical support level (bearish case) or above the resistance level (bullish case). Both scenarios indicate that the inside bar formation confirms that the level is broken, so it makes sense to open position.

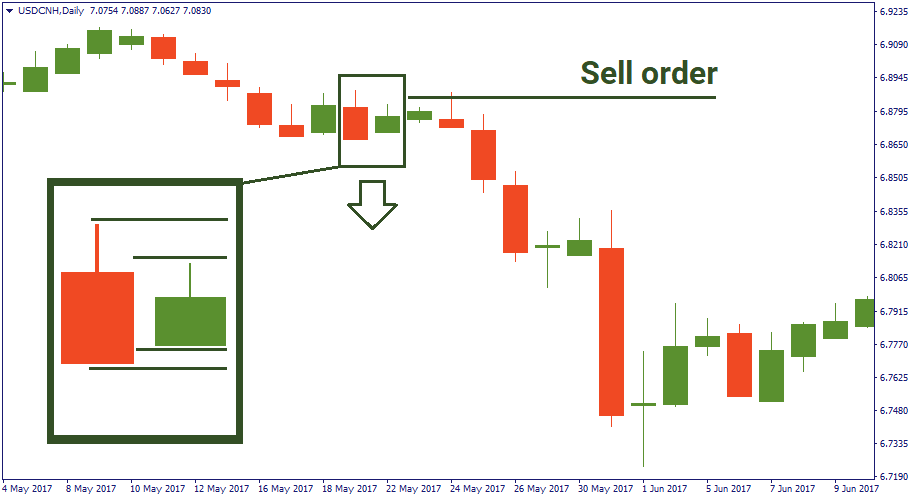

In an example below, you see that the trend was in a sluggish move slightly aimed downwards. But after the inside bar, it went straight downwards. In this scenario, you would open a sell order after the completion of the inside bar formation at any level within the first bar’s limits.

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later