Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2022-08-26 • Updated

Information is not investment advice

Every trader wants to achieve the best results. However, only a clever trader understands the importance of performance analysis in their daily operations. Imagine, you can randomly open trades and even get profit in some of them, but without good data you will be kind of lost. Analyzing your trading performance is especially necessary when you are testing out or developing a new trading system. This article will cover the primary metrics of trading performance that scrutinize your trading actions and help you create a perfect trading approach.

As you have probably guessed from the introduction part, the term “trading performance” refers to a method of evaluating a trader's results. A trader can use different metrics to get a proper evaluation and make a decent conclusion.

The simplest example of such a metric is a return on capital (ROC). It is calculated as the sum of profit divided by invested capital. So, for example, if you deposit $1000 and earn a profit of $200 during a specific period, your return would be 20%.

Apart from the return, there are other measures that you can use to assess your trading results. In the next paragraph, we will discuss the most popular techniques.

There are different ways you can track your trading performance. For example, some traders use Microsoft Excel, listing their deposit, size of lot per order, spread, take profit and stop loss. Based on this data, they automatically calculate the primary metrics for performance analysis, including average win/loss target price, etc. If you trade in MetaTrader 4 or 5, you can use the tools this software provides.

Generating Performance Reports with MT

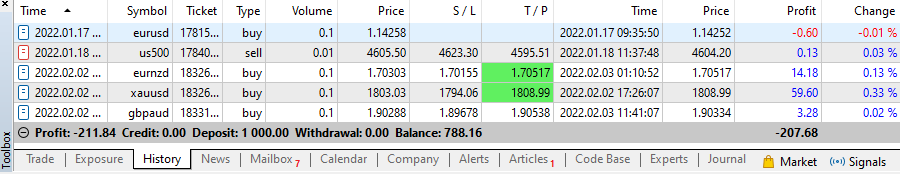

If you want to look at your trading performance in MetaTrader, open the “History” bar in your Toolbox window.

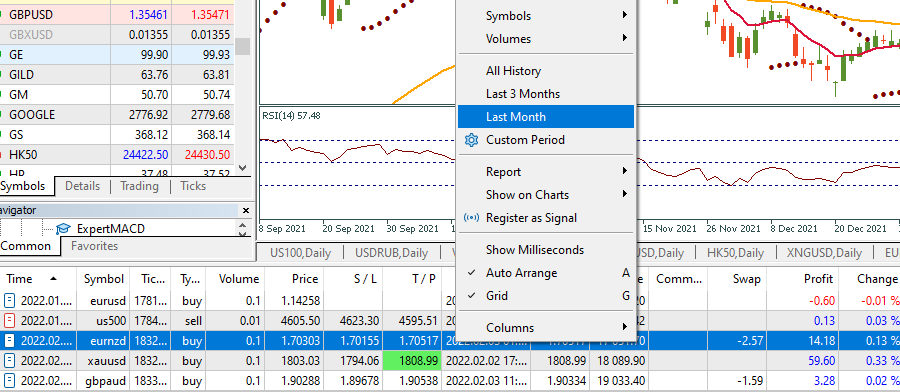

Firstly, you make a right-click on the chart and choose the period you want to analyze.

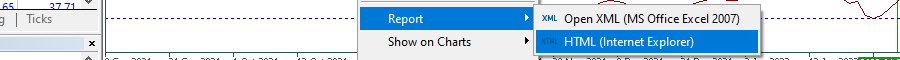

We chose one month. After that, you click “Report” and save it as either HTML or XML. If you save it as HTML, you can use any browser to open this file.

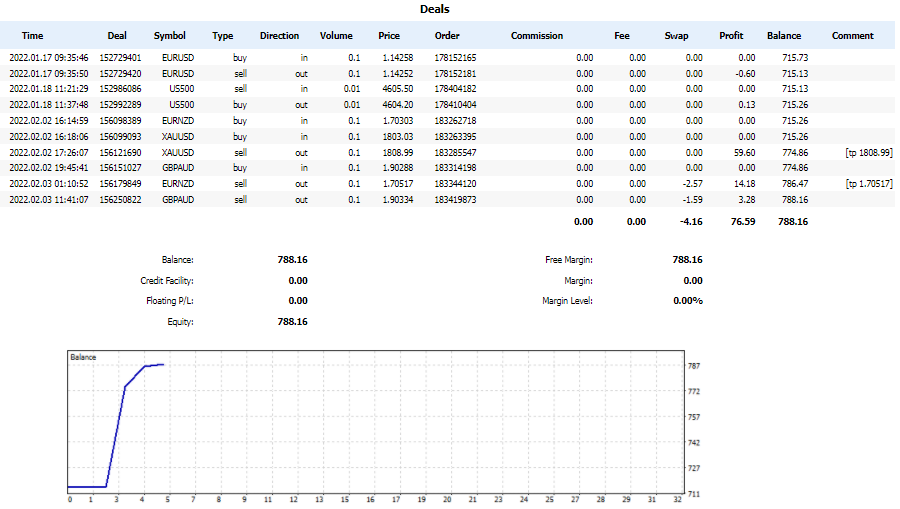

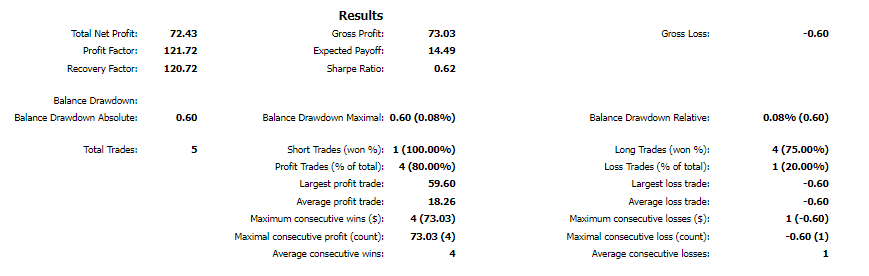

MetaTrader will generate the report that will look like this:

Below the chart, MetaTrader provides some handy trading statistics.

Let’s figure out what all these metrics mean!

First of all, let's understand the difference between gross and net profit. Gross profit shows profit before any expenses or costs, while net profit is a trader's profit after all costs. In Forex, costs may be swap charges and commissions paid to the broker.

The profit factor shows how much money you make compared to how much money you lose. For example, in the case above, we had five trades. We made money in four of them with the following profits: $0.13, $14.18, $59.6, and $3.28. On the other hand, we lost $0.6 in one trade. If we divide the total value of the winning positions minus swaps by the total value of the losing positions, we get:

((0.13+14.18+59.6+3.28)-4.16)/0.6=121.72

It means that your profits were 121.7 times higher than your losses. This is an extremely high figure. Keep in mind that if you test a strategy, it's highly recommended that a profit factor is between 1.75 and 4. Otherwise, the strategy is unreliable.

Absolute drawdown is the difference between the initial deposit and the lowest point the trading account reached below the deposit level. For example, if you deposited $1000, your account peaked at $2000 and then fell to $800, the absolute drawdown would be $200 ($1000-$800=$200). This figure represents your biggest loss compared to the initial deposit.

Maximal drawdown shows the difference between the highest and the lowest values your account has reached. Using the example in the description of the absolute drawdown’s definition, the maximal drawdown would be $1200 ($2000-$800).

Relative drawdown is the maximum drop of your equity in percentage. It can be calculated as maximal drawdown divided by maximal equity value multiplied by 100%. In our case, the relative drawdown would be equal to 60%.

All three metrics are crucial for a trader, as they help identify your trading account's risk factor. The quality of your drawdown depends on the size of a trading account. If your account size is large, 5-6% is normal, and you should keep it below 6%. If your account size is small, then 15-20% of a drawdown is normal, and a drawdown above 20% can be named as risky.

Based on the calculation of a drawdown, we can identify our recovery factor. The recovery factor equals the absolute value of net profit divided by maximal drawdown. For example, if our net profit is 72.43 and maximal drawdown is 0.6, our recovery factor will be:

72.43/0.6=120.72.

The recovery factor should be typically larger than 1. According to traders, the higher the recovery factor is, the faster a trade is recovering from drawdowns.

Another interesting indicator from the report is the Sharpe ratio. Nobel laureate William F. Sharpe developed it. This ratio helps investors understand the return of an investment compared to its risk. The higher the ratio gets, the higher the trader’s return in relation to the risk taken. Usually, traders prefer to have a Sharpe ratio equal to or higher than 1. If the ratio is smaller than 1, a trader is taking too much risk compared to the expected return. A classic formula of the Sharpe ratio looks like this:

Sharpe ratio = (Return of a portfolio – Risk-free rate) / Standard deviation of the portfolio's excess return.

In MetaTrader, the Sharpe Ratio is calculated as average profit to standard deviation.

There is also a Sortino ratio, which is very similar to the Sharpe ratio, but with some adjustments. The Sortino ratio does not take into account the total volatility of the investment. Apart from the Sharpe ratio, it focuses on the downside volatility. It is computed by finding the difference between an investment's average return and risk-free rates. The result is divided by the standard deviation of negative returns. A high ratio is preferred, as it shows that a trader will get a higher return for each unit of downside risk.

The third brother of the Sharpe and Sortino ratios is a Calmar ratio, which takes the drawdown as a risk measure.

Besides metrics listed in the MetaTrader’s report, there are some other ones you can use to analyze your performance. Let’s look at them in detail.

This is not exactly the metrics but the rule of risk management. If you use it, you choose a percentage you are willing to risk per trade and do not exceed it. The 2% figure is what traders normally select. This way, you prevent your trades from unexpected drawdowns.

If you choose this method, you focus on the number of points or pips you want to risk per trade. However, experts do not recommend using this approach, as they advise focusing on a % of the risk.

In classic books on Forex, it is usually recommended to use a 1:3 risk/reward ratio. That is, the reward on a particular trade should be three times higher than risk.

This data shows how many winning trades compared e to the number of losing trades a trader has. For example, if you have 6 successful trades out of all 10, you would have a win ratio of 60%. Sometimes, profitable traders have a win ratio of less than 50%. This can happen because their profit on their winning trades outperforms the loss they make on their losing trades.

After reading this article, you can find the analysis of your trades in MetaTrader and interpret the metrics listed there. It is worth mentioning that these elements of performance analysis are ideal for testing out a strategy either manually or with the help of a back tester. If you program a trading robot, analysis of drawdown and profit factors will be your keys to understanding further improvements.

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later