Bill Williams est le créateur de certains des indicateurs de marché les plus populaires : Awesome Oscillator, Fractals (fractales), Alligator et Gator.

Ne perdez pas votre temps - analysez l'influence du NFP sur le dollar américain!

Avis de collecte de données

Nous conservons un enregistrement de vos données pour gérer ce site web. En cliquant sur le bouton, vous acceptez notre politique de confidentialité.

Guide pour débutant Forex

Votre guide ultime dans le monde du trading.

Consultez votre boîte de réception !

Dans notre e-mail, vous trouverez notre guide Forex. Appuyez simplement sur le bouton pour l'obtenir !

Avertissement sur les risques : Les ᏟᖴᎠ sont des instruments complexes et ils présentent un risque élevé qui peut vous faire perdre de l'argent rapidement en raison de l'effet de levier.

68,53 % des investisseurs particuliers perdent de l'argent lorsqu'ils tradent des ᏟᖴᎠ avec ce fournisseur.

Vous devez vous demander si vous comprenez le fonctionnement des ᏟᖴᎠ et si vous pouvez vous permettre de prendre des risques élevés qui peuvent mener à d'importantes pertes d'argent.

2022-11-18 • Mis à jour

Les informations données ne sont pas des conseils en investissement

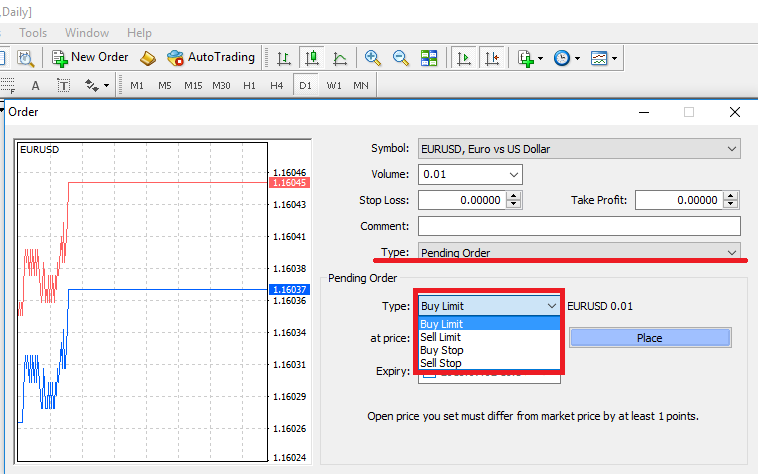

Il y a des situations où vous ne voulez pas entrer sur le marché avec prix qu'il vous offre. Les raisons peuvent être différentes. Par exemple, vous savez que vous pouvez acheter la paire à un prix inférieur et vous préférez attendre ou vous n'êtes pas sûr de la direction du prix mais vous savez que si la paire atteint un certain niveau, sa direction sera alors évidente. Alors, que devez-vous faire ? Attendre devant votre écran que le niveau du prix soit dans les conditions que vous voulez ? Pas du tout ! Fort heureusement, il y a les ordres différés !

Il existe deux types d'ordres différés : les ordres à cours limité et les ordres stop. Comme un trader a toujours le choix d'acheter ou de vendre, il est logique qu'il existe deux types d'ordres à cours limité: "Buy limit" et Sell limit". Les ordres stop peuvent également être décomposés en ordres "Buy stop" et "Sell stop".

Commençons par les ordres à cours limité.

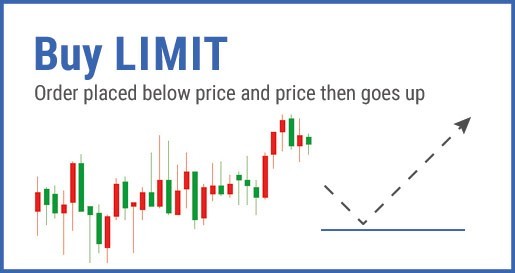

Imaginez que vous supposiez que, même si le prix diminue maintenant, il va rebondir à partir d'un certain niveau et remonter ensuite. En conséquence, vous devez placer un ordre d'achat au prix que vous pensez être un point d'inversion pour le prix (en dessous du prix actuel). Ce type d'ordres vous permet ainsi d'acheter à un prix inférieur.

Inversement, il peut y avoir un moment où vous constatez que le prix augmente, cependant, vous êtes certain qu'il va rencontrer une forte résistance, reculer et baisser. Dans ce cas, vous devez placer un ordre SELL LIMIT au-dessus du prix actuel. Ce type d'ordres vous permet de vendre à un prix plus élevé.

Notez que vous devez utiliser des ordres à cours limité lorsque vous attendez un niveau de soutien ou de résistance.

Qu'en est-il de l'autre type d'ordres différés, les ordres stop ?

Les ordres stop sont utilisés lorsqu'un trader s'attend à ce que le prix traverse un niveau de résistance ou de soutien.

Imaginez que le prix augmente et que vous êtes sûr que s'il va atteindre un certain niveau, en allant encore plus loin. Dans ce cas, vous devez placer un ordre BUY STOP à un niveau supérieur au prix actuel.

Inversement, supposons que le prix baisse et que vous pensez qu'après avoir atteint un certain niveau, le prix baissera encore plus. Par conséquent, vous devez placer un ordre SELL STOP en dessous du prix actuel.

Vous pouvez vous demander : pourquoi devrais-je utiliser un ordre stop si le prix ne rebondit pas et continue son mouvement dans la même direction ? Je peux acheter au prix le plus bas ou vendre au plus haut. Il y a un indice ici. L'ordre stop est utilisé afin de confirmer avec précision l'orientation ultérieure du prix. Si la paire atteint un certain niveau, vous pouvez être sûr qu'elle ira plus loin, sinon, elle peut rebondir avant d'atteindre le niveau que vous avez défini.

Un conseil important : n'oubliez pas que si le prix n'atteint pas le niveau que vous avez défini pour votre ordre différé, le trade ne s'ouvrira pas. Il y a quelque chose d'important qu'il ne faut surtout pas oublier ici : vous devez fermer l'ordre s'il n'a pas été exécuté, car si vous l'oubliez, une transaction pourra s'ouvrir ultérieurement sans que vous ne le vouliez. Afin d'éviter ce problème, il suffit de définir la période d'expiration de vos ordres différés.

En conclusion, nous pouvons dire que les ordres différés sont un excellent moyen afin de réduire vos efforts et passer moins de temps devant l'écran. En outre, les ordres différés vous permettront d'être sûr de la direction future du prix et de rentrer sur le marché au prix le plus attractif. C'est un excellent moyen afin de rendre votre trading plus précis et plus rentable !

Bill Williams est le créateur de certains des indicateurs de marché les plus populaires : Awesome Oscillator, Fractals (fractales), Alligator et Gator.

Les stratégies de tendance sont intéressantes, elles peuvent donner d'excellents résultats sur tous les intervalles de temps et avec tous les types d'actifs. L'idée principale de la stratégie ADX basée sur les tendances est d'essayer d'identifier le début de la tendance.

Les stratégies de contre-tendance sont toujours les plus hasardeuses mais aussi les plus rentables. Nous avons le plaisir de vous présenter une excellente stratégie de contre-tendance qui fonctionne sur tous les marchés et avec tous les actifs.

Votre demande a été acceptée.

Nous vous appellerons lors de l'intervalle de temps que vous aurez choisi

La prochaine demande de rappel pour ce numéro de téléphone sera disponible dans 00:30:00

Si vous avez un problème urgent, veuillez nous contacter via le

Chat en direct

Erreur interne. Veuillez réessayer ultérieurement