Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2022-01-26 • Updated

Information is not investment advice

Earnings seasons offer unique opportunities for traders. This is the time when the largest American companies publish their earnings reports for the previous quarter. The price can jump or fall by tens of percent after these releases.

The best thing is that the earnings not only influence the stock’s prices but also increase volatility in the currency pairs. As a result, the entire financial market comes in motion, and this time is ideal for trading.

Are you interested? Below you will find more information about trading on earnings.

Do you know that you can trade stocks of the world's largest companies with FBS? Just download FBS Trader app or open an MT5 account in your Personal Area!

There are four earnings seasons a year. Each one lasts for several weeks. Earnings are released during the month, which follows the quarter (January, April, July, and October). This is when you should check the earnings calendar to learn when to trade.

The theory of trading companies’ earnings is very simple:

In practice, there are nuances. You may find many similarities between trading on companies' earnings and trading on the news from the Forex economic calendar.

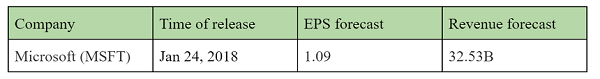

Analysts make their forecasts about the awaited numbers several weeks before the earnings season starts. Usually, they predict earnings per share (EPS) and revenue. This information is available on the FBS website ahead of the earnings release. After the forecasts are published, the price gets in motion on the basis of these estimates and investors’ expectations. If the forecast is good, the stock's price goes up. If the prediction is bad, the price declines.

Tip 1. If you want to make a deeper analysis of the company’s report to increase your profit probability, check the website of the company the stocks of which you plan to trade. For quick access, google “[company name] investor relations”, and you’ll get the exact time of the earnings release, the previous reports, and the full actual report once it’s out.

The most interesting thing starts when the earnings report is released. The element of surprise is very important: the bigger the difference between the actual reading and the forecast, the bigger the movement of the market. In addition, the so-called “buy the rumor, sell the fact” scenario may happen: the price can fall despite strong numbers if the market has already priced in the good outcome, and investors who bought the stock before the release start selling it afterward.

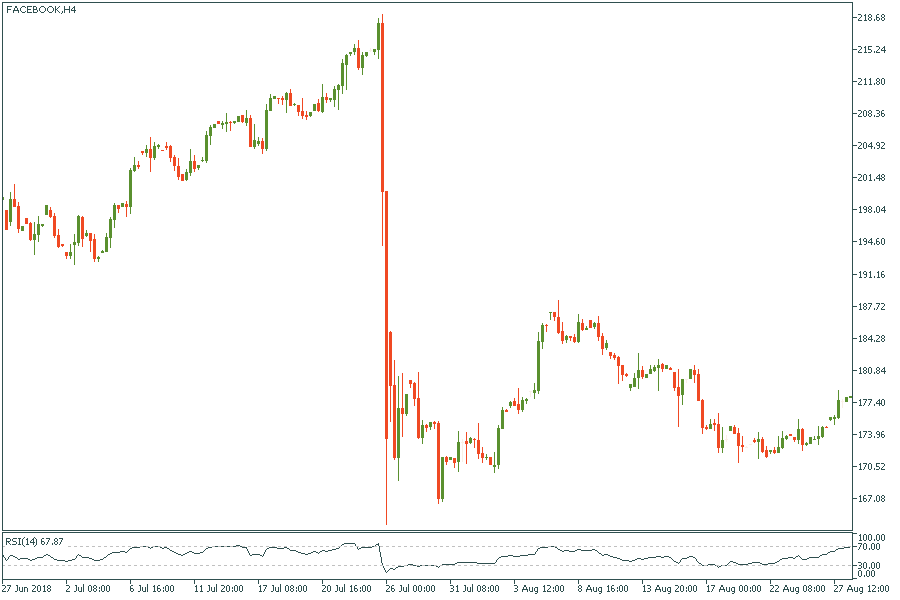

Here's an example of how the price moves on an earnings report. Facebook stocks plunged by about 25% on July 25, 2018. The company’s revenue was lower ($13.23 billion vs. $13.36 billion per a Thomson Reuters consensus estimate), and the number of global daily active users turned out to be lower than expected (1.47 billion vs. 1.49 billion, according to a StreetAccount and FactSet estimate). Notice that the stock was constantly rising ahead of the release and got overbought.

Wise traders pay attention not only to the company’s EPS and revenue but analyze the bigger picture. Here are the life hacks that will help you trade on earnings properly.

Tip 2. The news from large companies has a great impact on the entire American stock market. So, if the stocks of Microsoft or Amazon jump, S&P 500 will likely go up as well. In addition, the stocks can influence the USD exchange rate as well. Rising stocks can either increase demand for the greenback as investors will await the Federal Reserve’s rate hike or encourage risk appetite and demand for higher-yielding currencies like the AUD and the NZD. The reaction of the Forex market will depend on the recent drivers of the USD.

All in all, if the earnings forecasts come true, the price of a stock will likely reverse in the opposite direction compared with its dynamics during the previous two weeks. If the reading overshoots/undershoots the forecast on a big scale, the overbought/oversold market will correct up if the surprise is positive or down if the data is disappointing.

Now you are ready to trade on earnings! Make sure that you get the FBS Trader app or have set up MT5 and start planning your trades!

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later