Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2022-03-31 • Updated

Information is not investment advice

Well, you’ve decided to invest in stocks, but what stocks to choose and how? Read this article and you’ll get a step-by-step guide to pick the right stocks.

To understand whether the stock has the potential to grow or not, you’ll need to know the following terms.

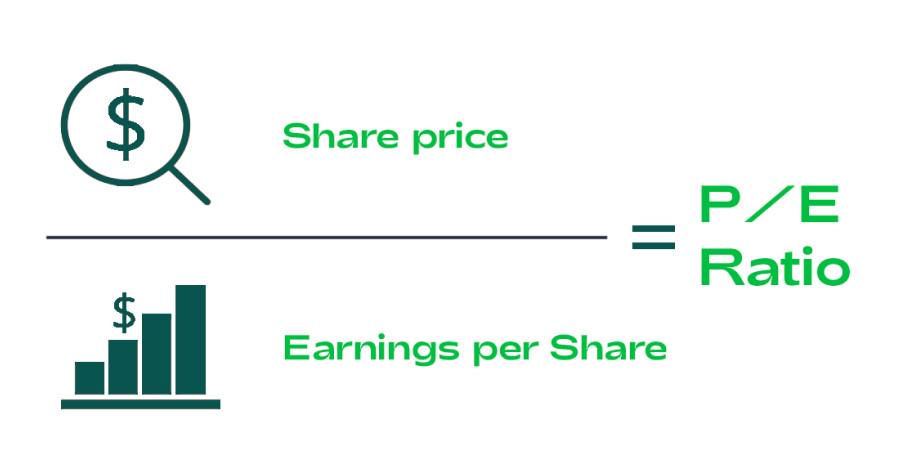

The price-to-earnings ratio (P/E ratio) is one of the most widely-used tools used by investors to determine stock valuation. The P/E is calculated as the price per share divided by earnings per share. To find the current price per share, you can open the FBS Trader app or MetaTrader 5. To get the latest earnings report of a particular company, you can just google “[company name] investor relations” and you’ll get the exact time of the earnings release, the previous reports, and the full actual report once it’s out.

P/E ratio simply shows how much investors are paying for a dollar of profits. Investors use this indicator to compare different stocks or even one stock with its historical record.

High P/E could mean that a stock's price is high relative to earnings and possibly overvalued. Conversely, a low P/E might indicate that the current stock price is low relative to earnings.

In general, if P/E is high, investors expect higher earnings growth in the future compared to companies with a lower P/E. However, a low P/E can signal that a company is undervalued and thus it may have a potential to rise or that the company is doing exceptionally well relative to its past trends.

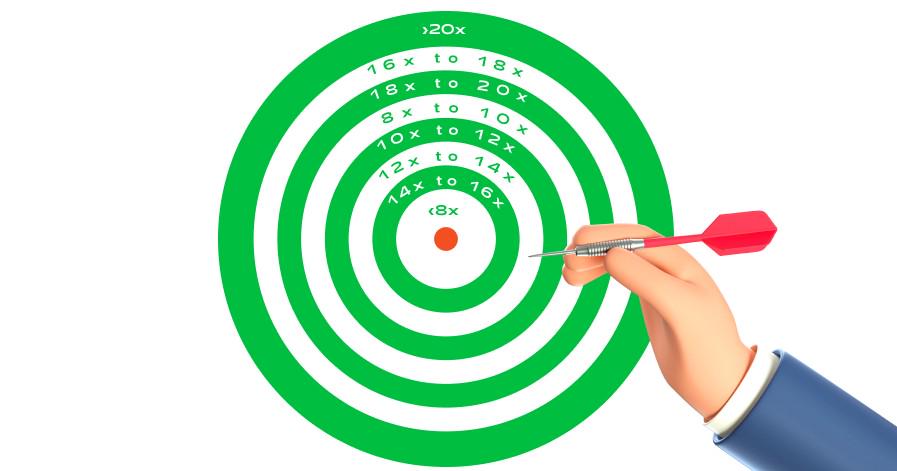

There are no strict rules for defining P/E as low or high, but, typically, the P/E ratio below 14 means the stock price is low, above 20 are considered to be high.

Most investors prefer investing in stocks with lower P/E ratios as it means these companies have room to rise further, but it also protects on the downside, as cheaper businesses tend to fall less than more expensive ones during a market crash. Obviously, you don’t want to buy the cheapest companies. A P/E ratio that is significantly lower than the average one in the stock segment may be a negative sign.

|

Stocks |

P/E ratio |

|

Goldman Sachs |

9.17

|

|

Citigroup |

9.89 |

|

Intel |

12.58

|

|

Philip Morris |

17.72 |

|

Qualcomm |

18.49 |

|

Pfizer |

20.03 |

|

Alibaba |

26.10 |

|

|

26.22 |

|

|

30.22 |

|

MasterCard |

56.30 |

|

Netflix |

59.94 |

The company pays some percentage of the stock's value to its investors, which is called a dividend. The yield is the annual dividend payout divided by the stock price. If a company increases its dividend payouts every year, it’s a positive signal for investors as it shows its economic sustainability over some period of time. There are some companies in the S&P 500 that increase their dividends for 25 years in a row. They are called dividend aristocrats. Among them are Coca-Cola, McDonald’s, Procter & Gamble, etc.

Growth stocks are those expected to grow faster than the rest of the stocks, and that’s why they are named so. Sometimes, they can be riskier but traders prefer choosing them because of greater potential in the end. Examples are Google and Amazon. They have never paid a dividend as these companies prefer using their available capital investing in internal businesses.

Income stocks are those that are not volatile but have a good background of paying higher dividends than other stocks. For example, AT&T, a giant telecom company.

Value stocks are those that are undervalued. They are trading at a lower price than their underlying companies are worthy of, according to investors/analysts. The trick is to find it faster than the rest of the investors! When others recognize its potential, the owner of such a stock would gain. Examples are General Motors and Ford.

Blue-chip stocks are those that have been rising for a long time and thus considered low-risk investments. However, they tend to increase the value slower than the growth stocks or pay as well as income stocks. Examples are Microsoft and Alibaba.

Defensive stocks are those in which companies offer such necessary products and services that people would buy no matter what. They include the stocks of food and beverage companies and pharmaceutical companies. A good example would be the giant retailer Walmart.

Cyclical stocks generally follow the economic cycle of growth and recession – they rise in times of economic expansion but fall during recessions and market instability. Cyclical stocks are usually the travel and hospitality industries, automakers, and banks.

Speculative stocks are usually young companies with revolutionary technologies or unique products. The performance of these stocks is hard to predict, and they are viewed as high-risk investments as high returns always go along with high risk.

It is the most universal recommendation for stock investors. The idea behind diversification is not to put all the eggs in one basket – to collect a set of various stocks that will react differently during the same economic events. The goal is to minimize the risks of unexpected price movements of one asset. To diversify, you need to do the following things.

In the short term, the chosen stocks can fluctuate, drop during market shocks, but it’s necessary to stick to your long-term plan especially during a high-volatile market.

Be updated with the news of the stock market and experts’ opinions. For example, now the electric vehicles are on hype as Biden is planning to make the US carbon-free and analysts forecast the bright future for EV stocks. However, it’s not only Tesla, there are other stocks like Ford and General Motors which are trying to move from petrol to electricity and are also viewed as value stocks. Pay attention to both the overall stock market trends and to the news of the particular companies that you own or you’re interested in.

Well, this was a lot of information. If you read till the end, you’re the hero! Take your time, digest all this knowledge and then find your favorite stocks!

P.S. If you feel overwhelmed, it’s a good idea to start with investing in an index fund.

Here’s how Warren Buffett has advised his trustees to manage the money he will leave to his wife: “Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund”.

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later