Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2022-08-26 • Updated

Information is not investment advice

While trying to find a perfect balance between day trading strategy and scalping, traders may discover an attractive in-between style. The name of the article speaks for itself: today we are going to talk about swing trading. So, what is swing trading?

Swing trading is a specific approach to trading, which combines fundamental and technical analyses. Trading swings reminds of surfing: you catch the swings when the price changes direction. If you choose this trading style, you hold your position for several days. Therefore, you should be familiar with the main principles of position size management and the mechanism of swaps.

You’ve probably guessed that swing trading works perfectly during sideways markets, as in that situation the price fluctuates within certain levels. At the same time, “swing-catching” is also possible when a price makes corrections within a trend.

If the swing trading sounds too complicated for you, we will be happy to reassure you with a good swing strategy called “H4 crossover”. Its rules are as simple as its name! Let’s look at the details.

Don’t forget about money management. Your maximum risk and profit target per trade should equal about 1-2% of the account balance.

The steps for the strategy will be, as usual, presented for both “sell” and “buy” scenarios.

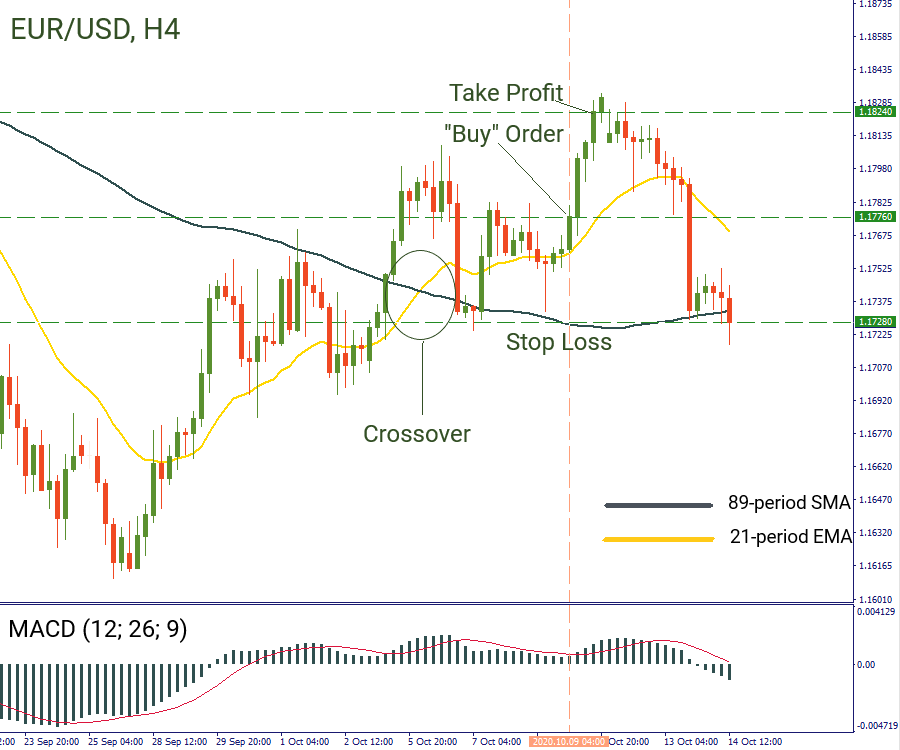

Below we provided an example of the strategy on the H4 chart of EUR/USD.

In the chart, we can see that the 21-period EMA (yellow line) broke above the 89-period SMA (grey line) on October 6. The price jumped higher, but then corrected downwards. At the same time, MACD was going down. We waited for the price to rise back above the moving averages and for MACD to go up. After that, we opened a position at 1.1776 (closing price of the bullish candlestick). We placed Stop Loss 5 pips below the support at 1.1728. The level of Take Profit was placed at the same distance between the “buy” order and the Stop Loss, which is 48 pips. As a result, our Take Profit went to: 1.1776+48=1.1824.

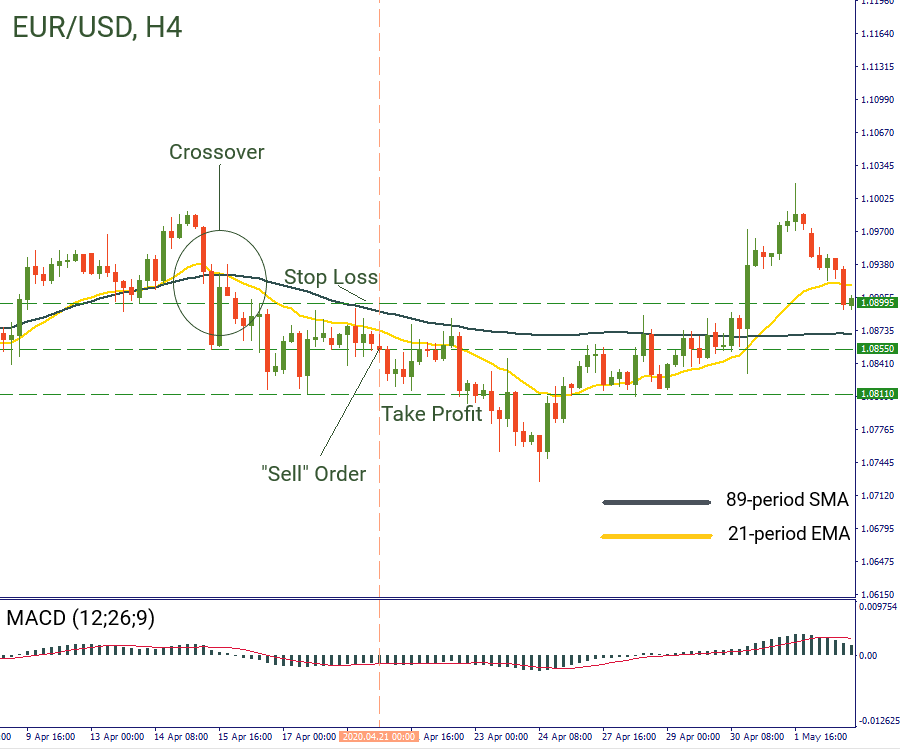

In the same chart of EUR/USD, we saw that that the 21-period EMA (yellow line) broke below the 89-period SMA (grey line). The price then moved down and up. MACD was moving higher as well. We waited for the oscillator to reverse and opened a “sell” order at the closing price of the red candlestick. Stop loss was located above the resistance level at 1.0899, while take profit was put at 1.0811 (1.0855-0.0044=1.0811).

This strategy seems pretty easy, right? By following the simple rules explained above you can master swing trading quite effectively. We recommend you to try it out on the demo account first for backtesting and then implement it in the real market environment.

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later