Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

2023-02-02 • Updated

Information is not investment advice

There are many reasons why you might want to trade stocks. First, it’s their long-term predictability: most of them keep rising in the long run. You may say, ‘but a lot of them also fail’ – fair enough. That’s why FBS offers you selected stocks most of which are either decades-proven titans like Coca-Cola, giants of modern reality such as Amazon, or promising hi-tech like Tesla. In other words, all stocks you find at FBS are worth considering.

On the FBS website, you go to Trading, press Stocks, and you’ll the full list with all specs.

In the MT5 (remember you don’t trade stocks on MT4 – only MT5), you right-click in the Market Watch, press Symbols, and choose Stocks.

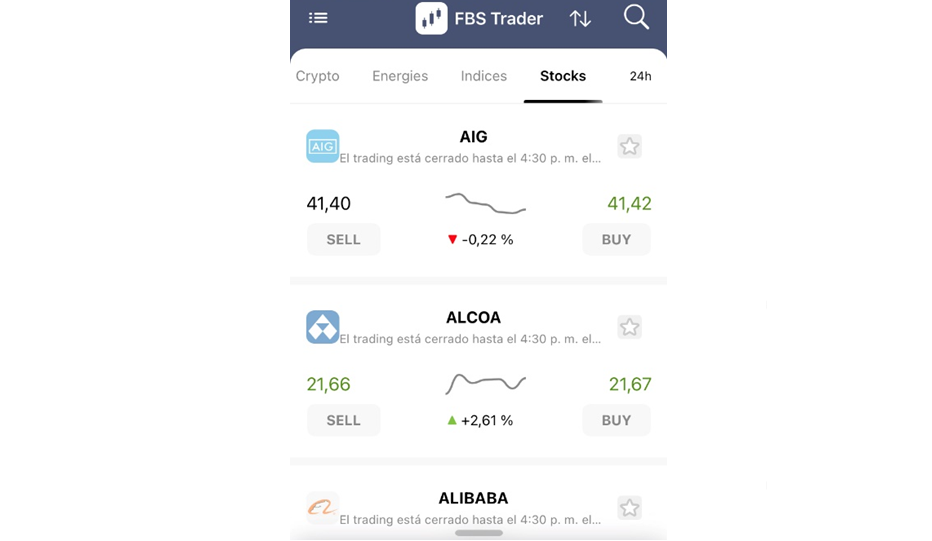

In the FBS Trader, which may be the easiest option, you just open the app and go to the Stocks section.

Technically, you can use all the techniques you trade currencies and commodities with, in stocks. At the meantime, stocks are best suited for mid-term and long-term trading – exactly for the reason explained in “Why trading stocks” (go check it out if you skipped it). Therefore, if you’re bored with intra-day trading and want to have a life while still operating on the market – stocks may be your best option.

What you’re looking for is a company that’s expected to bring consistent profits in the observable future and to expand faster than its industry average. A local or an absolute industry champion. That’s a growth stock. How to find one?

Fundamentals and the trend. Check the stock’s last several years of performance. Don’t get distracted by the fluctuation – they are all volatile. Look at the trend. If the stock has been following an uptrend for the last 24 months, that’s a good candidate. Be cautious with ‘rocket-launchers’ like Tesla (unless they have really outstanding fundamentals): very often, after inflating like a black hole in a very condensed period of time, such stock faces a possibility to lose steam and cool off rapidly. Next, dig into the company’s earnings, reports, news. Read some forecasts. Does it look optimistic and solid? Do observers believe this company has a bright perspective for the next several years? What about the mid-term outlook: is the company likely to make good sales and show better-than-expected performance? Has it done so already? If the answer is ‘yes’ to most of this question, looks like you’ve found a worthy stock.

So, you go for those, which are relatively stable in the uptrend and have good fundamentals – that’s your guide to find a growth stock.

For example, you have Apple below. After going down in the beginning of 2020, it recovered, took the upward trajectory and has been loyal to that trajectory ever since. Note the inclination: it stays relatively stable. That’s good: the stock is following the path of well-balanced growth. That’s what you want. What about the fundamentals? Pretty solid last earnings report, ambitious expansion plans up to making electric vehicles and tapping into this new market sector, good sales projections – looks nice.

Another example – Coca-Cola. It suffered much more from the virus than Apple. It didn’t yet recover its pre-virus highs of $60. But look at the recovery trajectory: it falls well into an equilateral channel. That means it grows in a balanced manner. On the fundamental side, it proved to be a very resilient business. In the fourth quarter of 2020, it performed quite impressively and beat the expectations. A couple of intriguing acquisition prospects in the mid-term future adds to the promising outlook Coca-Cola has. What does it mean? It’s worth looking at – especially from the technical perspective to benefit from buying it at local lows where it is on the chart.

Now that you’ve chosen a stock, you think, ‘How do I actually trade it’. In case “How to trade stocks” wasn’t clear enough, here is a simpler guide: just buy a stock and hold it for a month. Put Stop Loss at -2%, and Take Profit at 5%. From experience, if you’ve chosen well, there’s a very high likelihood that in about four weeks, your Take Profit will be executed successfully. Seems hard to believe? Try it out!

Here are some simple steps.

Bill Williams is the creator of some of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

Trend strategies are good - they may give significantly good results in any time frame and with any assets. The main idea of the ADX Trend-Based strategy is to try to catch the beginning of the trend.

Counter-trend strategies are always the most dangerous but also the most profitable. We are pleased to present an excellent counter-trend strategy for working in any market and with any assets.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later