Inflation

Inflation

What is inflation?

The inflation definition means a steady increase in the overall level of prices for goods and services. Most of the time, it is common to report the inflation rate in annual terms or, as they say, year-on-year.

Besides, inflation indicates the degree of monetary devaluation and affects price volatility. For instance, if price inflation in annual terms equals 6.7%, it means an identical set of goods that cost $100 a year ago has now gone up to $106.7. As a result, $100 devalued or lost 6.7% of their purchasing power.

On the contrary, there is such a term as deflation, which occurs when prices fall and purchasing power increases. The combination of high inflation, slow economic growth, and rising unemployment is known as stagflation. The rapid, excessive, and out-of-control price increase is called hyperinflation.

The most comfortable level of inflation is seen as a level at which economic growth continues while keeping unemployment low.

Annual refined sugar prices (cents per pound) using data from the USDA

What causes inflation?

To understand better what inflation is in economics, we need to know what causes it. A variety of factors influence prices and become causes of inflation within an economy.

Demand-pull inflation

Demand-pull inflation appears from heavy consumer demand for a product or service. It manifests itself in near full employment, an economy growing ahead of the long-term trend, and too much money chasing too few commodities.

How does it occur?

There are various theories of inflation. In the Keynesian economic principle, for instance, demand-pull inflation outlines the effects of an overall supply and demand imbalance. When total demand in an economy greatly exceeds total supply, prices rise. This is the most frequent reason for inflation.

Several preconditions can cause demand-pull inflation:

- A growing economy. When consumers are financially self-confident, they start spending more and borrowing more. Ultimately, this leads to a firm increase in demand, resulting in higher prices.

- Increasing export demand. A surge in exports leads to an undervaluation of local currencies.

- Government spendings. As the government spends more freely, prices rise too.

- Inflation expectations. Some companies tend to raise their prices, expecting inflation in the near future.

- Increase in money flows. An expansion of the money supply with too few goods to purchase leads to higher prices as well.

Cost-push inflation

Also known as wage-push inflation, cost-push inflation occurs when prices rise due to increased costs of wages and raw materials.

How does it occur?

Here are some reasons for this kind of inflation to appear.

- Higher labor costs. An increase in the minimum wage per worker.

- Natural disasters. The unforeseen causes of cost-push inflation are often natural catastrophes.

- Increased production costs driven by public authorities. Situations like a sudden change of government affect the country's ability to maintain its previous production. However, they appear mostly in developing countries.

- Changes in current laws. Although usually anticipated, a few regulations can result in higher costs for businesses.

Built-in inflation

Built-in inflation happens when sufficient numbers of people expect prices to continue to rise. People may demand higher salaries in anticipation of higher prices while maintaining an old quality of life. Eventually, higher salaries result in higher business costs that can be passed on to consumers.

Types of price indexes

Economists measure inflation with what is known as a price index, which tracks the price of a particular set of goods and services. The most popular indexes are the Consumer Price Index (CPI) and the Wholesale Price Index (WPI).

Consumer Price Index

Each state forms a certain set of goods and services necessary to ensure a minimum standard of living – the consumer basket. An index that shows changes in the price of this basket is called the Consumer Price Index (CPI).

CPI is one of the main indicators of inflation. Its’ value reflects the average prices for services and goods in the consumer basket. It serves as a reference point for the recalculation of wages, social benefits, and other payments.

Wholesale Price Index

Wholesale Price Index (WPI) depicts the average change in commodity prices at the wholesale level. It measures inflation by determining the price paid by wholesalers to manufacturers and comparing it to base-year prices. WPI is used to track price trends that show the current supply and demand within the industry.

Producer Price Index

In manufacturing, Producer Price Index (PPI) measures the rate of change in prices of products sold as they leave the producer. It excludes taxes, transportation charges, and trade margins that the buyer may have to pay. PPIs provide measures of average changes in prices received by producers of various products.

How to prepare for inflation?

As a regular citizen, you may wonder: What can I do apart from switching to lower-cost substitutes or asking for a raise? Luckily, there are ways to be more profoundly prepared for inflation.

- Stock up on long-term items. Buying non-perishables and items that keep for a while may be a good start.

- Borrow responsibly. You can consider refinancing your home when interest rates become low.

- Buy stocks that will benefit from rising prices. Analyze sectors that normally do well during the crisis and consider picking their stocks.

- Examine government inflation-protected bonds. Such offerings are a great tool for protecting your capital. Treasury-protected securities increase their payouts based on the inflation rate. As a result, your purchasing power increases along with rising inflation.

- Invest in real estate. When inflation hits, real estate prices usually rise as well.

Pros and cons of inflation

Despite many people seeing inflation as a negative phenomenon, which results in the population becoming poorer, economists point out certain positive effects of inflation.

Advantages

- Inflation performs a stimulatory function. While money devalues, imported goods become much more expensive than analogs produced within the country. Inflation stimulates the demand for domestic products and supports local producers.

- Inflationary processes briefly stimulate the development of consumption of expensive goods. People become less interested in keeping money that is getting cheaper and decide to purchase goods from which more benefits can be derived.

- Companies with significant product stocks get the opportunity to unload their warehouses by increasing exports. The value of goods produced in terms of another country’s stronger currency is reduced. Thus, products gain a competitive advantage – lower prices.

- Inflation helps to evolve. During periods of crisis, weak market players cannot withstand the pressure and cease to exist. Strong companies become even stronger. They gain experience in crisis management and a clear understanding of how to protect themselves from similar issues in the future.

Although there are a number of positive aspects, the high inflation rate causes many serious drawbacks.

Disadvantages

- Increasing financial burden on the state budget and business entities. They have to ensure the entry of goods belonging to the critical imports category.

- Decrease in real incomes of the population, which results in the growth of discontent with the current government.

- Difficulties with servicing loans taken in foreign currency.

- Development of distrust in national currency, which leads to a demand for foreign currency. A danger of imbalance between the entry of money and its expenses occurs. It can cause a monetary deficit, start a fictitious exchange rate, and even drive a new wave of inflation.

- Crisis stimulates enterprises to reduce costs, usually by reducing staff and redistributing responsibilities. The result is an increase in unemployment and an emerging potential for social unrest.

- Inflation contributes to the outflow of capital from the production sector. Money starts to concentrate in the spheres of intermediation and consumption, where earning opportunities increase many times over.

- Competitiveness in foreign markets reduces if an enterprise cannot carry out timely modernization of production facilities.

When analyzing the effects of inflation, most economists say that the 5-6% per year inflation rate is the “sweet spot.” It makes it predictable and controllable and positively affects the state economy. Namely, the real sector develops, as well as the gross product grows.

How to control inflation?

In order to fight high inflation, it is necessary to act in two directions:

- Take urgent measures to reduce the inflation rate.

- Take a strategic course to strengthen the state’s economy.

Urgent measures

- Limit the flow of new money. The main way for money to get into the economy is through loans. To block it, it is crucial to make it unprofitable to take them by raising the key rate and the annual interest rate on loans.

- Control the banking system. Since banks manage money, it is necessary to establish control over financial flows in the country. Banks have to lend to important strategic sectors of the economy and do not allow non-repayable loans.

- Take control of socially essential goods. In a period of high inflation, the state must control the price of basic commodities, such as bread, flour, etc. It is also necessary to support agricultural producers.

- Control the exporters. Their goods should be in sufficient quantities inside the country. They should also be sold at a suitable price.

Alas, urgent measures will not lead the country out of a crisis. They can only slow down the devaluation. To solve the problem in full, strategic measures are needed.

Strategic measures

- Achieving established inflation targets. The first thing that a state is obliged to do is to return financial guidelines to businesses and the population. It is essential to timely provide accurate information on the real and planned inflation rate for the current year. If done right, it will speed up the process of economic recovery and strengthen public confidence in the authorities.

- Change in budget policy. The fall of the economy results in a lack of money in the state budget. The issue of an unsecured money supply will never solve this problem. The process of devaluation will only be launched, and inflation will continue to rise.

- Creation of comfortable conditions for business development. Entrepreneurs are a powerful driving force capable of reviving the country’s economy.

- Import substitution course. Reducing the country’s dependence on imports makes the economy more resistant to external shocks.

Examples of inflation

There are many examples in history when the devaluation reached 100% or more. Here are 3 of the most striking cases.

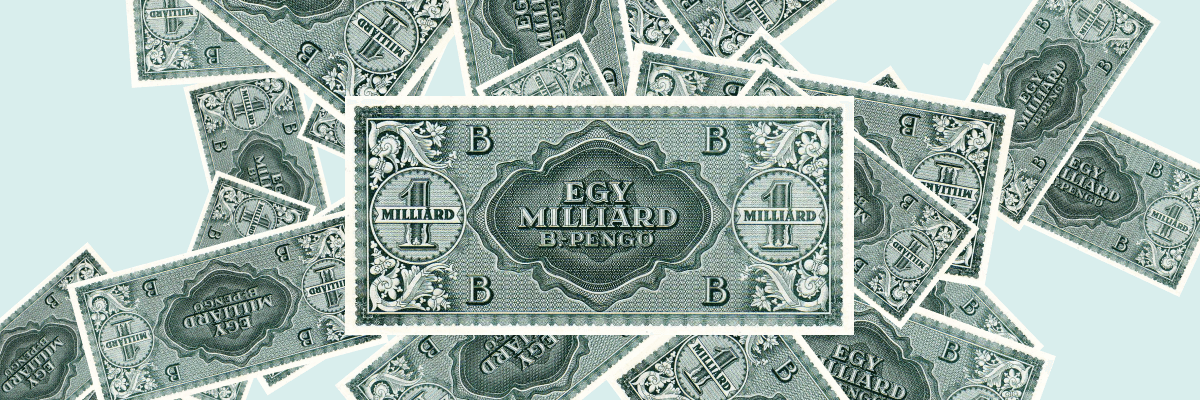

Hungary

Timeframe: August 1945 - July 1946

Inflation rate: 207% per day

Due to the lack of production, prices of goods in post-war Hungary began to rise. There was no tax system, so there was nothing to fill the budget of the country. The government decided to print more banknotes and lower interest rates simultaneously. As a result, Hungary was flooded with unsecured money.

The Hungarian pengő currency is the record holder for inflation in the world economy: every 15 hours, prices on the country’s market doubled. The maximum inflation per month was 40 000 000 000 000 000%.

Later in 1946, the authorities carried out a monetary reform. The Hungarian forint put into circulation was equal to 400 000 quadrillion pengő. The Hungarians still use the new currency.

1 billion pengő banknote

Zimbabwe

Timeframe: March 2007 – 2008

Inflation rate: 98% per day

Unsecured money is also the reason for the Zimbabwean economy to fall. It happened after a special land reform took place. That reform intended to deprive British farmers of plots and livestock and give them to the landless local population.

New landowners simply did not know how to cultivate, so the production of the main export goods fell sharply. The manufacturing industry collapsed as well – starvation and rising unemployment began. Government officials have undermined their own economy.

The only “salvation” was the denomination. In Zimbabwe, it was carried out three times over a 4-year period.

100 trillion Zimbabwe dollar banknote

Yugoslavia

Timeframe: April 1992 - January 1994

Inflation rate: 65% per day

Many factors caused hyperinflation in Yugoslavia. Country leader Tito died, Slovenia broke away, bureaucracy was bloated, and the UN imposed a trade embargo. The shaky economy was finished off, so the government turned on the printing press.

Hyperinflation reached its peak in 1994 – 116 546 000 000% per year. During this period, the dinar lost its function as money: in stores, food prices were already indicated in German marks.

Later, the government adopted the Avramovich Plan. It was a set of unpopular financial measures to save the remnants of Yugoslavia. Consequently, the country moved to a market economy. Nevertheless, the situation improved only when the war ended, and sanctions were lifted in 1995.

5 thousand Yugoslav dinars, 1985

Conclusion

Inflation is an increase in prices that causes purchasing power to decline over time. Governments constantly seek ways to control it through monetary policy, as inflation – is one of the most significant indicators of a country's economic strength.

FAQ

Is inflation good or bad?

Theoretically, a low inflation rate can indicate a healthy sign of a growing economy. On the contrary, high inflation can be damaging for a country. However, certain groups of people benefit from such situations.

What are the effects of inflation?

Effects of inflation vary. On the one hand, they stimulate domestic producers and give tremendous experience in crisis management. On the other hand, they lead to decreased real incomes, issues with servicing loans, lack of competitiveness, and many more.

Why is inflation so high right now?

There are several reasons for global inflation going up around the world. Some of them are:

- Rising energy and petrol prices. Oil prices fell early in the pandemic, but demand has rebounded since and reached a seven-year high.

- Goods shortages. Manufacturers in places like Asia have struggled to meet demand since the COVID-19 restrictions. This led to shortages of materials like plastic, concrete, and steel, which drove up prices.

- Shipping costs. Global shipping companies were overwhelmed by the surging demand after the pandemic. This means that retailers have had to pay significantly more to put these products on the market.

- Rising wages. When the unemployment level is low, companies have to put up wages or offer signing-on bonuses to attract and retain staff.

- Climate impact. Severe climatic conditions in many parts of the world have contributed to inflation.

- Trade barriers. More expensive imports are also driving up prices.

Disclaimer: This is for informational purposes only and do not contain - or to be considered as containing - investment advice, suggestion or recommendation for trading.

2023-05-11 • Updated