The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The Bank of England will have the monetary policy meeting today at 14:00 MT time. Analysts expect the interest rate to remain unchanged at 0.75%, but there will be some more interesting things to follow during the event.

The Bank of England meeting is usually followed by the official votes of the Monetary Policy Committee members. Last time, two of them: Michael Saunders and Jonathan Haskel called for lower interest rates. This time analysts expect them to repeat their moves. Some of them even predict the third member: Gertjan Vlieghe to turn dovish, too.

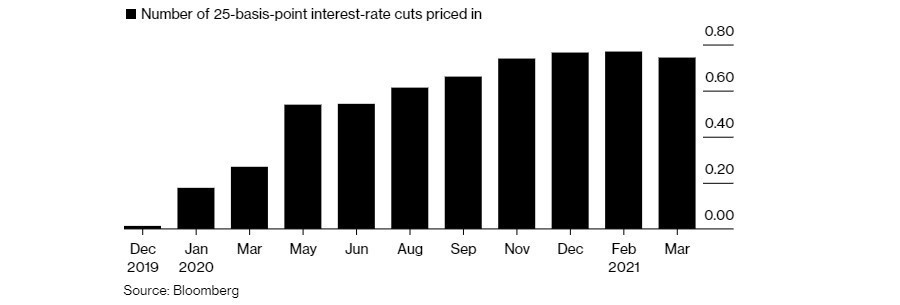

Now, after the election is over and the UK Prime Minister Boris Johnson threatens to change the law to stop the extension of the Brexit transition phase, some of the analytical banks start to expect the BOE to cut rates in January. According to Bloomberg, traders already price in the rate cuts through the next year.

It is worth mentioning the weak economic data of Great Britain. You can read the detailed analysis of the economic situation in Great Britain and the long-term forecasts for the GBP here.

The meeting will be also important for the comments by the BOE Governor Mark Carney. Earlier this week he noted that the possibility of a no-deal Brexit increased due to the Tories victory. He also warned traders to prepare for a “high-level update” on the economy today. So, prepare your nerves. Let’s not forget that Mr. Carney is due to leave the post of the governor on January 31, and his last meeting may be full of surprises.

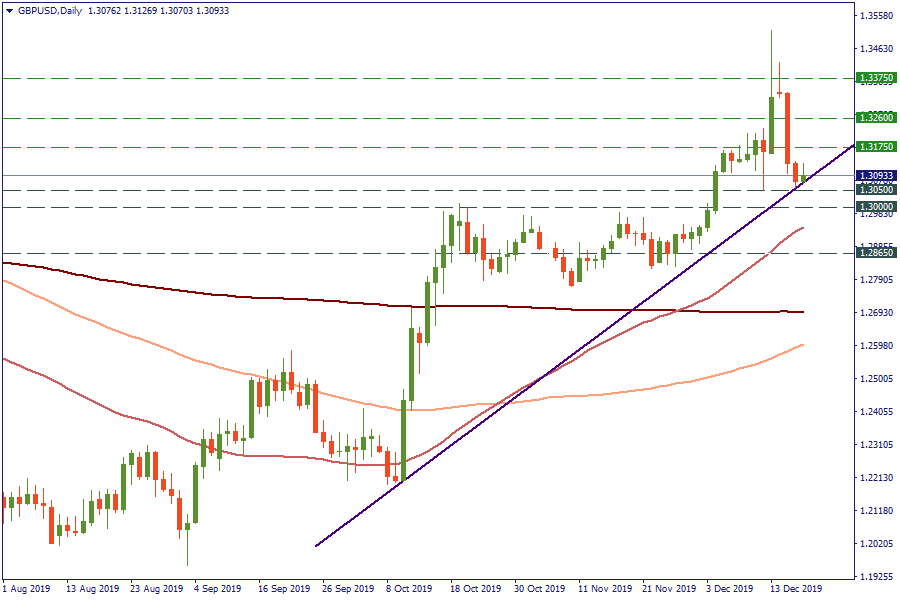

After testing the support at 1.3050 on the daily chart, which lies close to the border of the ascending trendline, the pair is preparing for its further move. If the GBP gets stronger today, the pair will likely retest the 1.3175 level. The next key level for bulls will lie at 1.3260. Bearish scenario may happen ifs the pair breaks below the uptrend and the 1.3050 level. After that, the next key level in the focus of bears will be placed at the psychological point of 1.3.

Follow the updates on the official BOE site and on our Telegram channel.

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later