Saluti dal lontano 2022! Gli analisti di FBS hanno usato un po’ di magia per viaggiare nel futuro e hanno portato indietro alcune previsioni esilaranti.

Non perdere tempo: analizza l’influenza dei NFP sul dollaro statunitense!

Avviso sulla raccolta dei dati

Manteniamo un registro dei tuoi dati per gestire questo sito web. Cliccando il pulsante accetti la nostra Informativa sulla privacy.

Guida Forex per i principianti

Una grande guida al mondo del trading.

Controlla la cartella “In arrivo”!

Nella nostra email troverai la Guida Forex. Premi il pulsante per ottenerla!

Avviso di rischio: I ᏟᖴᎠ sono strumenti complessi che comportano un rischio elevato di perdere denaro rapidamente per via della leva.

Il 68,53% degli investitori retail perde denaro negoziando ᏟᖴᎠ con questo provider.

Dovresti considerare se comprendi come funzionano i ᏟᖴᎠ e se puoi permetterti di correre il rischio di perdere il tuo denaro.

Le informazioni non possono essere considerate consigli di investimento

The Parliamentary elections boosted the British pound to highs of March 2019. Analysts predicted the positive outcome if Johnson’s party takes the majority. The Conservative party won. But why analysts predict the fall of the GBP? Let’s figure it out.

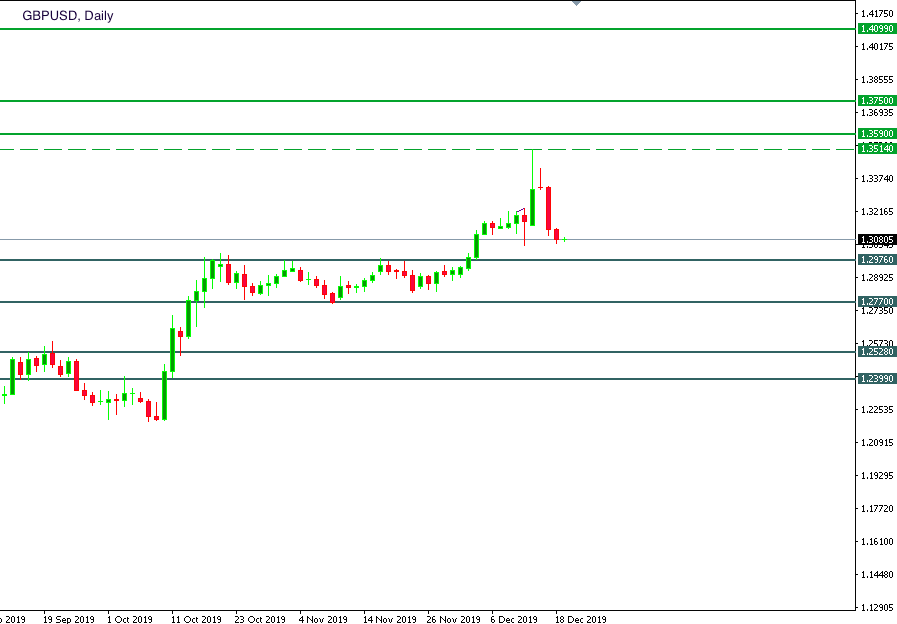

GBP/USD managed to reach the level of 1.35 after the Conservative party took most of the seats as investors accepted that as a chance for Boris Johnson to use this majority to deliver a soft divorce. Nevertheless, traders were surprised by a new vector of Mr. Johnson’s policy that has already wiped out the rally after the victory.

The biggest aim of Boris Johnson is to principally get the UK out of the European Union. For that, the Prime Minister is ready to do anything, even to not “brush shoulders with the global elite at a Swiss ski resort” because he canceled the attendance of the World Economic Forum in Davos next year. However, his rush may revoke all efforts of supporting the British pound.

Britain is supposed to leave the EU on January 31, 2020. Likely this Friday, December 20, Mr. Johnson will put the divorce part of the Brexit deal to a vote. As soon as MPs ratify it, it will confirm the UK to leave the EU by January 31. The important part of the legislation is supposed to ban the government to extend the transition period and delay the day Britain stops being subject to EU laws, even without a trade deal. This law increases the risk of the no-deal Brexit that may raise threats of tariffs and disruption to trade.

The main threatening point of the new policy of Mr. Johnson is to make a free-trade deal – based on the Canada-EU agreement - by December 31, 2020. Although the EU is to prevent tariffs and quotas from emerging in the relationship with the post-Brexit Britain, the December 2020-deadline seems to be too tight. The new deadline and the new legislation increase risks of the no-deal Brexit. JP Morgan announced the 25%-chance of a no-deal Brexit that is considered as “uncomfortably high."

A probability of the rate cut 2020 has risen significantly after Johnson’s announcements. Brexit uncertainties may continue putting pressure on the British economy that will force the central bank to cut the rate.

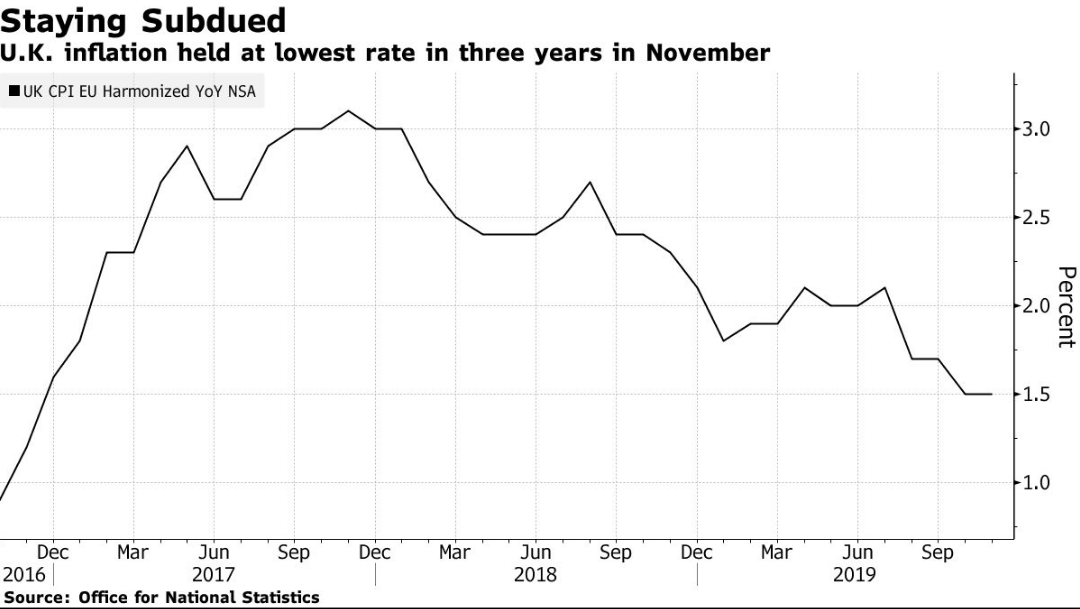

Weakening economic data with CPI being at its lowest rate in three years in November (the Office for National Statistics) provides additional signals of the cut.

Source: Bloomberg

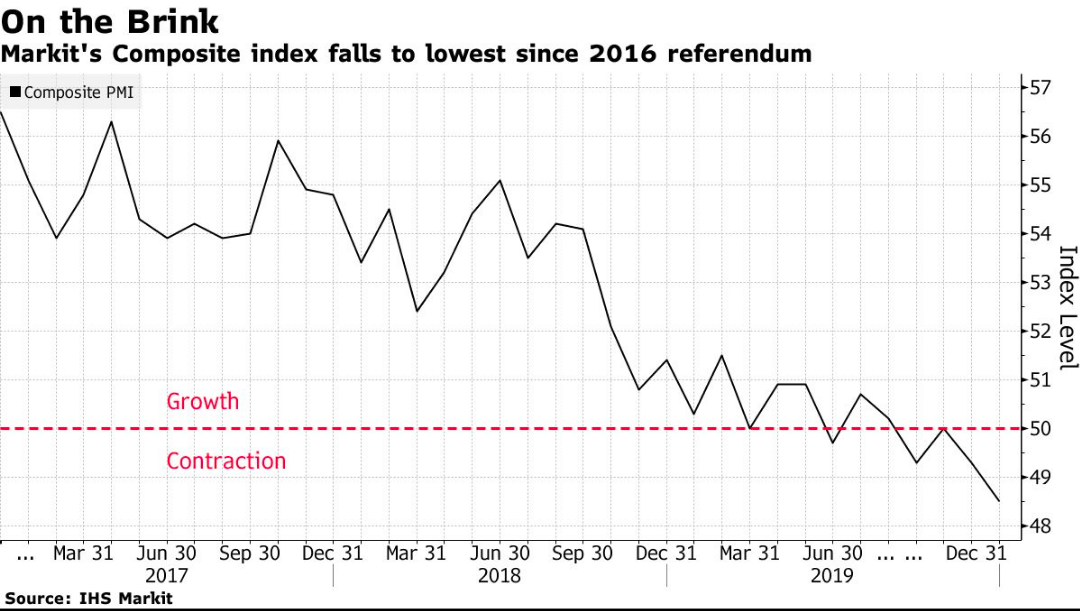

Source: Bloomberg

Moreover, in December, the manufacturing production suffered its worst month in more than seven years. That raises the risks of the economy as a whole to contract this quarter.

Source: Bloomberg

Markit’s Composit index that reflects all business activity dropped to the lowest since the 2016 referendum.

Money markets predict a 76% probability of the rate cut by 25 basis points in December 2020. However, Deutsche Bank AG forecasts the bank to do so as soon as January 2020. After the rate may stay on hold, however, additional internal and external threats don’t erase the risk of more rate cuts.

The situation may become clearer after the BOE meeting on December 19. The central bank may give clues on the upcoming rate cuts and outlook for the economy. If the bank doesn't provide any signals, the following economic data and Brexit updates may shed light on the monetary policy. Remember that the UK is to leave the EU on January 31. This event will also be among the determining factors. Brexit uncertainties and negative economic data will force the bank to cut the rate.

Middle-term

Until the year-end, such events as the BOE Meeting and the new law will determine the direction of the GBP.

On the daily chart of GBP/USD, the pair has been sliding that may be considered both as a correction after the surge caused by the Parliamentary Elections and as a reaction to the surprising change in Johnson’s policy.

If the GBP keeps suffering, supports are located at 1.2976, 1.2770, 1.2528, and 1.2399.

If the British pound manages to gain momentum, the pair will target the previous high at 1.3514. Additional resistances may be placed at 1.3590, 1.3750, and 1.4099.

Long-term

The new vector of Johnson’s policy may put additional pressure on the British pound in 2020. Moreover, the weakening economy adds threats of the rate cut that may affect the British currency. If this year, the GBP/USD pair is able to close above March highs of 1.3292, a chance of the pair’s rise will increase. Brexit deal and recovering economy may boost the pair to new highs at 1.3590, 1.4245, and 1.4630. In the environment of uncertainties, the pair will target support levels at 1.2870, 1.2590, and 1.2015.

To conclude, we can say that the surprising policy of Mr. Johnsons added additional risks for the British pound. Brexit uncertainties, new law and weakening economic data are among threats for the further rise of the GBP. The GBP/USD pair may end 2019 lower than it was expected. However, 2020 may boost the British currency as soon as the UK and the EU make an agreement.

To conclude, we can say that the surprising policy of Mr. Johnsons added additional risks for the British pound. Brexit uncertainties, new law and weakening economic data are among threats for the further rise of the GBP. The GBP/USD pair may end 2019 lower than it was expected. However, 2020 may boost the British currency as soon as the UK and the EU make an agreement.

Saluti dal lontano 2022! Gli analisti di FBS hanno usato un po’ di magia per viaggiare nel futuro e hanno portato indietro alcune previsioni esilaranti.

La nuova variante Omicron e i commenti di Powell hanno fatto aumentare la volatilità in EUR/USD. Cosa aspettarsi ora?

La società rilascerà i propri dati questo venerdì. Cosa dovresti sapere?

La pandemia continua a danneggiare l'attività economica in Cina, la guerra in Ucraina sta colpendo l'intera economia europea e gli sforzi della Federal Reserve per controllare l'inflazione minacciano di innescare una recessione.

Ogni volta che l'inflazione supera il 4% e la disoccupazione scende al di sotto del 5%, l'economia statunitense entra in recessione entro i due anni successivi.

BCE accomodante e Fed aggressiva dipingono uno scenario ribassista per EUR/USD. Il prossimo passo sarà un declino a 1,0770?

La vostra richiesta è accettata.

Ti chiameremo durante l’intervallo di tempo che hai scelto

La successiva richiesta di richiamata per questo numero di telefono sarà disponibile in 00:30:00

Se hai un problema urgente, ti preghiamo di contattarci tramite

chat live

Errore interno. Si prega di riprovare più tardi