The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The 2020 year has started and the direction of the markets is unclear especially due to the US-Iran tensions. Take a fast look at the major events that will determine markets’ direction in January 2020.

Key events:

Jan 10 – NFP, Average Hourly Earnings, Unemployment Rate

Jan 14 – CPI m/m, Core CPI m/m

Jan 29 - FOMC Statement, Federal Funds Rate, FOMC Press Conference

Jan 15 – Phase One Trade Deal with China

The US dollar was weak in the last days of 2019 but managed to rebound at the beginning of the month. However, recovery is questionable. Analysts see risks in the November Presidential elections, the slowdown of the economic growth, the US-China trade war, and the Fed monetary policy. At the same time, these factors are long-term. As for the January movements, we should consider the phase one trade deal with China, Fed meeting, and US-Iran tensions as the main market drivers.

Mr. Trump tweeted he is ready to sign the Phase One Trade Deal with China on January 15. The agreement is supposed to make China increase purchases of American farm goods in exchange for lower tariffs on some of the Chinese products.

Although the trade deal is expected to be a positive event for market sentiment, the USD is more likely to decline. The US dollar is still considered as a safe-haven currency, although losing its position. Nevertheless, the US-Iran tensions can be more positive for the USD. The US airstrike at the direction of Donald Trump killed a top Iranian commander Qassem Soleimani.

The risk-off sentiment was reflected in spikes of the safe-haven currencies such as the JPY and gold. Although the rise of the USD was not that extensive, the American currency managed to continue its upward movement.

The monetary policy is one of the major market drivers. However, it’s still one of the most unpredictable events.

The Federal Reserve cut the interest rate 3 times last year. It seems like the Fed is comfortable with keeping the rate on hold. However, some risks may signal changes in the monetary policy. Although the risks of the US-China trade disputes are melting, US-Iran confrontation and under-target inflation may be considered as additional points to worry.

San Francisco Fed President Mary Daly: "We are seeing some early evidence that long-run inflation expectations are slipping. We don't have a really good understanding of why it's been so difficult to get inflation back up.”

As for the jobs data and CPI, these events may move the USD. However, the effect will last during the day.

Technical setup

On the weekly chart of the US dollar, the index has been moving within the downward channel. The MACD indicator has crossed the 0 level upside down, which is a negative signal for the USD. If the index falls, other majors have higher chances to appreciate against the US dollar.

Jan 30 - BOE Monetary Policy Report, MPC Official Bank Rate Votes, Monetary Policy Summary

Jan 31 – Brexit

The month will be crucial for the Brexit saga. The UK is expected to leave the European Union on January 31. With the majority in the House of Commons, likely, Mr. Johnson will not have difficulties to pass the deal through the Parliament. The deal will also require ratification in the European Parliament. Although difficulties in signing the deal are not anticipated, the risks still exist.

Moreover, a series of daily seminars covering all of the different issues that will be addressed in the talks will take be host by 27 member states with the European Commission since the middle of January. Brexit news may keep affecting the British currency until the deadline. Be up to data with FBS to not miss important news that may affect the market.

Talking about the Bank of England, traders should pay attention to the mood of the central bank. If it sounds dovish mentioning external risks and the weakness of the economic data, the GBP is supposed to move down. However, if the sentiment of the BOE is not pessimistic, the British pound will be additionally boosted.

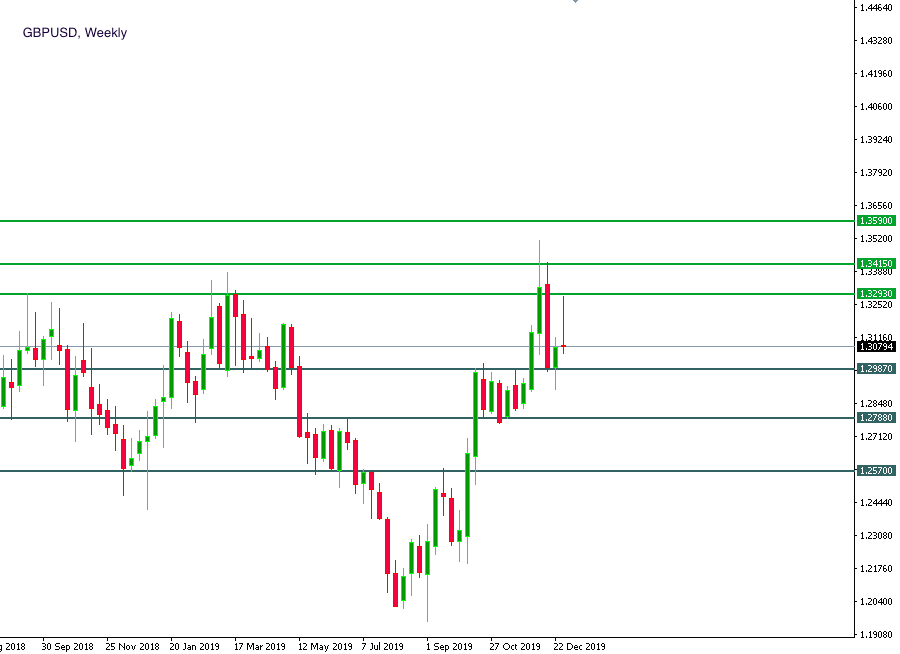

Technical picture

At the end of 2019, the GBPUSD pair reached the highs of the middle of 2018. The weakness of the USD and the positive comments on the Brexit deal may push the pair to the previous highs near 1.34. Resistances are located at 1.3293, 1.3415, and 1.3590. If the British pound is weak, GBPUSD will target supports at 1.2987, 1.2788, and 1.2570.

Key events:

Jan 16 - ECB Monetary Policy Meeting Accounts

Jan 23 – Main Refinancing Rate, Monetary Policy Statement, ECB Press Conference

Jan 31 – Brexit

Since the end of November 2019, the euro could recover against the USD. EURUSD reached highs of August 2019. The strength of the euro against the USD is mostly determined by the force of the USD and market sentiment.

Nevertheless, the ECB monetary policy will be important as well. The European central bank has been keeping the rate on lows for long. Currently, the central bank is at the crossroad. The bank has reached the limits of monetary policy. The new ECB president Ms. Lagarde of the ECB has to review the policy. The only way to boost the economy is to launch dual interest rates. Such a policy may be more efficient than QE, negative interest rate or forward guidance. Shortly saying, the central bank will set different interest rates for loans and deposits. As a result, both savers and borrowers would benefit. The ECB meeting and meeting accounts will determine the mood of the central bank and further monetary policy.

Among market sentiment factors, the Brexit deal is the major for the European currency. If the Brexit issue improves, the euro will rise as well.

Technical outlook

On the weekly chart of EURUSD, the pair reached highs of August 2019 but rebounded and moved down. The euro will get a chance to rise against the USD in the case of the weak US dollar. Resistance levels are placed at 1.1173, 1.1242, and 1.1417. The MACD indicator is below the 0 level. If it crosses the 0 level bottom-up, the pair will get a chance to rise. However, the downward pressure is high. Supports are at 1.0982, 1.0875.

To conclude, market sentiment will be the major driver of currencies in January. The US-Sino trade war, Brexit deal, and US-Iran tensions will be crucial for many markets. At the same time, we should not forget about such economic events as central banks' meetings, inflation levels, and jobs data.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later