The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The market awaits the big moves on the release of American job data at 15:30 MT time. This term comprises important indicators related to the employment of the United States: unemployment rate, average hourly earnings and, of course, non-farm employment change (non-farm payrolls). Together, these indicators provide ideal fuel for making the USD highly volatile.

The first and the foremost reason: non-farm payrolls make the USD moving greatly against the other currencies.

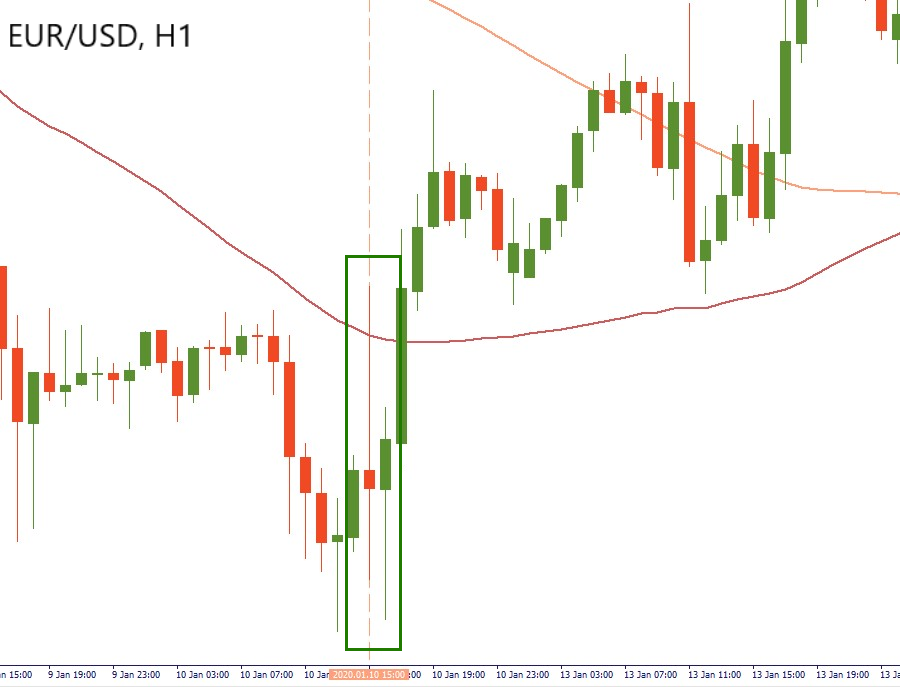

Let’s take a look at the previous release on January 10. NFP was expected at 162K - a much lower level than the December one. The actual figures came out as an awful surprise for traders with just 145K payrolls reported. Besides that, average hourly earnings increased only by 0.1% (vs. the forecast of 0.3%). At the same time, the unemployment rate remained at 3.5%. The first reaction of the market caused the mixed performance of the USD. If we look at the H1 chart of EUR/USD, we can see a candlestick with long upper and lower shadows. After the initial uncertainty, bulls took control of the situation and pushed the pair higher.

If you want to take advantage of the initial reaction after the NFP release, we recommend you to consider one useful NFP strategy.

Besides EUR/USD, you can trade any currency pair which consists of USD. Just be sure that you know what are base and quote currencies in the pair so you are not confused while placing an order. For example, if the NFP release is greater than the forecasts and you want to trade USD/JPY, you should place a “buy” order, while for GBP/USD it will be a “sell”.

Plus, pay attention that Canada releases its job data at the same time, so the performance of USD/CAD may be choppy.

Analysts expect NFP to advance by 163K payrolls and an increase of average hourly earnings by 0.3%. The unemployment rate may likely remain at 3.5%. As usual, higher-than-expected non-farm payrolls and average hourly earnings and the lower unemployment rates will be in bulls’ favor.

Experts see the strong releases of ADP employment change (291K vs 157K), the drop of 4-week jobless claims, and CB consumer confidence at the 5-months high as the main arguments which may drive the NFP higher. Will we see a surprise?

On H4 of EUR/USD, we can see that the pair has been trading at the lowest levels since the last October.

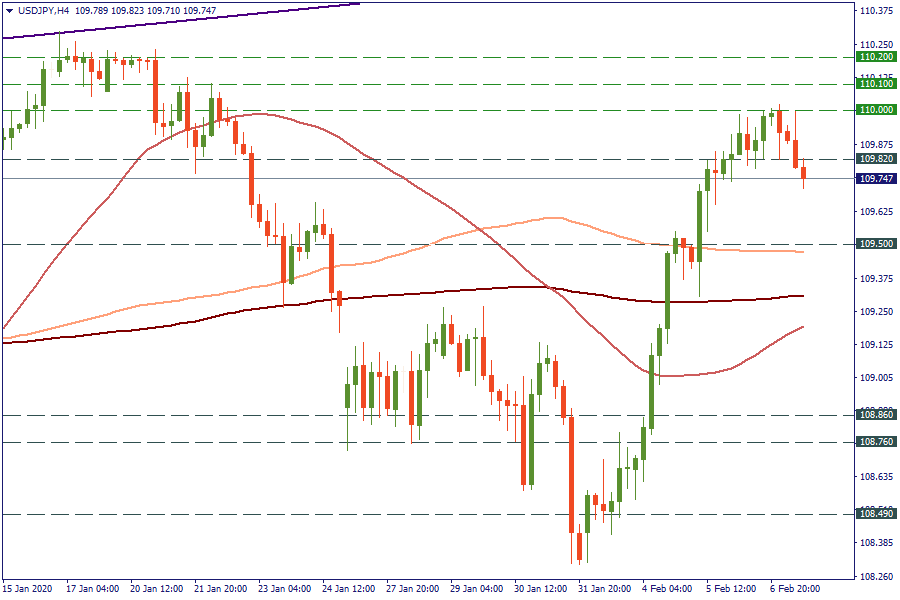

What about USD/JPY? We can see that the pair is getting ready for its further move. Following the scenarios for EUR/USD described above we can say that:

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later