Indicateurs techniques: trading des divergences

Les informations données ne sont pas des conseils en investissement

Le trading des divergences est un des concepts de trading les plus efficaces qui offrent des signaux de trading fiables et de haute-qualité. Le plus curieux dans tout cela, c’est que ce concept doit sa précision à l’action retardée des oscillateurs.

Le trading des divergences est une stratégie utilisée par de nombreux traders. Certains l'utilisent pour identifier les points d’entrée bénéfiques, d’autres pour choisir le bon moment afin de fermer leurs positions. Dans ce tutoriel, nous vous expliquerons comment repérer et trader ces tendances de trading interfonctionnelles.

Divergence : définition

Commençons par identifier ce qu'est une divergence. Basiquement, une divergence implique que le graphique des prix et l’indicateur technique (oscillateur) que vous utilisez pour analyser le marché aillent dans des directions opposées. C’est le premier signal afin que vous compreniez que "quelque chose" se passe sur votre graphique.

Les divergences peuvent être baissières ou haussières.

Une divergence baissière survient lorsque le prix génère des hausses plus élevées sur le graphique, tandis que votre indicateur indique des hausses moins élevées. Après une telle divergence baissière, les prix devraient normalement baisser : le prix doit rattraper l’indicateur inférieur.

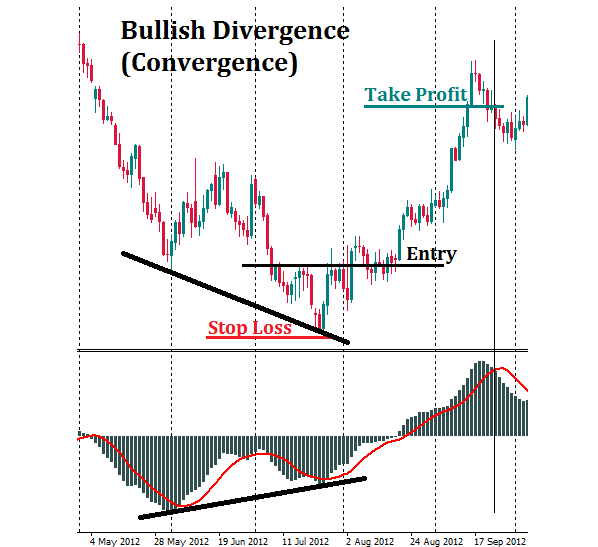

Une divergence haussière (également appelée "convergence") survient lorsque les prix génèrent des baisses moins élevées sur le graphique, tandis que votre indicateur indique des baisses plus élevées. C’est le premier élément qui vous indique que les prix vont bientôt se rétablir : le prix doit rattraper l’indicateur le plus élevé.

Notez que lorsque nous parlons de divergence baissière, nous examinons des sommets sur un graphique de prix. Lorsque l'on parle de divergences haussières, nous parlons de creux.

En plus des divergences classiques, il y a des divergences dites "cachées".

Une divergence baissière cachée survient lorsque le prix génère des hausses moins élevées sur le graphique, tandis que votre indicateur indique des hausses plus élevées. L’absence de nouvelles hausses sur le graphique des prix indique que les taureaux perdent de la force. En dépit de la hausse la plus élevée de l’oscillateur, le mouvement haussier est probablement un retracement. Ce mouvement représente une opportunité afin de vendre à des niveaux plus élevés.

Une divergence haussière cachée survient lorsque le prix génère desbaisses plus élevées sur le graphique, tandis que votre indicateur indique des baisses moins élevées. L’absence de nouvelles baisses sur le graphique des prix indique que les ours perdent de la force. En dépit de la baisse la moins élevée de l’oscillateur, le mouvement baissieer est probablement un retracement. Ce mouvement représente une opportunité afin d'acheter à des niveaux moins élevés.

L’expérience montre qu’il est plus facile de repérer les divergences classiques plutôt que celles qui sont cachées.

|

Type |

Prix |

Oscillateur |

Description et Trading |

|

Classique : S’attendre à un retournement |

|||

|

Baissière |

Hausse plus élevée |

Hausse moins élevée |

Retournement potentiel à la baisse |

|

Haussière |

Baisse moins élevée |

Baisse plus élevée |

Retournement potentiel à la hausse |

|

Cachées : S'attendre à des correction et à une continuation |

|||

|

Baissière |

Hausse moins élevée |

Hausse plus élevée |

La tendance baissière va probablement reprendre |

|

Haussière |

Baisse plus élevée |

Baisse moins élevée |

La tendance haussière va probablement reprendre |

Les divergences sont normalement utilisées afin de prévoir les retournements et les corrections de prix. Elles sont susceptibles de survenir avant l’action réelle du prix. C’est ce qui les rend si efficace et permet aux traders d'ouvrir une position dès le début de l'apparition d'un mouvement de prix.

Comment trader avec une divergence classique

Pour le trading des divergences, vous devez intégrer l'un de ces oscillateurs sur votre graphique : la stochastique, l'indice de force relative (RSI) ou la moyenne mobile "convergence-divergence" (MACD).

Quel que soit l’indicateur que vous choisissez, nous vous recommandons de toujours placer des ordres Stop Loss avant d’effectuer vos opérations. Ce n’est pas différent lorsque vous tradez des divergences. Vous pouvez mettre un Stop Loss au-dessus du dernier sommet du graphique qui confirme la présence d'une divergence baissière. Si la divergence que vous identifiez est haussière, vous devez placer un Stop Loss en dessous du dernier creux du graphique.

Afin de trouver l’endroit ou placer un ordre Take Profit, vous aurez probablement besoin d'un indicateur supplémentaire (surtout si vous tradez avec le RSI et la stochastique). Vous pouvez utiliser l’analyse swing ou des niveaux de soutien/résistance afin de définir un ordre Take Profit. Cependant, si vous préférez utiliser la MACD lorsque vous tradez des divergences, vous pouvez compter entièrement sur cet indicateur sans avoir besoin d'aucun autre outil de trading supplémentaire. Lorsque l’histogramme MACD franchit la ligne de signal de haut en bas, c’est un signal indiquant qu'il faut clôturer la position haussière. Lorsque l’histogramme MACD franchit la ligne de signal de bas en haut, c’est un signal indiquant qu'il faut clôturer la position baissière.

Voici un exemple de trading de divergences avec un oscillateur MACD.

Supposons que vous avez repéré une divergence haussière (convergence) entre le MACD et le graphique des prix. En outre, vous remarquez un croisement haussier dans la fenêtre de la MACD. Vous utilisez cette divergence de prix comme un signal afin d'ouvrir une position longue. Un ordre Stop Loss doit être placé au-dessous du dernier creux du prix. Clôturez votre trade lorsque le croisement baissier se forme sur l’oscillateur MACD.

Autres articles de cette section

- En quoi consiste le principe de la "troncature" ?

- Ichimoku

- Figure de diagonale d'initialisation

- Le modèle des vagues de Wolfe

- Modèle des "Three drives"

- Shark

- Papillon

- Crabe

- Chauve-souris (bat)

- Gartley

- ABCD

- Les figures harmoniques

- Introduction à l'analyse Elliott Wave

- Comment trader sur les cassures

- Actualités sur le Forex

- Comment placer un ordre Take Profit ?

- Gestion des risques

- Comment placer un ordre Stop Loss ?