The Us Bureau of Labor Statistics will release monthly average hourly earnings, non-farm employment change (NFP), and unemployment rate on June 3, 15:30 MT time (GMT+3).

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Big news shake financial markets more and more often. This time oil is once again the biggest news maker.

West Texas oil futures expiring on Tuesday turned negative for the first time in history. Negative prices mean that sellers were actually paying buyers to take the stuff off their hands. Such a situation occured because the US economy is on the lockdown and, as a result, there’s so much unused oil that America is running out of places to store it.

Crude oil futures is a futures contract, in which a seller agrees to transfer a specified amount of barrels of oil to a buyer at a specified price on a specific date.

Some market players, such as refinery companies, use futures to ensure that they will have a favorable price fixed for the future. Most traders, however, trade oil futures without waiting until the expiry date. They don't want the actual oil, they just buy and sell oil futures to make money on the price swings. However, if they don’t get out of the position before the due date, they will have oil actually delivered to them.

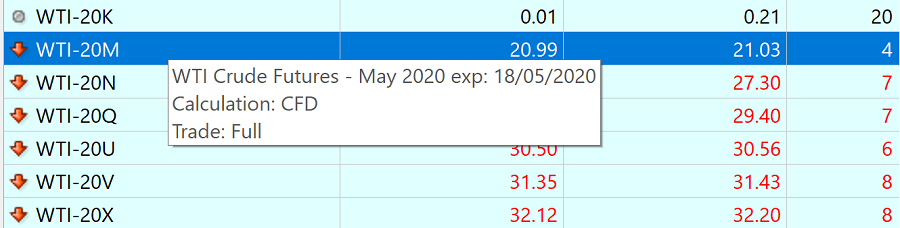

There are oil futures for every month for years ahead. Trading terminates 3 business day prior to the 25th calendar day of the month prior to the contract month. In April 2020, such day is Tuesday, April 21. Physical delivery for these contracts should take place in May, but as the storage capacities are near the limit, the demand has plunged. Storage is especially scarce in Cushing, Oklahoma, where WTI May-dated futures contracts require futures buyers to take delivery of the oil. Hence, market players just wanted to get rid of these futures. There was a wave of selling and the price of WTI-20K dropped below 0.

Although, the futures market has experienced an impressive move, there's no way this is an apocalypse. We can see that other contracts haven’t collapsed at all. For instance, WTI June prices (WTI-20M) are above $20 a barrel.

Prices for Brent futures fell, but the decline wasn’t dramatic at all and accounted for about 5% on Monday. Unlike WTI, Brent crude can be delivered offshore to a variety of locations, so if there’s a lack of storage in one place, oil will be just moved elsewhere.

All in all, the story will likely keep oil under pressure for a time being. Notice that with FBS you can take advantage of various oil futures, both buying and selling these contracts in the form of CFD.

The Us Bureau of Labor Statistics will release monthly average hourly earnings, non-farm employment change (NFP), and unemployment rate on June 3, 15:30 MT time (GMT+3).

The Organization of Petroleum Exporting Countries will hold a meeting on June 2.

Organization of the Petroleum Exporting Countries (OPEC) is scheduled to meet on January 4.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later