Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Every week we expect many interesting events that can shake the market. Next week is not the exception! Let’s look through the key market events that can bring volatility on September 12-16.

September 13, 15:30 GMT+3.

The US Bureau of Labor Statistics will publish its CPI and Core CPI data on Tuesday, September 13, at 15:30 GMT+3. This is one of the most important data releases in September for financial markets.

Nowadays, inflation is enormous in many developed countries, so every inflation rate release is a big deal. Last time, the results were pretty encouraging. A monthly change of 0.0% gave people hope that inflation might slow down. Falling energy prices led to the lowest monthly inflation rate since the current surge in US inflation started. Gold, which reversely collates with the USD, gained 2055 points immediately after the release.

This time the release may confirm that the US copes well with inflation and that the rising interest rate works. Still, Fed Chair Jerome Powell made it clear in his August speech that the Fed would unlikely ease up on rate hikes until they are confident US inflation is well under control.

Instruments to trade: EURUSD, XAUUSD, USDJPY.

September 15, 14:00 GMT+3.

The Bank of England will announce its Interest Rate decision and make a statement about future monetary policy on Thursday, September 15, at 14:00 GMT+3.

Now experts are becoming increasingly pessimistic about the UK’s economic situation. A recession is now seen as much more likely. Besides, interest rates are about to rise higher than previously was thought.

A similar to the previous release half-point hike in September is expected as politicians battle double-digit inflation. A subsequent quarter-point hike in November would raise the Bank of England's benchmark rate to 2.5%, higher than the previously forecast peak of 2%.

Unlike the Bank of England, economists believe that the UK will avoid a recession: a slight decline in the fourth quarter is replaced by stagnation in the first months of 2023, and then modest growth resumes. However, downside risks are growing. The chance of a recession is currently estimated at 75%, which is up sharply from 44% in early July.

Now the GBPUSD stays in its long-term downtrend at 1.1530 level. The 50-period Moving Average plays the role of resistance level. In case of hawkish BoE monetary policy, the GBP may try to test levels above 1.1600, which is the nearest target. If the BoE policy is dovish, the GBP is likely to fall down to 1.1400.

Instruments to trade: GBPUSD, GBPCAD, EURGBP.

September 15, 15:30 GMT+3.

The US Census Bureau will update its data on the Retail Sales and Core Retail Sales on Thursday, September 15, at 15:30 GMT+3. It’s a great event to follow, as it’s the main measure of consumer spending and accounts for the majority of overall economic activity.

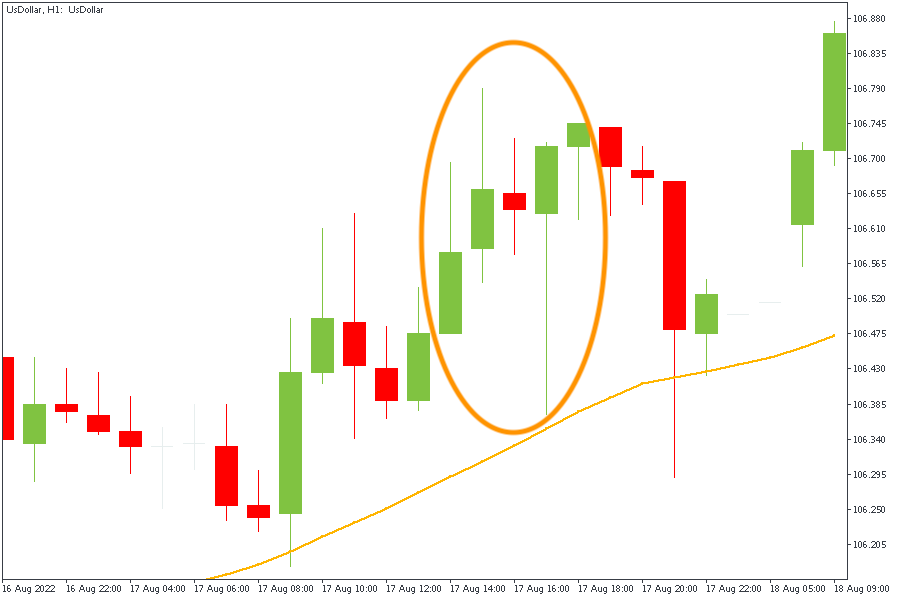

The last release showed that US retail sales stagnated in July compared to June. Total US sales went up 9.2% from May to July compared to last year's period. At the moment of data release, the US dollar index went down a little by almost 500 bp but recovered quickly.

Still, after adjusting for "dramatic price declines" for some commodities, notably gasoline, real retail sales actually rose 0.6%, the first volume increase in for the last three months. Retail sales have tumbled in recent months due to the worst inflation in decades, as consumer sentiment remains close to all-time lows.

Instruments to trade: AUDUSD, USDCAD, EURUSD.

Trading on economic events is a great opportunity to practice both fundamental and technical analysis.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later