Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The Japanese Monetary Policy Meeting Minutes will be published at 01:50 MT time on December 24.

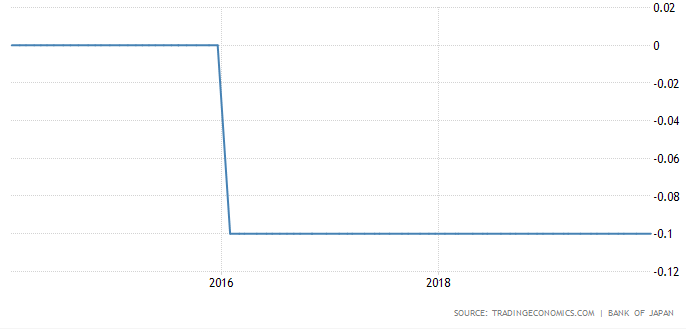

The Bank of Japan left its interest rate unchanged at -0.1% on December 19. Although governor Haruhiko Kuroda gave a generally upbeat economic outlook for Japan with a “moderate expansion trend”, he admitted there were weak spots and certain signs of slowing down in the Japanese economy. The governor explained that was due to a lower abroad demand and the negative effect of a typhoon that hit the country in October. Also, Mr. Kuroda made it clear that the BOJ will stay ready for further ease if required, in addition to the continued government spending program. Hence, the Monetary Policy Meeting Minutes will give more detail to these concerns and shed light on the vision of the monetary policy makers and the nation’s economic prospects for the nearest future.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later