The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The week will have the biggest event in the US political process over the last two years. How will the elections affect the Forex market? We covered the most important news of this week in this report.

November 8, all day.

The US House of Representatives Elections will happen on Tuesday, November 8. It will be part of the 2022 midterm elections during President Joe Biden’s current term. A total of 435 representatives from the two biggest parties will be reassigned according to the results.

There are two main parties in the US: Democratic, with Nancy Pelosi as a leader, and Republican, with Kevin McCarthy in charge. Since the previous elections in 2020, people have lost trust in the Democratic party. The level of support fell from 49 to 42, marking the wind of changes in the US political environment.

The elections may change the economic approach of the US significantly, thus changing financial market trends. The last one in 2020 resulted in a 5300-point rise of the EURUSD pair over the month.

Assets to trade: XBRUSD, XAUUSD, EURUSD, US500.

November 10, 15:30 GMT+2.

The US Bureau of Labor Statistics will release its monthly Consumer Price Index (CPI) on Thursday, November 10, at 15:30 GMT+2. This index is an inflation measure, and markets consider it the month’s most important release.

Inflation in the US is at a 40-year high of 8.2%. Although the US had an inflation rate of 15% in 1980, the Federal Reserve already implied a much more hawkish monetary policy to control rising prices. At the last FOMC meeting, Fed chair Jerome Powell stated that markets might see even higher rates if price growth won’t slow. Therefore, this release is critical for USD, gold, and risky assets such as stocks and cryptocurrency.

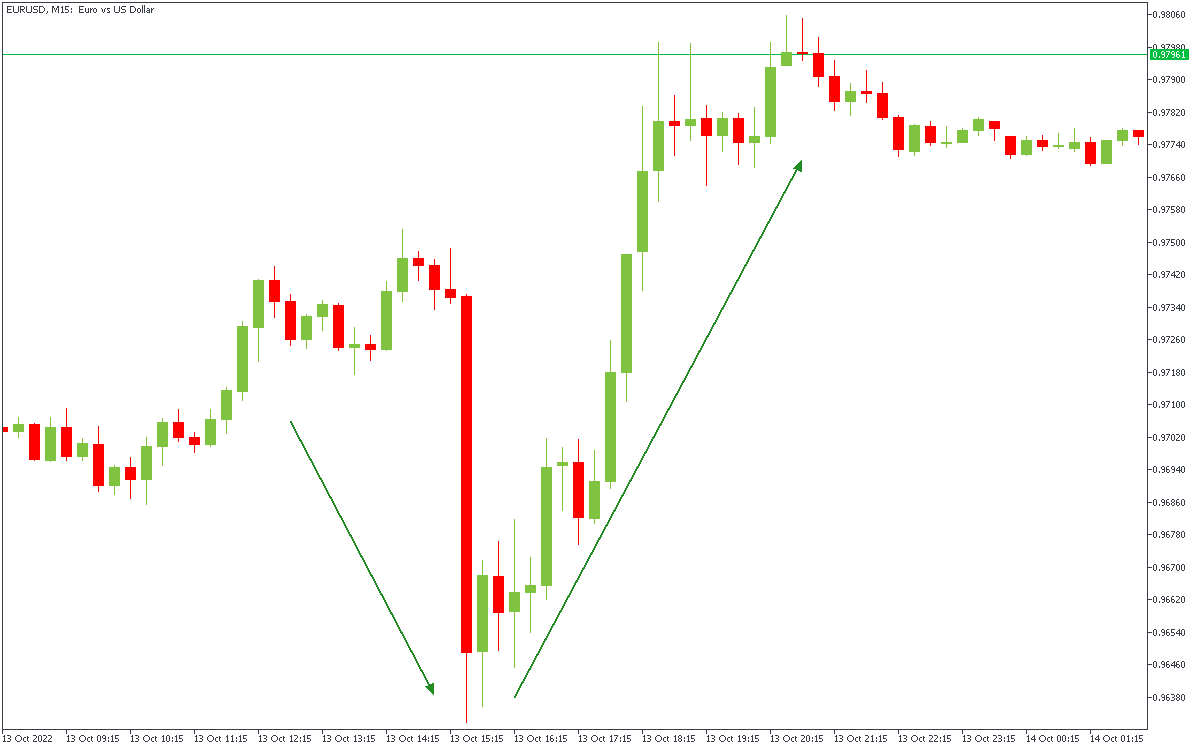

Every CPI release creates immense volatility that favors scalpers and day traders. The last reading caused a 1500-point soar in EURUSD.

Assets to trade: EURUSD, USDJPY, USDCHF.

November 11, 9:00 GMT+2.

The UK Office for National Statistics will release its monthly Gross Domestic Product (GDP) change on Friday, November 11, at 9:00 GMT+2. This data represents a change in the total value of all goods and services produced by the economy.

The previous Prime Minister (PM), Liz Truss, resigned after 44 days of ruling the country, leaving a bruised economic and political field after her. Now it’s for the new PM, Rishi Sunak, to decide how to respond to the GDP data.

As Great Britain is now under probably the heaviest political turmoil in decades, every new event in the country’s economy significantly impacts political decisions, thus affecting the GBP more than usual.

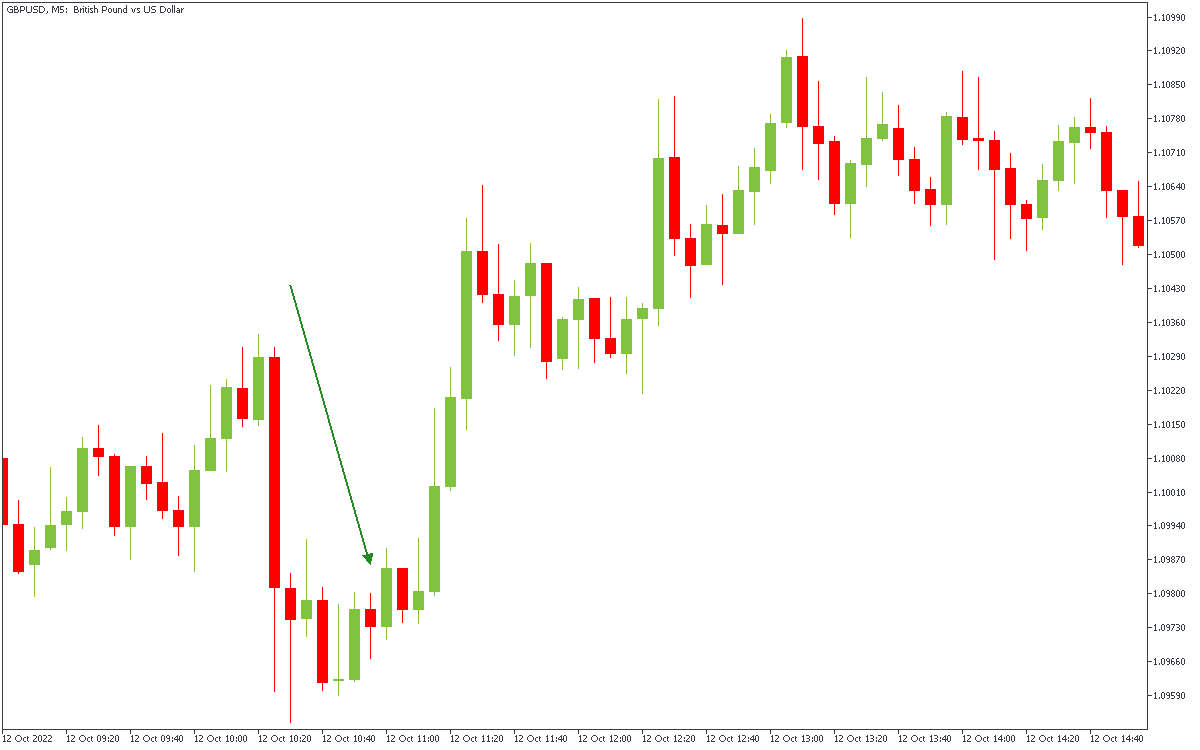

High GDP reading has a beneficial effect on the currency and vice versa. For example, lower-than-expected reading on October 12 resulted in a 500-point slide of the GBP.

Instruments to trade: GBPUSD, EURGBP, GBPJPY.

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later