Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

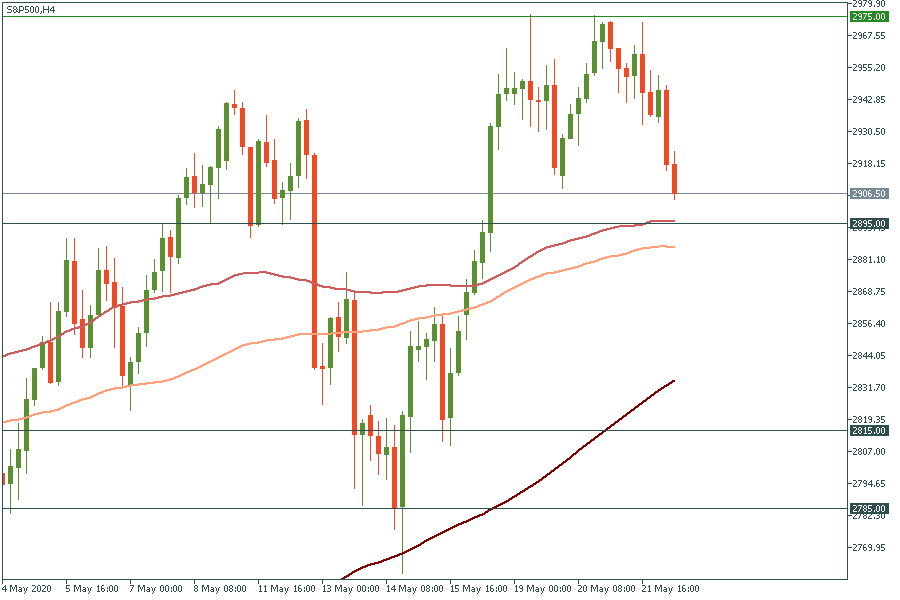

The US-China relationship is the focus of attention these days. China pledged to implement the first phase of its trade deal with the US. According to Chinese Premier, “China will continue to boost economic and trade cooperation with other countries to deliver mutual benefits.” On January 15 two sides signed a phase-one trade pact, but the agreement has come under threat as Donald Trump blamed China for the coronavirus outbreak. According to him, he had “a very hard time with China” and he would “save $500 billion” if it cut off ties with China. Also, China for the first time since 1990 hadn’t set its GDP target. All this raised market uncertainty, S&P 500 fell deeper. Let’s look at the chart. The price had been rising since May 14, but it struggled to cross the retracement level at 2975. Now it’s headed down to the support level at 2895. It may be a good entry point to go short as if it breaks through it, the price will dip down to 2815.

As we know, both USD and JPY are safe-haven currencies. However, now the Japanese yen has an advantage as it stays outside US-China disputes. Also, today the Bank of Japan released a new lending program to support small businesses. That all played into Japan’s hands, the price of USD/JPY plummeted. Now the price is struggling to cross the 200-period moving average, which it has hit recently. If it breaks through it, it will fell down to 107.1. In other case, it may reach the retracement level at 107.725, that will open doors towards 107.9.

The risk-off sentiment on the market pushed the oil prices down. Victor Shum, vice president of energy consulting at IHS Markit in Singapore, said “the nascent demand recovery is still vulnerable, and the drop in prices today is an injection of reality”. Yesterday the WTI oil price had reached unseen highs since March 10. However, it bounced back today. Support levels are 27 and 23. Retracement is 35.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later