Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The day started with the poor data from Japan. The country officially fell into a recession, that’s likely to deepen further as consumers limit their spending, companies cut back on investment, production and hiring stay at low levels amid the coronavirus.

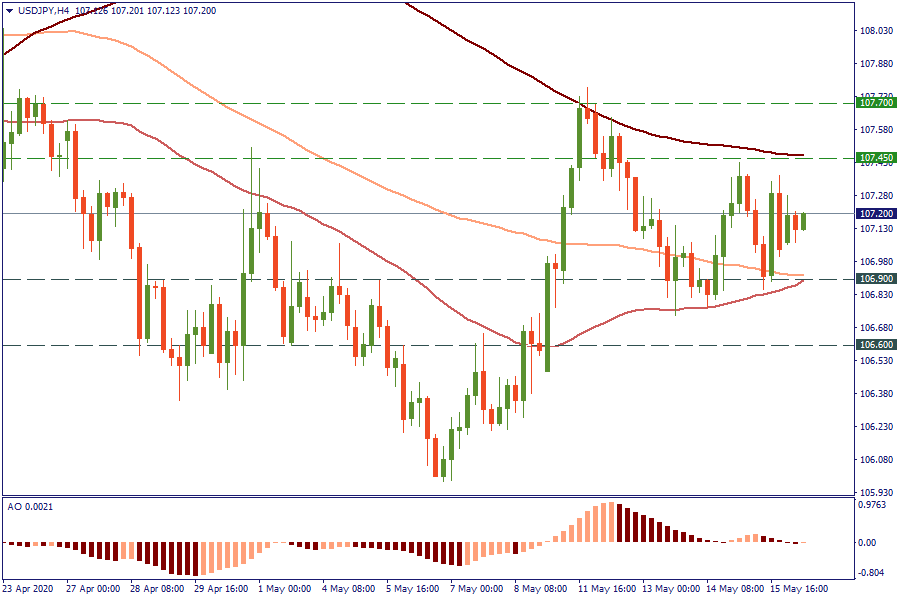

As we can see, USD/JPY didn’t react so much, it slightly moved up after the report. We shouldn’t forget that the Japanese yen is a safe haven, as well as USD. That’s why it’s hard to tell which way the USD/JPY will go this week as investors use both currencies for a safe-haven protection.

Let’s look at the chart. If the USD/JPY increases and crosses the resistance line at 107.45, it will open doors further to the next one at 107.7. Support levels are at 106.9 and 106.6.

Even so, futures on the S&P 500 climbed. It’s strange in such a risk-off market. This disconnect between economic reality and the stock markets could be associated with the comments by the Fed’s Chairman Jerome Powell that the central bank hasn't run out of ammunition yet and could do more if required. However, he also said that the stock rally could decline significantly if there were some setbacks in the fight to contain the virus. Another reason of stocks’ fall could be the deterioration of the US-China relationship.

Moreover, the WTI oil price went above $30 a barrel! For the first time in two months! As producers continued to cut production, helping to rebalance a market. Together with a tentative recovery in demand, that’s made a repeat of last month’s plunge below zero extremely unlikely before the expiration of the WTI June contract on Tuesday. There’s still a risk, however, that oil’s recovery could be derailed if the pandemic worsens. However, prices are unlikely to drop below $20 a barrel.

Resistance is 35. Support levels are 23, 20 and 13.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later