Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The market sentiment is mixed. China’s outbreak appeared to fade, what set the risk-on tone. At the same time, risk-off is fueled by the resurgence of new cases in the USA and some parts of Europe. Moreover, the US-China tensions are on the table again as China released details of a national security law that would give it the right to directly prosecute Hong Kong residents for still vaguely defined offenses. Also, US attempts to push the ceasefire in Libya as well as geopolitical tensions in Asia are catalysts that weigh on the trading sentiment.

The market uncertainty pushed gold up. The price retested the monthly high at 1750. It may continue rising, until it meets the resistance at 1762. At that moment or even earlier, gold can have a pullback. It has been trading in a range between 1680 to 1750 for quite a long time. If it breaks above this range, it will push the price higher. Otherwise, the move below 1717 will push the price even lower to the key psychological mark at 1700 and then 1680.

EUR/USD dropped significantly after rising for a month. However, it struggles to break down the support at 61.8% Fibonacci level at 1.1165. If it crosses it, it will open doors towards the next support at 1.1065, where the 200-period moving average lies. In opposite, if bulls get stronger, EUR will jump to the 100-period moving average at 1.125. However, many analysts have bearish prospect for EUR.

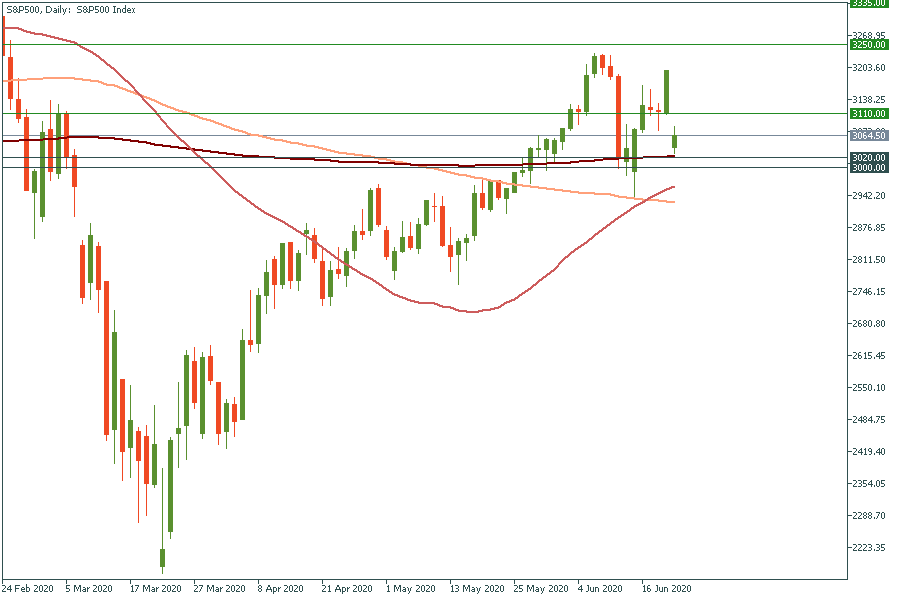

Receding figures of the coronavirus from China offer a boost to the market’s mood. S&P 500 has just crossed 3060. If it continues climbing up, it will meet the resistance at 3110. The support level is at 200-day moving average at 3020. If it breaks it down, it may fall even deeper to 3000.

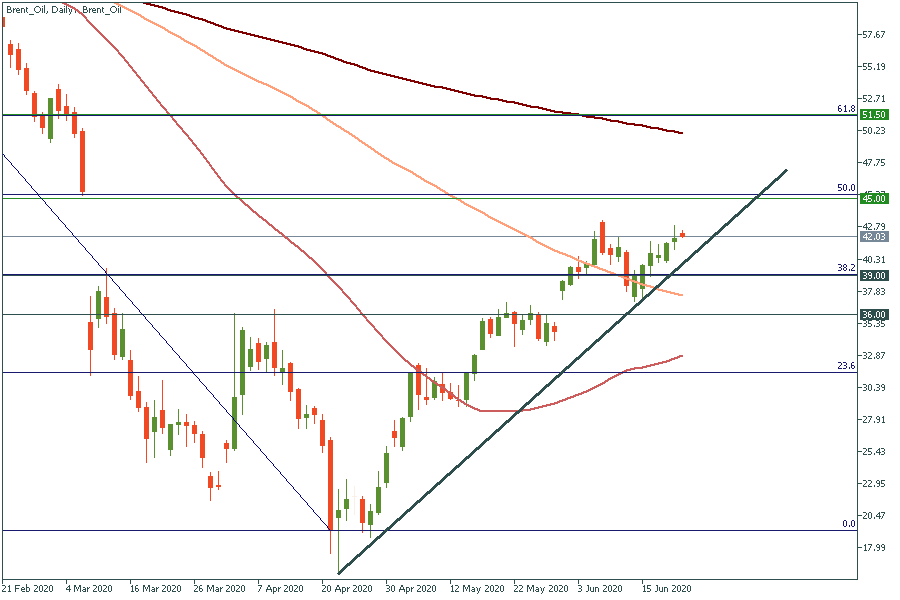

Let’s move on to oil. The Brent oil price has just passed $42. Now it’s moving up towards the resistance at 50% Fibonacci level at $45. Support levels are $39 and $36.

To trade Brent with FBS you need to choose BRN-20N.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later