The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Last week was bullish for the New Zealand dollar. The currency strengthened amid the market optimism surrounding the US-China phase one trade deal. Today we will see the release of GDP growth of New Zealand for the third quarter at 23:45 MT time. The important economic data may excite traders.

As you may know, the indicator of GDP growth stands for the gross domestic product of a country. It represents the inflation-adjusted value of all goods and services produced by the economy. The central bank uses this indicator to measure the economic health of a country. Wednesday’s release may affect the RBNZ decision, as the bank is assessing its further moves. After surprisingly keeping the interest rates on hold during the November’s meeting, the possibility of a rate cut during the next meeting remained. However, the positive data may change the mind of the regulator.

Recently, New Zealand banks raised their projections for Q3 economic growth.

ASB raised it from 0.7% to 0.5%, while BNZ increased it from 0.3% to 0.5%, citing a better manufacturing data.

The survey of economists by Reuters also shows the expectation of a rise to 0.6%.

If the actual level of indicator is higher than the forecasts, it will have a positive impact on the New Zealand dollar.

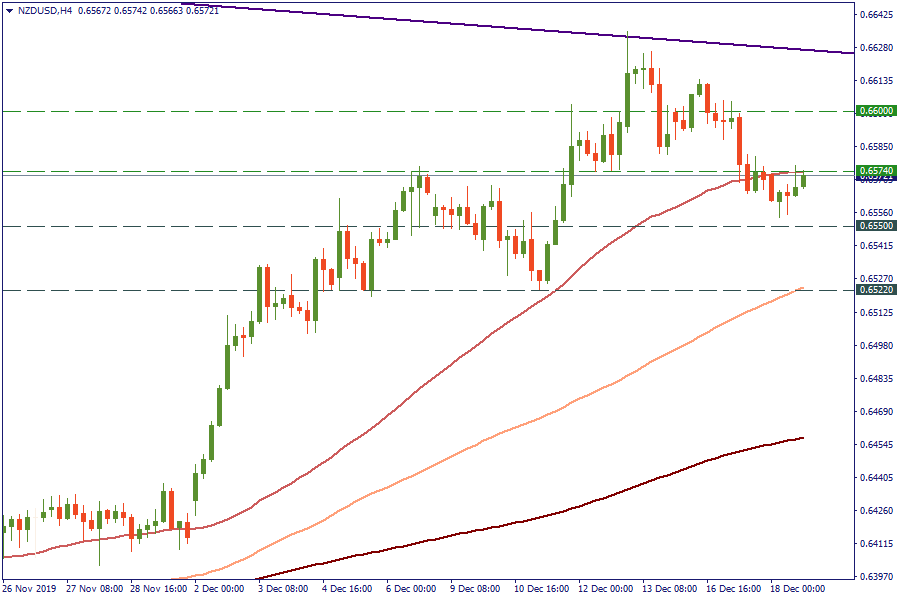

The 50-week SMA combined with the 0.66 level appeared to be too tough for buyers of NZD/USD. On the daily chart, the pair bounced from the 0.66 resistance level and moved down to the 0.6540 support, which lies close to the 200-day SMA.

On H4, bulls are testing the resistance at 0.6574 (50-period SMA). If the NZD is supported today by the positive data, we may expect the breakout of this level and rise towards 0.66. Otherwise, we may see the reversal towards 0.6550. In case of a breakout of this level, bears will target 100-period SMA at 0.6522.

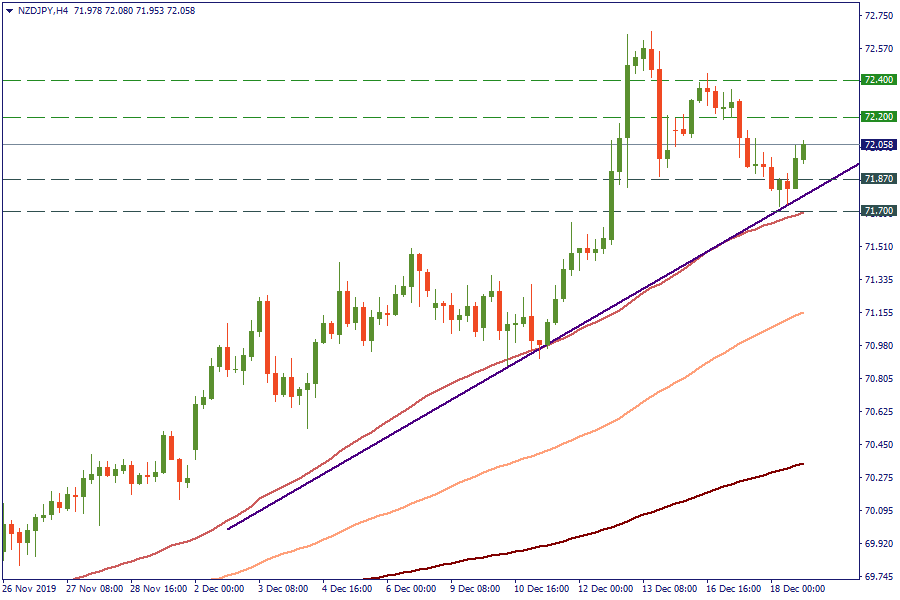

NZD/JPY has been trading at its July highs. On H4, the price has been trading within an uptrend, which is well supported by the 50-period SMA. The retest of a trendline may be attractive for opening a long position. If bulls push the pair higher, the chance of reaching the 72.2 level will increase. Key levels from the downside will lie at 71.7-71.87.

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later