Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

2022 was rough: inflation, energy crisis, and plenty of other controversial situations. We begin the new year with great hopes, and the economic events in the first week of January can rule the roost for at least the first month. Let’s see what events can bring volatility to the market at the beginning of January 2023.

January 4, 9:30 GMT+2.

Swiss Federal Statistical Office will announce its inflation rate on Wednesday, January 4, at 9:30 GMT+2.

Swiss consumer price index remained stable at 3.0% in November but still exceeded the 0-2% target range set by the Swiss National Bank for the 10th straight month. Economists, on average, expected the year-on-year rate to remain flat at 3.0%. The SNB raised rates twice in 2022 to fight inflationary pressures.

The Swiss economy grew by a real 0.2% in the third quarter compared to the second three months of 2022 and slowed to 0.5% year on year, falling short of market expectations.

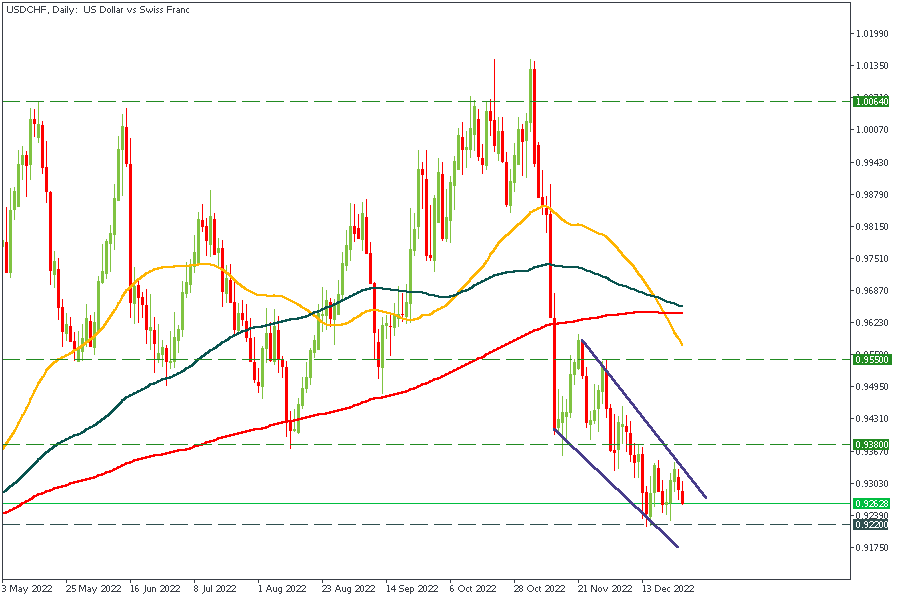

At the moment, the USDCHF is in a downtrend. The price is bouncing between two trendlines. The release results can make the price break this trend and may reverse. Otherwise, the price will continue to go down.

Instruments to trade: USDCHF, CHFJPY, GBPCHF

January 4, 21:00 GMT+2.

The United States will publish the Federal Open Market Committee Meeting Minutes on January 4 at 21:00 GMT+2. This detailed report of the previous Fed's meeting contains in-depth insights into the economic and financial conditions.

The Federal Reserve raised the interest rate to its highest level in 15 years, indicating that the fight against inflation is still ongoing, despite some recent encouraging signs.

True to expectations, the rate-setting FOMC voted to raise the overnight borrowing rate by half a percentage point to a target range of 4.25% to 4.5%. This increase broke a string of four consecutive three-quarter point increases, the most aggressive policy moves since the early 1980s.

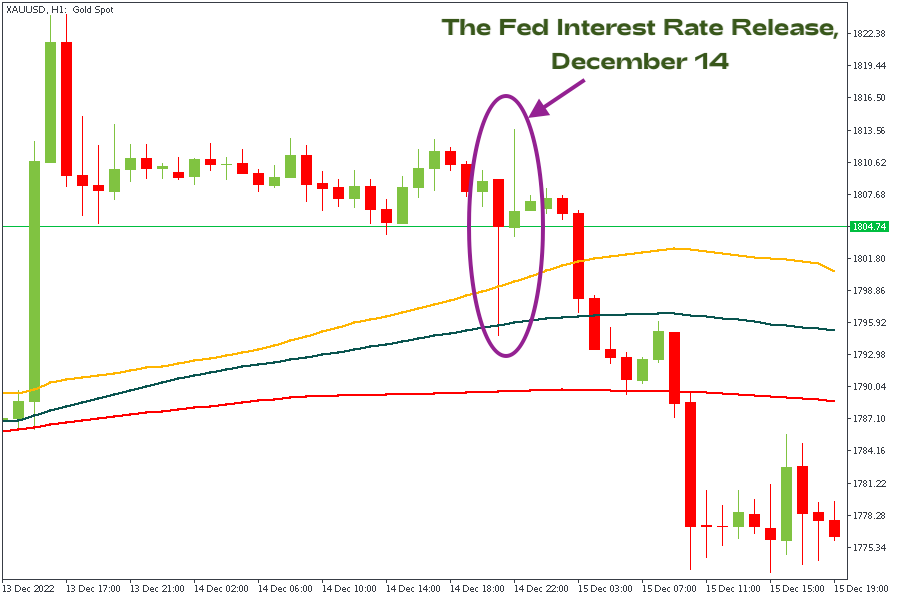

On December 14, when the Fed made its interest rate statement, the gold’s price, which reversely correlates with the USD, lost 1400 points. However, the price recovered after Jerome Powell’s speech, gaining almost 1000 points.

Instruments to trade: EURUSD, GBPUSD, USDJPY

January 6, 15:30 GMT+2.

The United States Bureau of Labor Statistics will release monthly average hourly earnings, non-farm employment change (NFP), and unemployment rate on January 6, 15:30 GMT+2. It’s the primary indicator of economic health.

All three readings are worth following because they’re released monthly and therefore reflect the current state of the economy. The markets often react to the release, making it a good chance to catch a price swing.

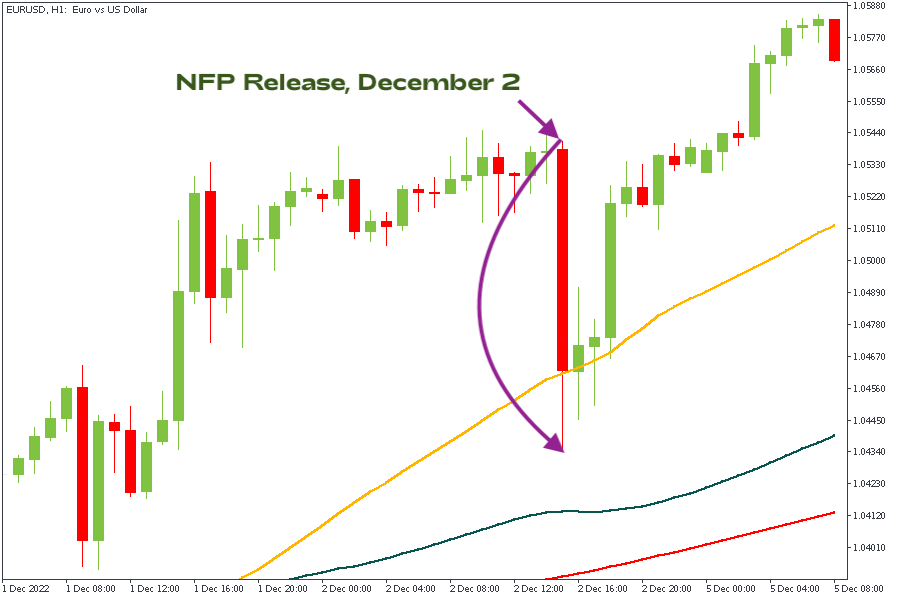

November NFP data reveals 263k jobs added to the US economy. Average hourly wage growth comes in at twice the expected figure (0.6% vs. 0.3%), which is worrying for signs of a wage-price spiral. The unemployment rate remains unchanged at 3.7%. These results confirmed that the jobs market was very tight, which became the Fed's selling point for higher rates.

The US Dollar strengthened at the moment of the previous release, and EURUSD lost around 1000 points.

Instruments to trade: XAUUSD, EURUSD, USDCAD.

New year, new beginnings. With all hopes for the best, we’ll continue following the economic events even further. Stay tuned with FBS and join trading with us.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later