Here is the digest with the most interesting news for today

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

All traders are looking forward to Fed announcement today because it can strongly impact stocks and currencies The inflation in the US influences USD, which for its part interacts with almost all spheres over the world.

Chinese stocks surged after China unveiled a more market-friendly policy stance. Hang Seng Index (HK50) is up by more than 10%. Remember that you can trade it with FBS!

CNH received support after reports that Saudi Arabia would consider paying yuan for oil sold to China. USD dipped.

Russia has begun the process of paying $117 million in interest on dollar bonds. Investors are waiting to see if there will be a default. The coupon payments have a 30-day grace period until a default can potentially be declared.

Trading in nickel is about to resume on the London Metal Exchange, more than a week after it was suspended due to a historic short squeeze.

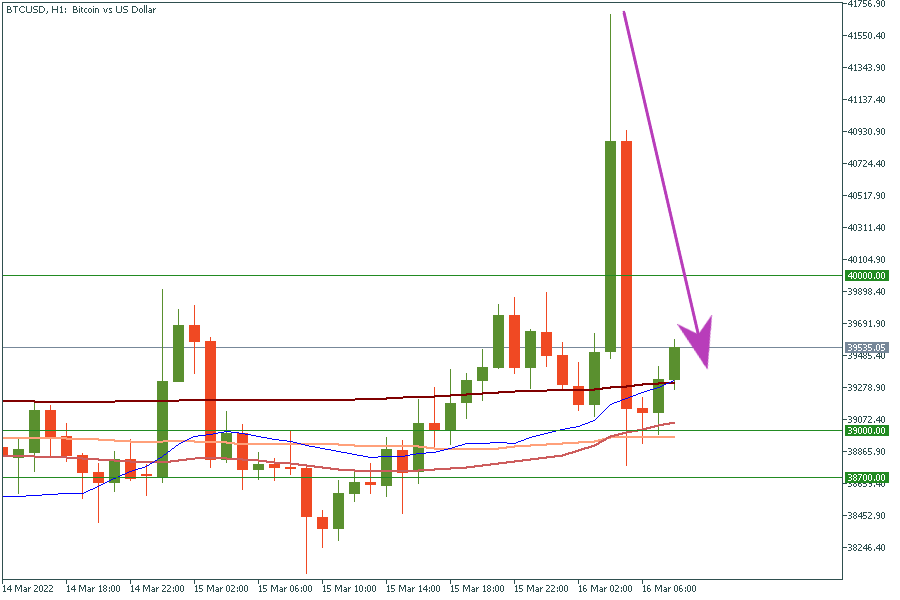

Bitcoin made a sudden rally, rising nearly 6% at one point before dropping to around $39,000.

Amazon.com Inc. received unconditional EU approval for its $8.45 billion acquisition of film company Metro-Goldwyn-Mayer, betting that the nearly century-old Hollywood icon could satisfy an insatiable demand for streaming content.

CEO of Meta Platforms Inc. Mark Zuckerberg confirmed that the company is building technical functionality to allow users to display their NFTs on Instagram.

Don’t miss: USD Federal Funds rate, March 16, 08:00 pm MT!

Here is the digest with the most interesting news for today

Markets never sleep! Let’s be prepared for a beautiful trading experience by looking at the most important news of Tuesday!

The first week of November promises to be eventful, as we have the Fed meeting, the BOE update, and the NFP release. Read more details here.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later