The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

As the situation with coronavirus got worse during the weekend, the Federal Reserve and the Reserve bank of New Zealand cut their interest rates in response to the treats to global economy.

The eventful Sunday began with the Reserve bank of New Zealand slashing its interest rate by 75 basis points to 0.25%. Against the USD, the New Zealand dollar has tested the 0.6 level on the announcement.

Just two hours later, the Federal Reserve also cut the interest rate, moving it within the range of 0-0.25%. In addition, the regulator softened the loans conditions for the banks, i.e. increased the length of the discount window to 90 days and reduced reserve requirement ratios to 0%. To boost the economic conditions, the Fed launched a new round of quantitative easing program in $700 billion.

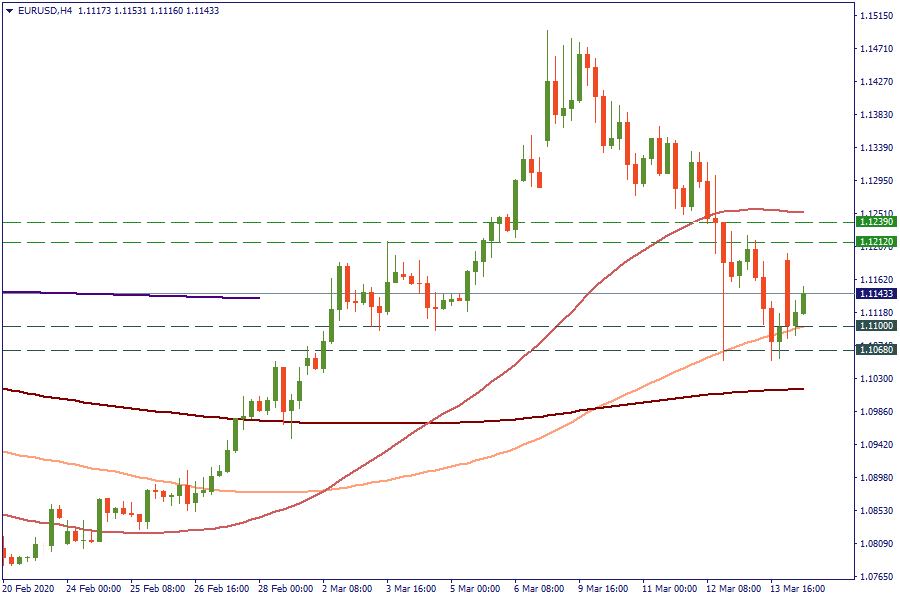

The surprising news pulled EUR/USD lower at first to the 100-period SMA at 1.11 on H4, but then the pair inched up to 1.1212.

Basically, the situation is not getting any better, and the central banks try to do their best to response the uncertainties surrounding the virus outbreak. Up next we will hear the breaking announcement of the Canadian government later today, the comments by the EU finance ministers, and the G7 video conference at 16:00 MT time. Follow the news with us to be updated on the events!

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later