Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

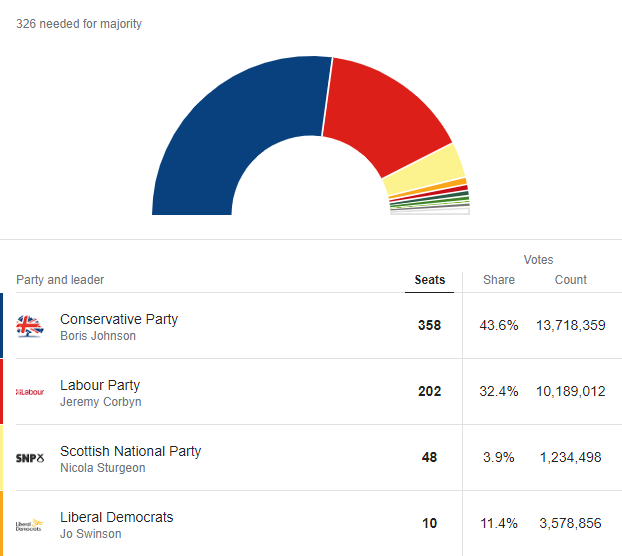

Finally, the victory of the Сonservative party under the leadership of Boris Johnson is confirmed. They have a 43.6% majority, while the Labour party follows with 32.4% and the Liberal Democrats got 11.4%.

Boris Johnson had previously commented he had a strong agenda for the United Kingdom should he win the election. One of the pillars of his plan was to “get Brexit done” at the soonest and in the best interest of the UK.

For the UK, it means higher stability and a better economic outlook with all the consequences.

For the world, it means stronger GBP against the related currencies.

All of that, of course, takes place if Mr. Johnson does not fail on his intentions.

GBP celebrating the victory

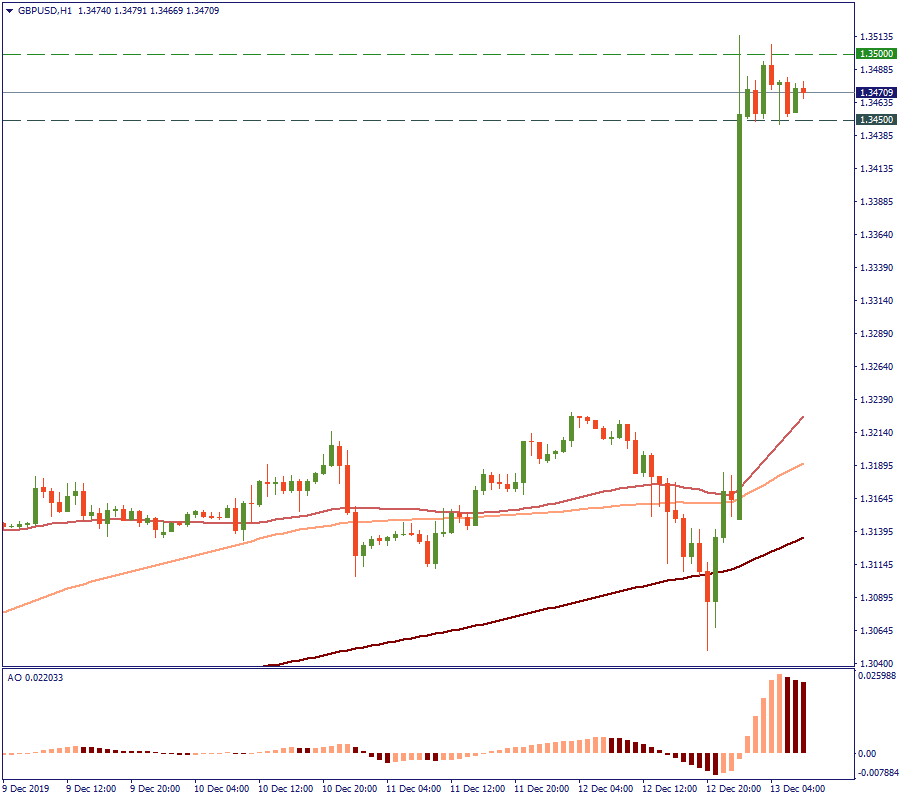

In the meantime, the British pound reacted immediately to the victory of Boris Johnson.

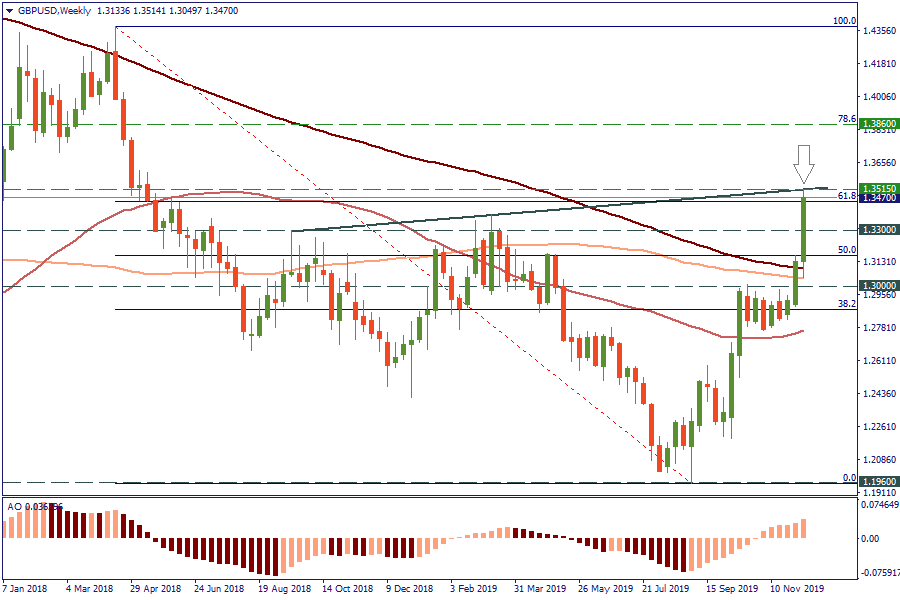

On the weekly chart, it is visible that the price of GBP/USD rose to the area of 1.35 – a height it has never been to since May 2018. And it is testing the August-2018-December-2019 resistance currently. Crossing this barrier would confirm the market’s intention to go even higher.

In the short term, however, we are expecting a certain correction downwards, as confirmed by the Awesome Oscillator. In any case, whether it is going further upwards now or later, the price would need to make a stop at the resistance it is testing now. On the hourly chart, the level of 1.3500 is going to be capping the bullish direction for a while, while 1.3450 will be the support. Crossing the support would mean a deeper correction downwards. Otherwise, we will observe a more sideways movement of the price.

Watch the news and stay informed!

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later