The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

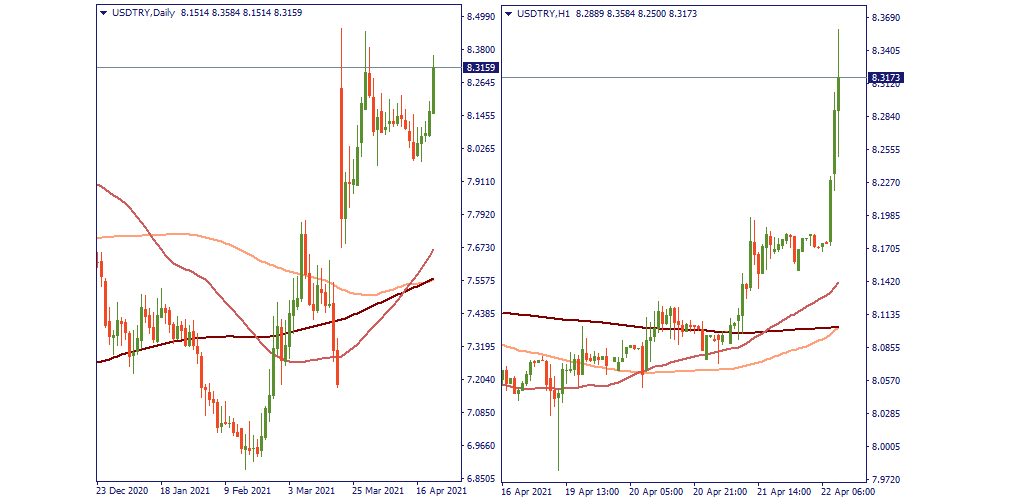

Today, USD/TRY is peaking above 8.30 - that's the zone of the all-time highs!

The first time the Turkish lira dropped that much value was in November 2020. Back then, a new Turkish Central Bank governor was appointed to put it back onto a healthy course - and Naci Aqbal managed to do it countering double-digit inflation. Eventually, USD/TRY dropped below 7.00. However, unfortunately for the Turkish lira, Naci Aqbal had to leave his post in February - and the national currency of Turkey responded by losing value again.

Taking into account these constant staff changes in the highest ranks of the Turkish Central Bank, it's not a surprise that the national Turkish currency behaves in such an unstable manner. On top of that, see that, global investors are increasingly losing faith in the Turkish economy that is becoming less attractive for investment and hence propels the lira's depreciation.

One of the reasons for the current upswing of USD/TRY may be the announcement that Joe Biden may officially recognize the actions of the Ottoman Empire in 1915 towards the Armenian population as genocide - a move that will definitely strike hard at the US-Turkish relations, and the Turkish authorities already warned their American counterparts of that. In the meantime, this move may be considered as US warning to Turkey as well: so far, while being in the NATO, Turkey did not hesitate to purchase Russian arms raising questions - at least, on the American side - about the true nature of its intentions and loyalty to the military alliance.

In any case, the US-Turkish relations are becoming worse day by day, and that's pressing on the Turkish lira. If it continues like that, USD/TRY may well reach 9.00 in the nearest future.

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later