The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

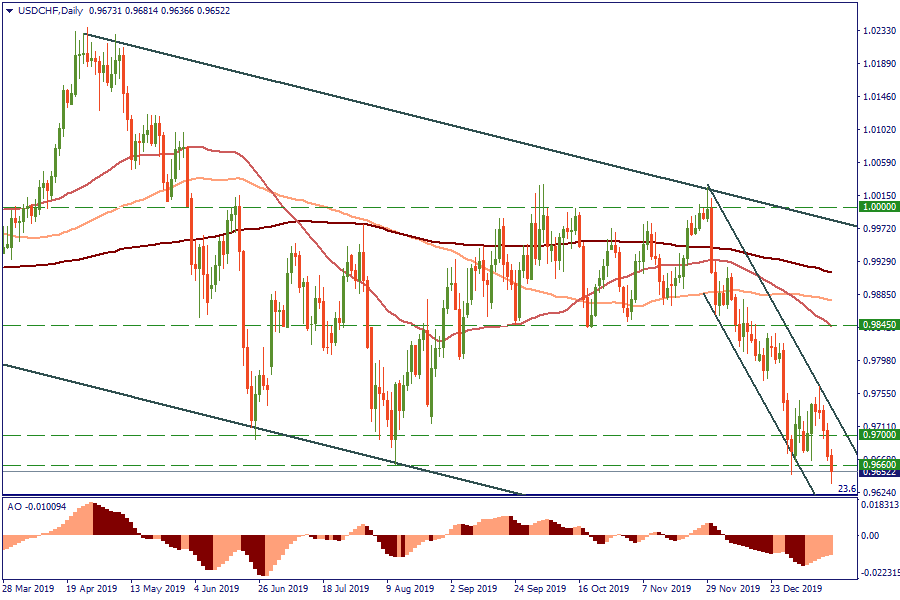

On Wednesday, January 15, USD/CHF fell to the minimum since September 2018, while EUR/CHF slid to the lowest levels since the start of 2017. The pair declined after the United States put Switzerland on the watch list as a currency manipulator.

As it happens, Switzerland has a large current account surplus. This is a sign of stability in the country’s finance. As a result, when the market’s sentiment worsens and they seek a safe haven, they buy the CHF.

At the same time, Switzerland is an export-oriented economy, and the excessive appreciation of the CHF is not good for Swiss exporters: when the CHF rises in value, they get less francs for a unit of foreign currency. The need to protect domestic companies has previously forced the Swiss National Bank (SNB) to intervene to the currency market by selling CHF.

The US doesn’t approve of such policy type: America has a history of criticizing other countries for exchange rate manipulations. Other countries, the policy of which currently worries America, are Germany, Ireland, Italy, Japan, Malaysia, Singapore, South Korea, and Vietnam. Earlier this week the US took the label “currency manipulator” off China as the two countries try to mend relations after their trade dispute.

By the way, it’s a remarkable day for the Swiss currency anyway as five years ago the Swiss central bank unpegged the CHF from the EUR. We don’t get market moving news related to the CHF very often, so this is the chance to consider the Swiss currency for trading.

Analysts at BNY Mellon think that now the SNB will be more reluctant to try and limit the franc's strength. Many traders probably think the same: that’s why USD/CHF and EUR/CHF dropped.

According to MUFG Bank, the market will keep testing the nerves of the Swiss central bank. Societe Generale points out that if the US releases weak economic figures, the negative pressure on the USD/CHF will be especially strong. Specialists say that the SNB will still have to take action at some point, and the US announcement increases the uncertainty. All in all, the opinion is that USD/CHF and EUR/CHF are capable of getting lower.

USD/CHF is oversold in the short-term, but it still lacks substantial support. The next levels on the downside are at 0.9620 and 0.9550. On the upside, resistance lies at 0.9660 and 0.9700.

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later