Happy Tuesday, dear traders! Here’s what we follow:

For a seamless experience, click “Redirect me.”

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

71.43% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Generally speaking, Jerome Powell’s announcement was bringing a message of cautious optimism. He recognized that recovery will take some time and that the current situation in the US is far from pushing into the hawkish direction. The interest rate is held steady at 0.25% and will stay there in the nearest future. He also noted that even after a strong period of job creation in the course of recovery there still will be a big chunk of people who wouldn’t get back to work. Hence, getting inflation back above 1.5% will take quite some time. Fed’s Chair made sure to clarify that the Fed is backing up the economy with all the means it has and will be doing so as long as it takes.

The US dollar didn’t lose more value than it would under current trends. Against the JPY, is actually gained recently, although a larger mid-term trend is a decline. Against the EUR, it also slightly gained, while the larger direction during the last week has been sideways.

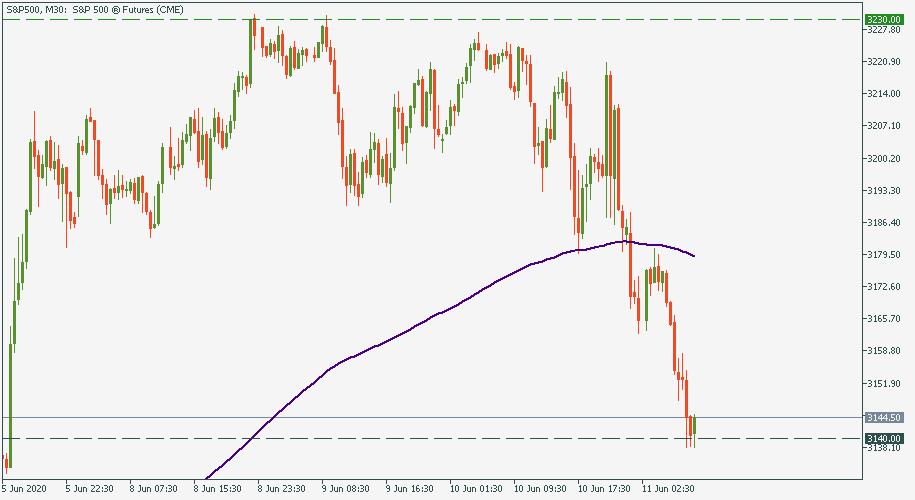

The S&P, on the other hand, erased the gains of the last week’s rally, getting down to 3,140. We can only say, though, that Jerome Powell’s message merely confirmed the already existing downtrend. May observers commented on it earlier saying that the stock market did a bit too much into the bullish direction last week, and had to cool down. The Fed’s message merely underlined and sealed this layout.

The economy is still in a recovery path. It is obvious and will just take time to complete. From the emotions point of view, all the market has to do is to not get overly optimistic and hopeful about the velocity of this recovery. But fundamentally, it is already around the corner, and proper waiting should bring its fruits.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later