The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Coronavirus and following shutdowns of American cities, including New York, the US financial center, cause a huge disruption of the American labor market. Companies operating in energy, travel, transportation, and services sectors are forced to fire their workers in order to cope with financial difficulties. Analysts predict especially tough times for Nevada and Florida: the states which are tourism-dependent.

While we are waiting for the complete monthly employment data on April 3, today we can already assess the number of people who lost their jobs last week. We are talking about the weekly unemployment claims – the earliest job data. The release is expected at 14:30 MT time. Generally, it shows the number of individuals who requested unemployment insurance within a week. According to analysts, the unemployment claims will soar to 1000K – the record level in history. For now, the highest level was in October 1982 with 695K claims recorded.

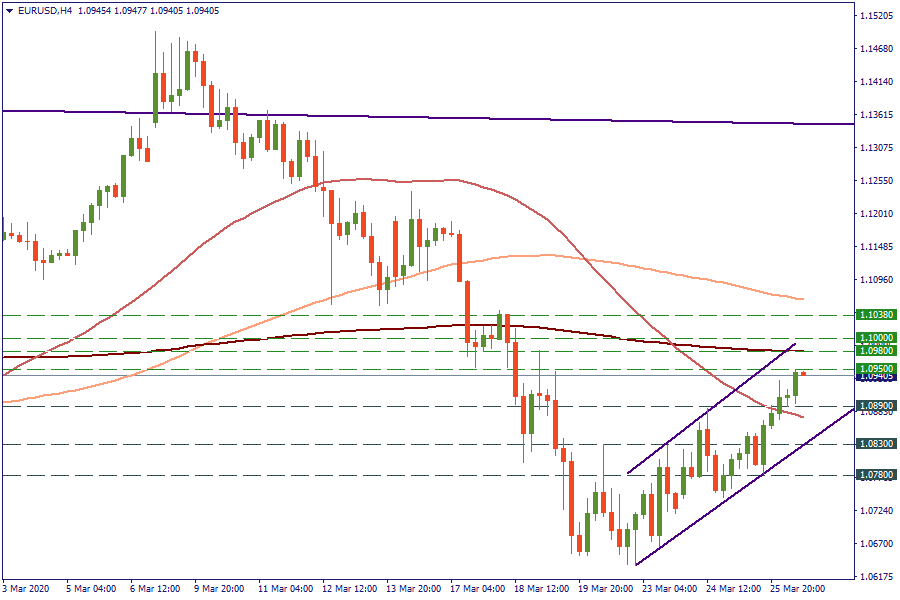

If the unemployment figures are that high, it will generate additional weakness for the USD. The currency has been already under pressure after the US Senate has approved the $2 trillion virus rescue plan. Looking at the H4 chart of EUR/USD, we can see that the pair has risen above the 50-period MA and is testing the 1.0950 level. The next resistance will lie at 1.0980 (200-period SMA) and 1.1. What if the unemployment claims are not so worrying (i.e. lower-than-expected)? In that scenario, we will be looking for a retest of 1.0890 level. The next support will be placed at 1.0830.

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later