The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Turkey’s central bank governor was at a crossroads: to hold interest rates and take a risk to be fired like it was for three governors before him, or to comply with the president, to cut rates, and to risk the market. Let’s find out, how to react to the rate cut.

Central Bank of the Republic of Turkey (CBRT) and its governor, Sahap Kavcioglu are in a complicated situation. The country’s economy is pressed from both inside and outside. In August the bank left the benchmark interest rate unchanged at 19%, in line with market expectations, for the fifth month in a row. But there is a problem. Turkey’s annual inflation rate stood at 18.95% in July, according to the latest data from the Turkish Statistical Institute (TurkStat), but now it has risen to 19.25%, making the real rate negative. And with the rate cut, it is now even worse.

Source: Bloomberg.com

The currency is down more than 16% since Kavcioglu’s appointment in March. Usually, it is an unambiguous signal to raise rates and to slow down TRY depreciation. But Erdogan is motivated not just to hold, but to cut rates, and this might cause a collapse in Turkey markets. But why would he do that? Many analysts say Erdogan appears to be growing impatient for monetary stimulus, given loans are expensive and he faces a tough election no later than 2023. A few say a prompt rate cut could even signal plans for an early vote.

In recent months, the central bank has urged patience due to unexpected inflation pressure brought on by rising global commodities prices and a surge in summer demand as pandemic restrictions eased. Despite the risk of currency depreciation and stubbornly high inflation, Erdogan has got what he wants.

The bank's policy committee said a rate cut was "needed" because of the lower core price measures - which strip out food and some other goods - as well as shocks to supply in the wake of pandemic measures.

Also, if Erdogan doesn’t stop changing governors, the lira will suffer even more, as every speech of him plunges the currency.

Source: reuters.com

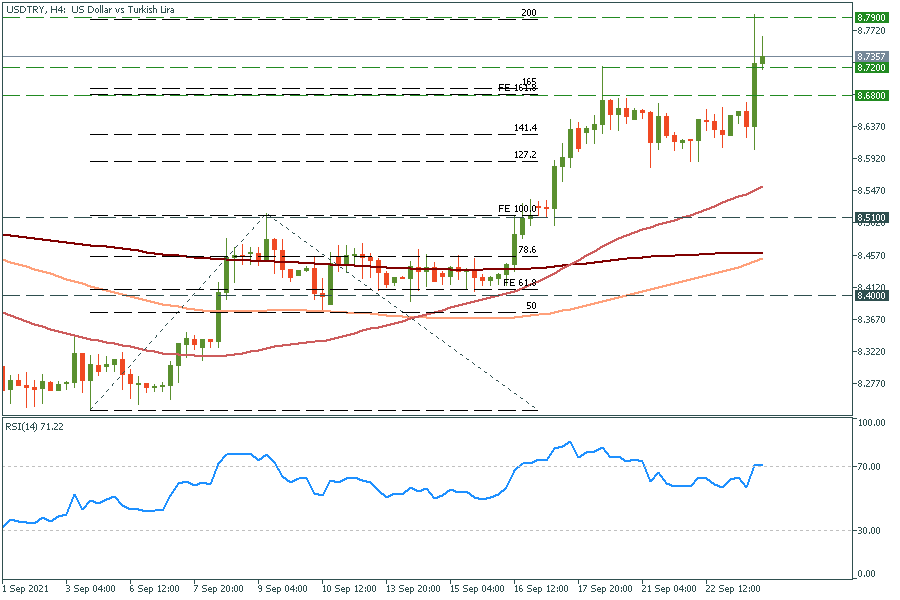

Obviously, the currency has weakened, and it will weaken further. As for the chart, USD/TRY is reacting to Fibonacci extensions and now we have a pullback from the 200 Fibonacci level. But it’s only a matter of time for the lira to fall.

USD/TRY H4 chart

Resistance: 8.720; 8.790

Support: 8.680; 8.510; 8.400

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later