Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The market sentiment has improved due to the possibility of Trump’s soon recovery. Doctors reported that the US president’s health is improving. As a result, safe-haven assets dipped, while stocks and riskier currencies got a boost.

Let’s look at the charts. EUR/USD plummeted on Friday amid the risk-off mood, but today the pair has started recovering its losses due to the upbeat comments over Trump’s health. EUR/USD has been trading in a descending channel since the beginning of September. The intersection of the upper line of the channel and the high of September 21 at 1.1770 has created a strong barrier for the pair. However, if it manages to cross it, the way up to the 200-day moving average at 1.1800 will be open. On the flip side, the move below the 50-day moving average at 1.1690 will drive the price lower to the next support of 1.1615.

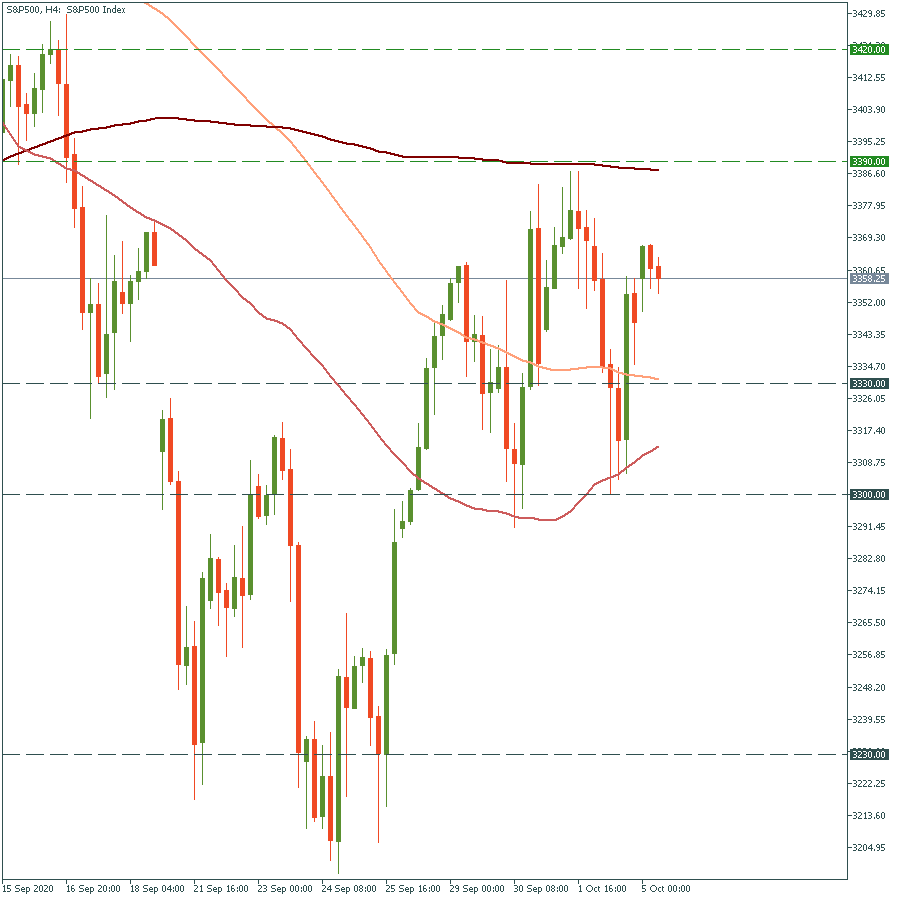

S&P 500 is fluctuating between 3 300 and 3 390. The escape of this range will define further movement. If it goes above the top of 3 390 at the 200-period moving average, it will rise to 3 420. Otherwise, if it drops below the key support of 3 330, it will plummet to the bottom of its range at 3 300. Remember that you can use pending orders not to wait for the breakouts, such as Buy Stop and Sell Stop.

Gold has started the week on the back foot. The move below the 50-period moving average will drive the price lower to September’s dips of $1 850. In the opposite scenario, if it jumps above the key psychological mark of $1 900, the doors towards $1 920 will be open, but it’s unlikely to move further up as it is constrained by the two-months trendline.

The British pound has gained on optimism over soon Brexit agreement as the EU and the UK are showing interest in negotiating further. The sooner they reach the deal – the better for the pound. The surge above the key resistance of 1.3000 will drive the price to a high of early August of 1.3150. On the flip side, the move below the 200-day moving average of 1.2720 will push the pair lower to the next support of 1.2550.

All eyes on PMI reports from Europe and ISM Non-Manufacturing PMI at 17:00 MT time.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later