Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The G20 summit and the US PPI release gave us a lot of volatility to trade on. Luckily, today’s markets may be even more volatile with new vital releases and geopolitical decisions. The daily news report will surely help you!

The UK CPI hit another high of 11.1% vs. the 10.7% forecast. The reasons behind it are the country’s energy crisis and the high monetary supply. Apparently, the Bank of England tries to control rising prices with interest rate increases but can’t succeed.

The BOE policy of helping the economy without a sufficient shrinking of the balance sheet has little to no impact. Until the BOE shows some efficient measures, inflation will likely grow. Today, the UK parliament will release its Monetary Policy Report Hearings, where we will refresh our outlook on the bank’s future actions.

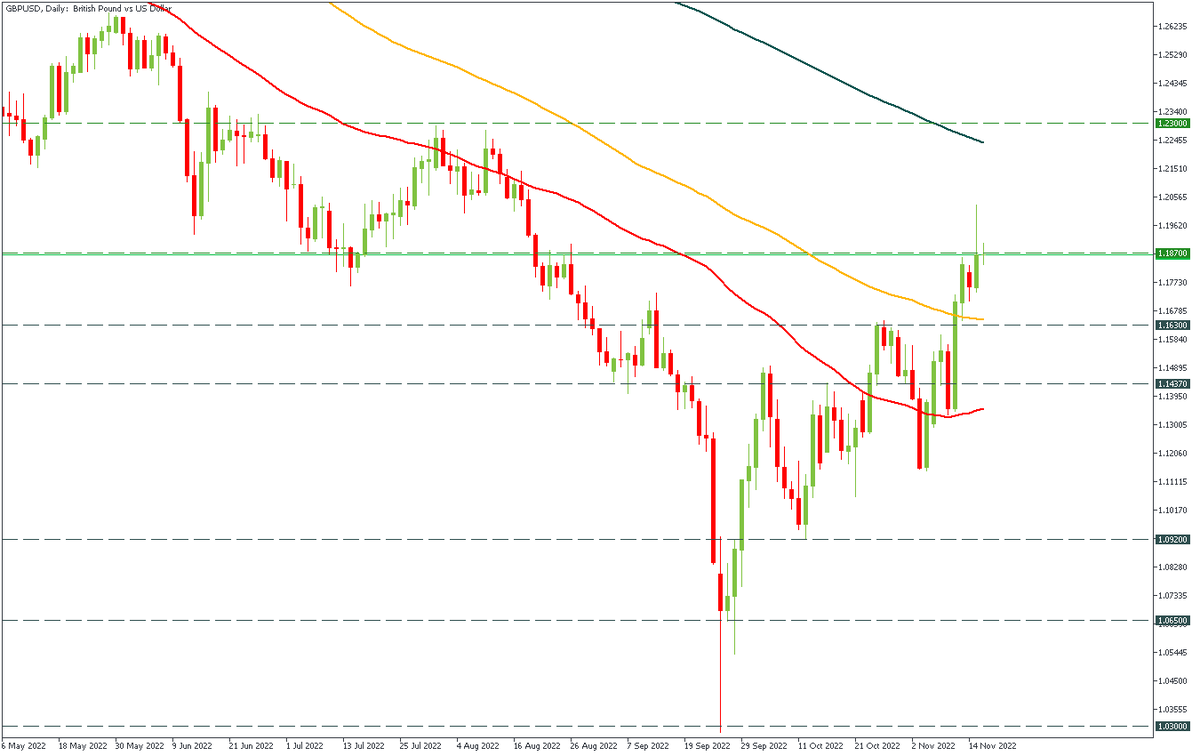

As for the GBPUSD chart, the breakout of the 1.1870 resistance will open a road to the 200-daily MA. On the other hand, the insufficiently hawkish meeting will press on the pair, edging it to 1.1630 and lower.

Stay focused, and it will lead you to victory!

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later