Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Welcome to Friday! The Week’s home straight! What's happening on the markets?

According to Markit, the UK Construction PMI for March reduced to 50.7 points – the fastest decline in housing activity since May 2020.

Tim Moore, Economics Director at S&P Global Market Intelligence: A sharp and accelerated decline in house building was the main area of concern in March. Cutbacks to new residential projects in the wake of subdued demand and rising interest rates contributed to the sharpest fall in housing activity across the construction sector for almost three years.

The cable is bouncing back from the resistance line 1.2525 on a long-term time frame. In the short run, the movement up is still possible. According to the currency options analysis, the market is sure the price will stay above 1.2408 during the following 24 hours.

The US yield curve has a negative incline. The spread between 3M and 10Y UST is 1.58%. The economy is in recession. Basic Dollar Index is falling, and soon it may touch 99.

Initial Jobless Claims in the US rose to 228K during the week (better than the forecast but worse than the previous fact). Continuing jobless claims started growing. Challenger Job Cuts for March increased. All of these are negative factors for the unemployment rate today.

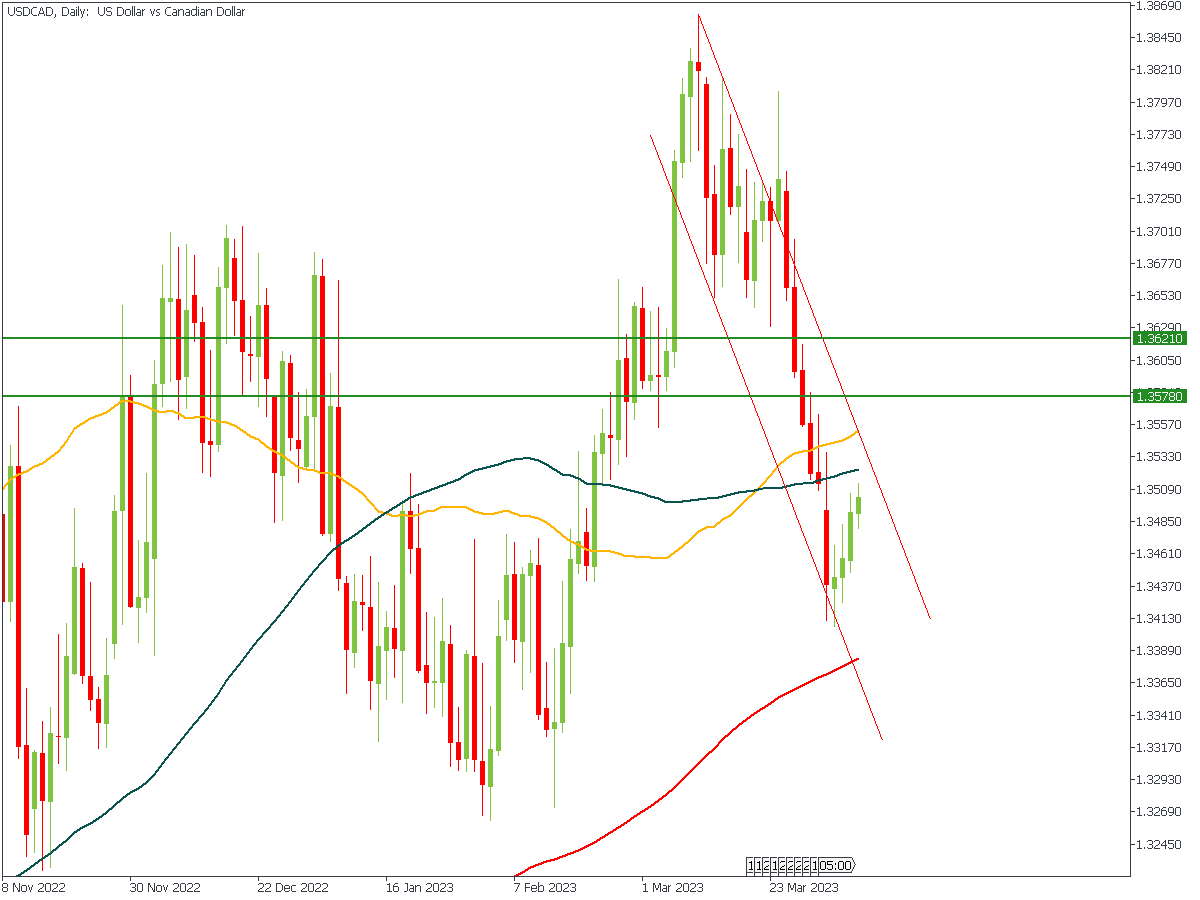

Canadian Ivey PMI surprisingly skyrocketed yesterday. The index was released at 58.2 despite Markit PMI in Canada falling. It didn’t help much that USDCAD continued growing. The trend is bullish!

Holidays are in almost all countries. The market is thin! Beware, friends. Meanwhile, NFP in the US will be published soon. We think the numbers won't be so high.

BTC is still flat. Quite boring. Support is in cluster 27500 – 27600. Resistance is around 28 000 – 28 100.

XAUUSD is trying to break $2010. There is an evening star doji pattern on a daily time frame – a bad sign for bulls.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later