The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Yesterday, we were fearing that a strict Brexit deadline announced by the UK PM Boris Johnson and other ministers may put excessive pressure downwards on the GBP in the short-term and the long-term.

Now, we see that all the gains that the GBP won on the Conservatives’ victory are undone. Moreover, the British pound seems to be preparing to continue falling against the major currencies in the observable future.

On the H4, the upsurge of EUR/GBP reached higher than where it dropped from on the day of the UK elections. More so, it crossed the 50-period and 100-period Moving Averages, now testing the resistance of 200-MA. The next big step would be the high of 0.8600, reached in November.

However, we see the consolidation and the slowdown of the current steep rise right at the resistance of the 200-period Moving Average. The Awesome Oscillator also shows that a high may have been reached, and the momentum for this particular upsurge has been exhausted.

Climbing further up requires additional power and most probably additional confirmation from the Conservatives side that they would not back down on their strict agenda. If such news comes in, we may witness the start of a gradual change in the overall trend. In addition, given the context of the situation and the commentaries already provided by the UK PM Mr. Johnson and his colleagues, the absence of any information disproving the rigidity of their plan may also serve as a confirmation of the looming hard Brexit. In this case, it will cause further weakening of the GBP.

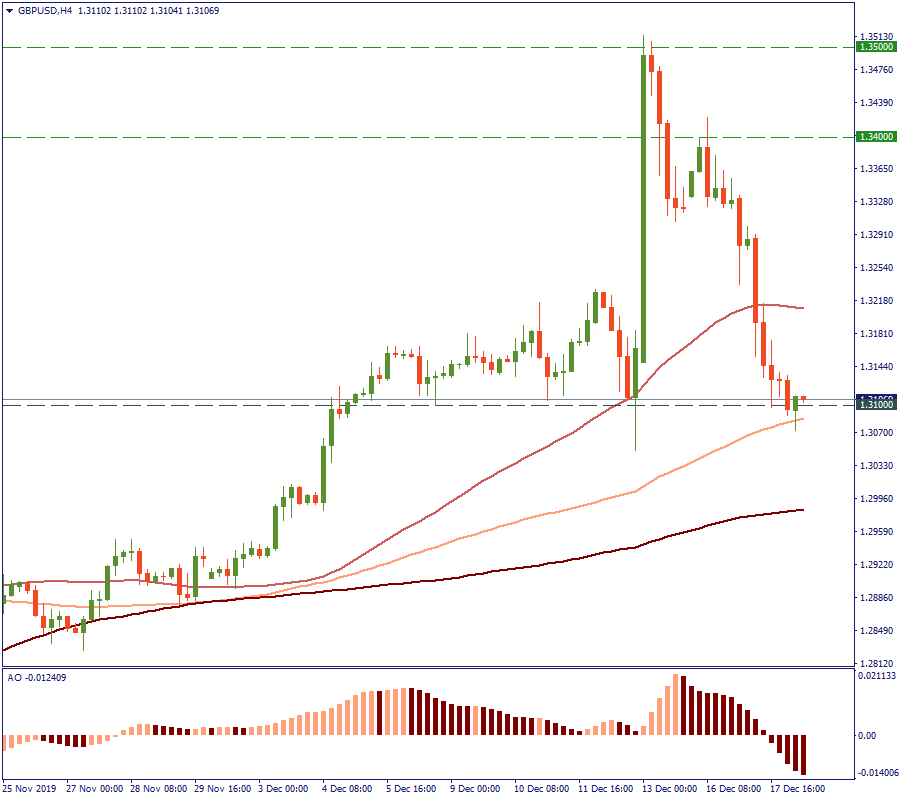

Against the USD, the GBP has dropped to the level of 1.3100 where it started its leap on December 12, breaking through the 50-period Moving Average. On the H4, the price is currently testing the support of the 100-period MA, showing signs of consolidation. Same as in the case with the euro, it is likely that the price will stay at the current support level for a while, waiting for additional information to guide the market movement. It may show a slight movement upwards or go sideways. If it does cross the 100-period Moving Average, it would be a sign that the market indeed has little hope for the GBP in the context of hard Brexit.

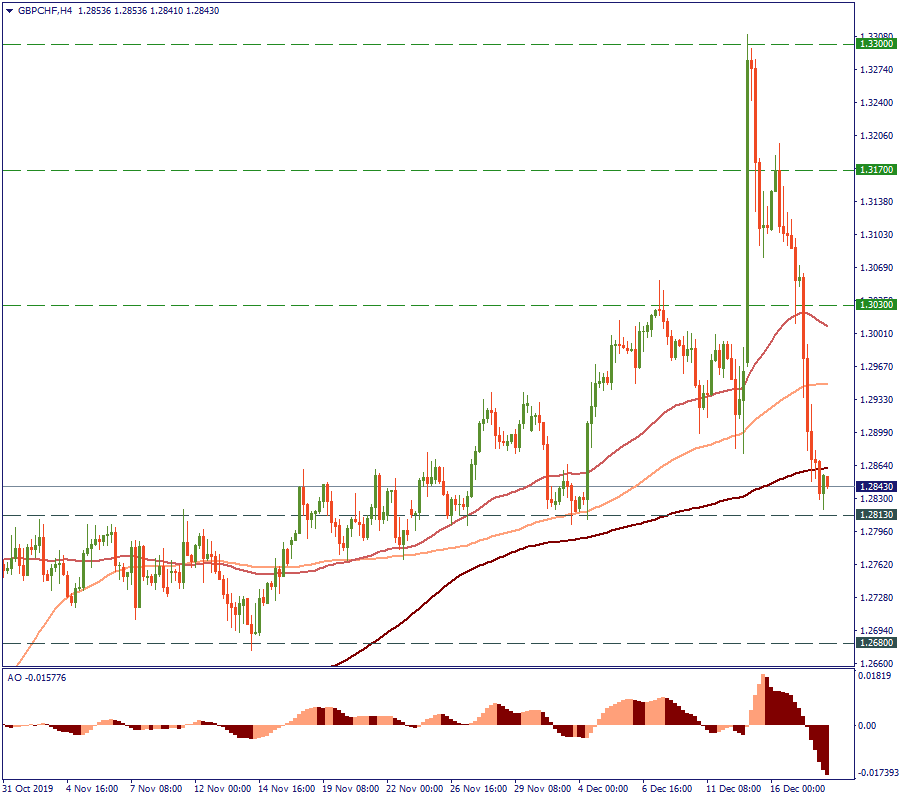

Most of the GBP currency pairs show a very similar dynamic, with certain variations. On the H4 of GBP/CHF, the price has crossed the 50-period, 100-period, and 200-period Moving Average on the way down. Currently, it is testing the support of 1.2813, left at the beginning of December. Crossing that line would mean the price aims at the level of 1.2680, along which it has been trading in October-November.

The impact of the announced Brexit agenda by the Conservatives is visible at the market. Now, the question is whether it will be a short-term disappointment or a start of a larger trend change.

To answer that, we need to follow the news and keep an eye on the price movement against the mid-term and long-term thresholds.

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later