Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The week has started with a cautious note, as the news surrounding coronavirus combined with the attack of the US embassy in Baghdad increased the risk-off sentiment in the markets.

What is a coronavirus and how it affects the markets? You can read more about it in our recent article. Long story short, it is a deadly pneumonia-like disease that started in the food markets of middle China. China has already reported more than 2,700 cases of coronavirus. The country even extended the Lunar New year holiday after the reports of 80 confirmed deaths. And while the doctors are looking for a cure, the spread of the virus continues.

Five rockets crashed near the US embassy in Iraq amid the wide protests in the country. The demonstrators have been demanding the removal of the ruling elite and an end to foreign interference in Iraqi politics.

The risk-weighted assets reacted immediately to the news.

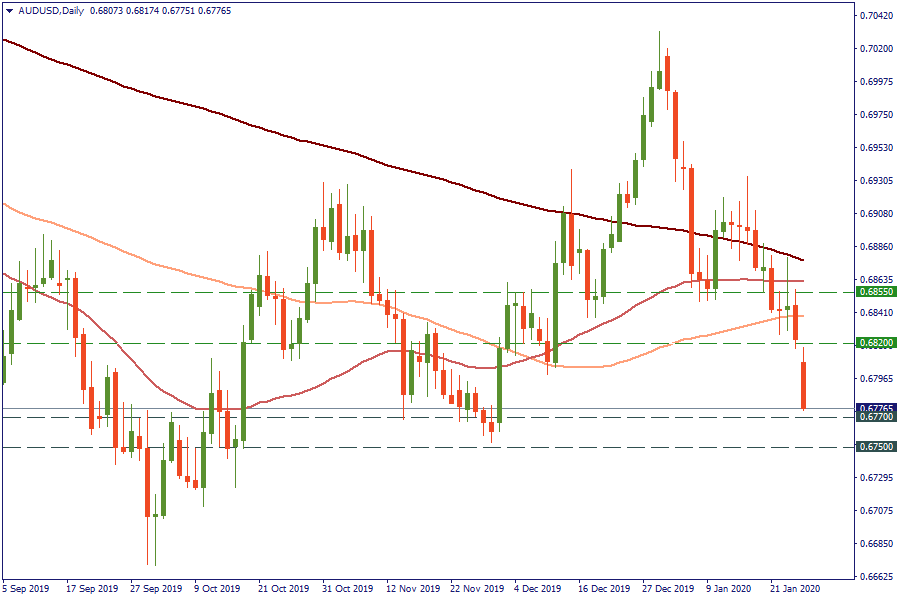

Against the USD, the Australian dollar gapped down towards the 0.6770 level on the daily chart. Strong bearish pressure may pull the pair lower to the 0.6750 level. The upside momentum will be limited by the 0.6820 and 0.6855 levels.

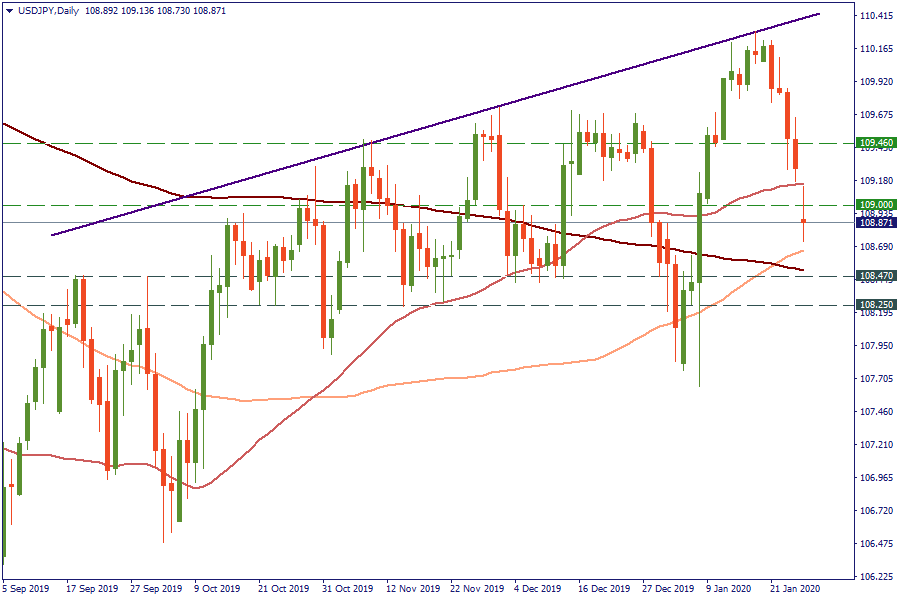

USD/JPY has been showing a mixed performance. After the opening below the 50-day SMA and the 109 level, bulls have been trying to take back their positions. On the other hand, bears are still trying to pull the pair as low as the 200-day SMA at 108.47. The next key support will lie at 108.25.

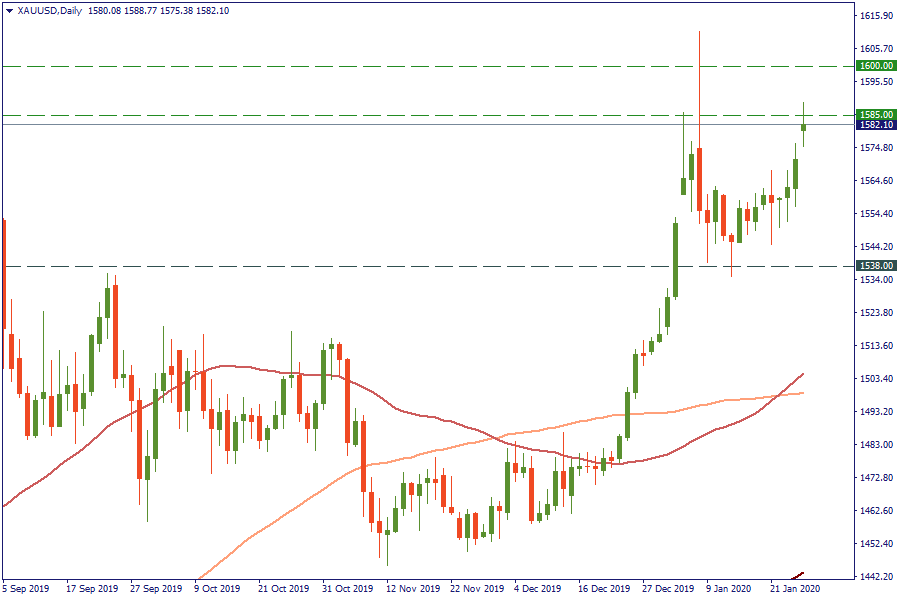

Gold has retested the highs of early January around the $1,585 level. Increased risk-off sentiment may push it higher towards $1,600. On the downside, there is support at $1,538.

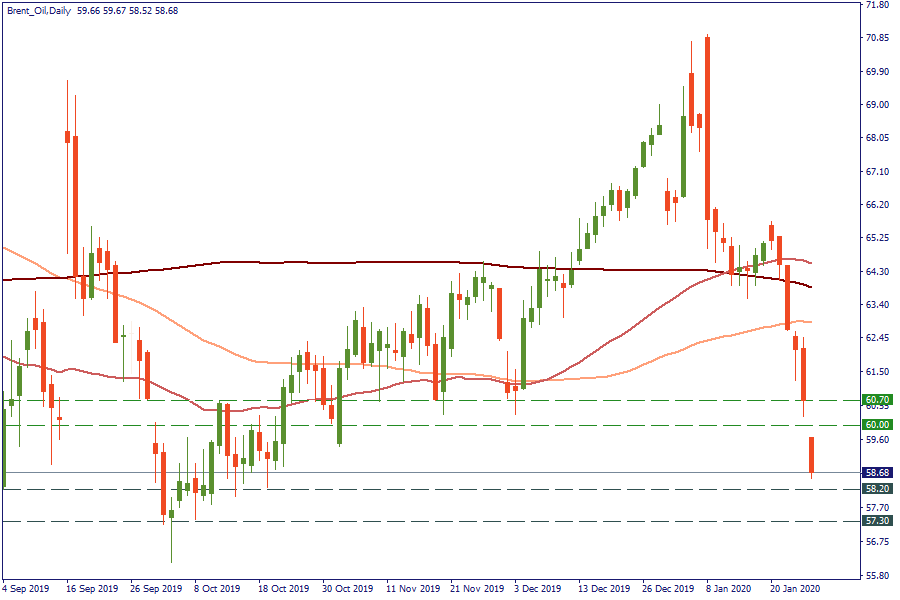

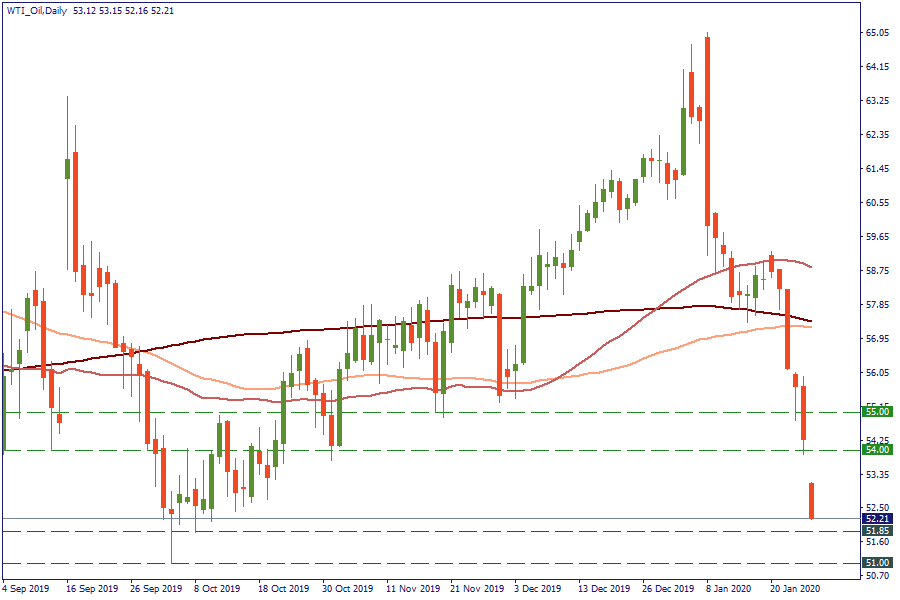

Oil prices opened much weaker, too. The price of Brent fell to the lows of last October, looking forward the support at $58.2. The next key level for bears will lie at $57.3. Bulls need to push the price above the $60 level to get back their positions.

WTI inched lower, too. Right now the price is moving down towards $51.85. The next support in focus will be placed at $51. The key level for bulls is placed at $54.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later