Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Thursday is on its way. We have several news for you to discuss

Elon Musk, Stewe Wozniak, Emad Mostaque, and other experts signed a letter to pause AI. They say that AI should be developed "once we are confident that their effects will be positive and their risks will be manageable." Skynet is close, guys

Meanwhile, one of the GPT’s developers Siqi Chen: ‘i have been told that gpt5 is scheduled to complete training this december and that openai expects it to achieve agi.’

And several companies if you want to invest in AI technologies: Microsoft, Adobe, Alphabet, Amazon, Meta, Snap, Pinterest, and Digital reality.

Pending home sales in the US beat the forecast. +0.8% in February (economists expected -2.3%).

Crude oil inventories decreased significantly in the US. -7.489M against 0.092M in the forecast. XBRUSD tries to rise, but it’s tough for bulls to break the 50% correction level ($78.25).

US500 grew during the American trading session yesterday. Almost all stock sectors are green. Nvidia stocks are growing three weeks in a row and even three months in a row. That’s what the reversal head and shoulders pattern do. The resistance level for the price is pretty close – 275.50.

Inflation in Germany is released today at 15:00 GMT+3. During the last few quarters, inflation has remained stable – higher than 8%. Now economists think that it will drop to the 7.3% level.

Instantly after the German CPI release, we will see the US GDP for the 4th quarter and Initial Jobless Claims. GDP will be better than expected (+2.7%). All eyes are on EURUSD, guys. Volatility will be high.

Bitcoin is trying to break the 29000 level. The bulls may succeed, but the risks for correction are high. Be careful, dears.

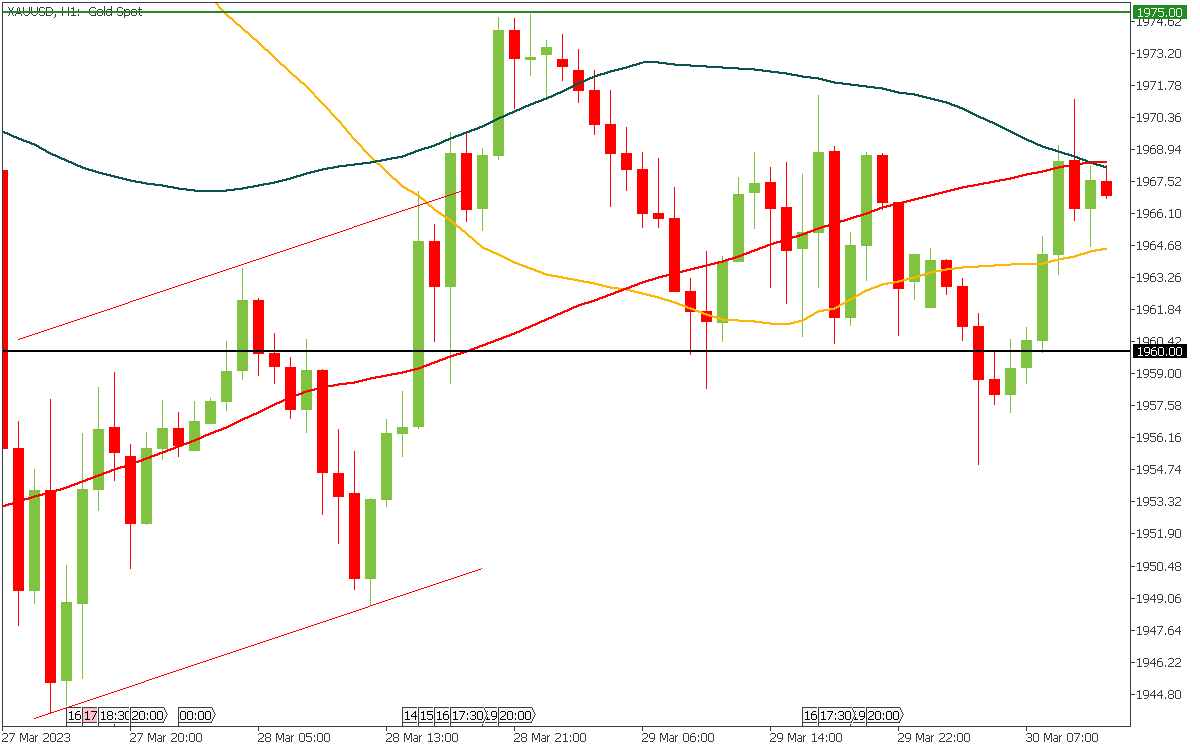

Gold is in flat. The support level is still 1960. The resistance began around 1975. 200MA is moving down, so the local trend is still more bearish.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later