Markets never sleep! Let’s be prepared for a beautiful trading experience by looking at the most important news of Tuesday!

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Tuesday is here, friends! And we are here too. Let’s go through the most exciting news for yesterday and today:

German Ifo Business Climate Index for March was released better than expected: 93.3 VS 91 in the forecast. EURUSD rose slightly during the day by 0.35%.

ECB’s Isabel Schnabel: ‘It is not easy to say how restrictive rates are at this point. Core inflation is still rising. ECB’s Elderson: ‘The ECB will continue to raise rates in the coming months

Australian Retail sales for February have released slightly better expectations (+0.2% VS 0.1% in the forecast). AUDUSD is rising on Tuesday (+0.5%). Do you trade on AUDUSD, guys?

US Treasury Department: ‘Current developments in the banking sector are very different from the 2008-2009 global financial crisis. If necessary, the government will apply tools to prevent a repeat of the chain reaction in the sector.’ We’ll see, we’ll see…

Prime Minister Kishida: ‘Japanese financial institutions have enough liquidity and capital.’ And the Head of the Central Bank of Japan, Kuroda: ‘It is too early to discuss the abandonment of the soft monetary policy.’. USDJPY is bouncing back today. The long-term trend is most likely to be bearish.

All eyes are on crypto, guys. News #1 yesterday: Binance and Its CEO sued by CFTC over US regulatory violations. Bitcoin plummeted by 3% on Monday. The support line is still on 25000. Be careful with long positions, dears.

XBRUSD keeps rising. The next resistance level is close – 50% correction or $78.25.

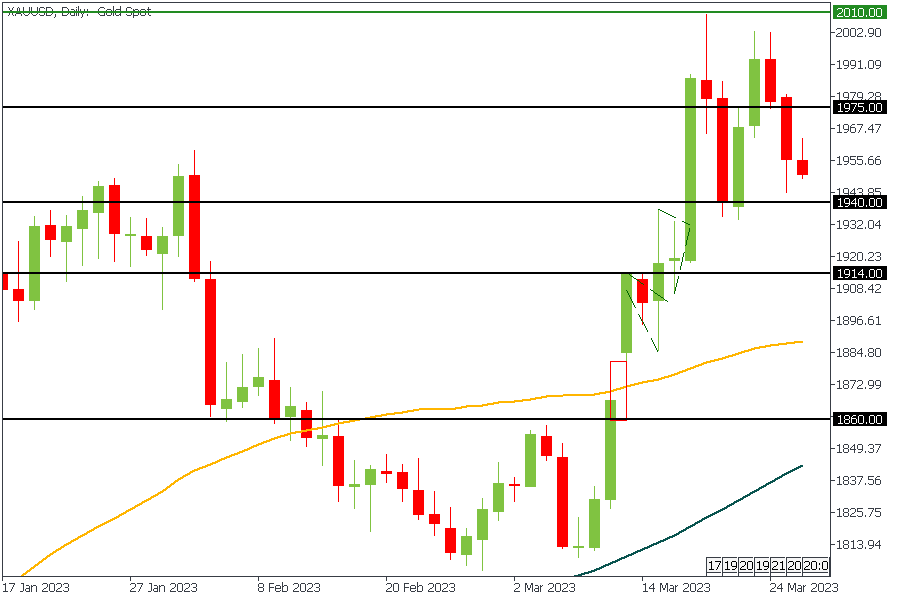

XAUUSD forms some double-top pattern. This is a bearish pattern. If the price breaks the cluster 1930 – 1940, it may continue falling. On the 4H time frame, the price moved below 50MA.

That’s it for today, guys!

Markets never sleep! Let’s be prepared for a beautiful trading experience by looking at the most important news of Tuesday!

The first week of November promises to be eventful, as we have the Fed meeting, the BOE update, and the NFP release. Read more details here.

China delays GDP data because of potentially harmful numbers, but we will never delay our news because every release is an opportunity to trade on it! Here’s what will move markets today:

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later