Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Who’s thinking that Credit Suisse is sinking? Stocks fell by 24.24%. A total disaster. Four years of constant falling. Credit-default swaps are 18 times higher than UBS CDS and nine times higher than Deutsche Bank CDS. It seems like SNB will recapitalize the bank.

The result of the Credit Suisse crisis is the situation with the EU banks’ stocks. Barclays Bank (BARC) -9% during the day, Deutsche Bank -9.27%. Is it time for the correction? Do you trade stocks?

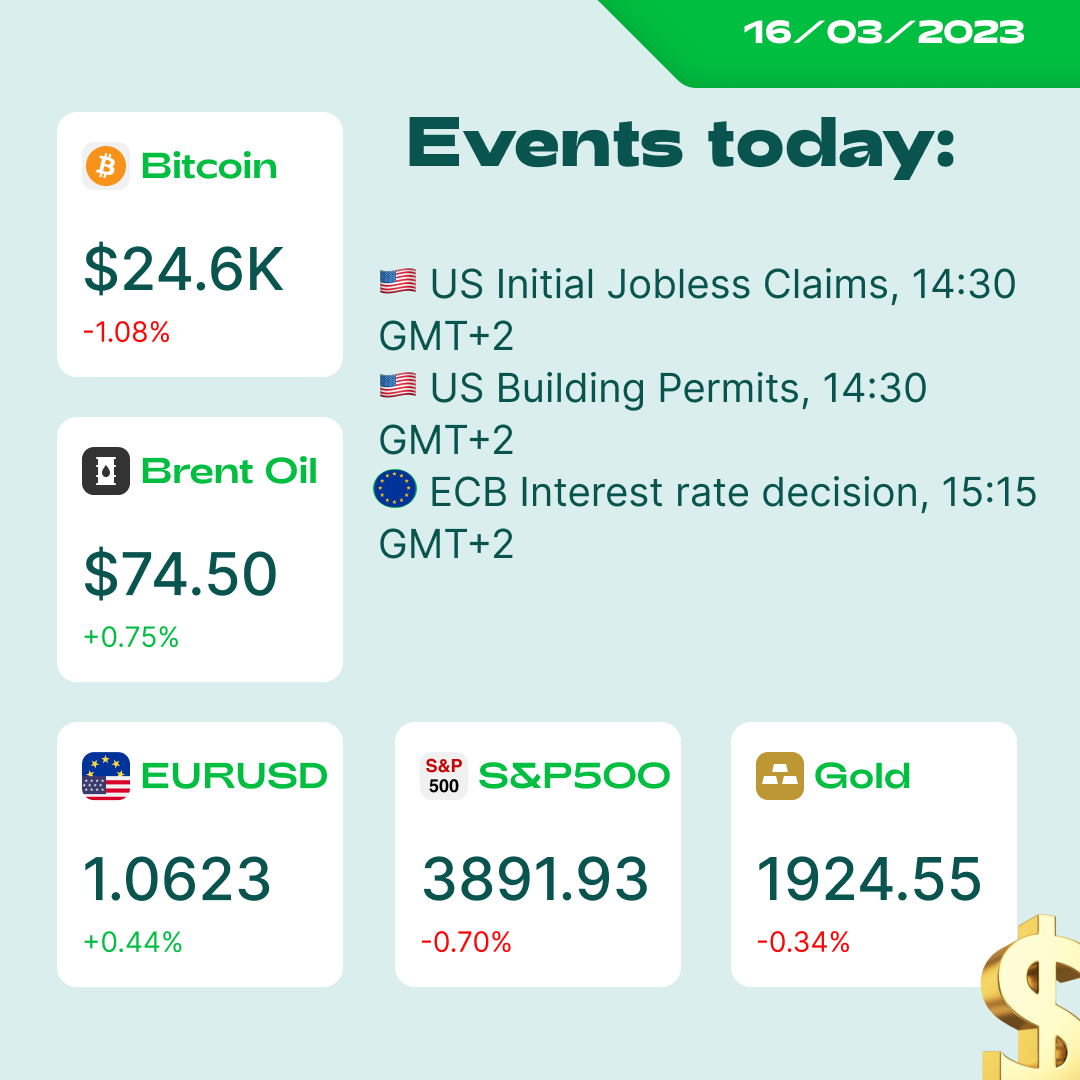

EUR fell too. EURUSD plunged by almost 1.5% - lower than 1.06. Now EURUSD started rising again.

US PPI is around 0% level. PPI YoY is 4.6%, meaning that the sequence of rate hikes gives the result. Retail sales fell in February by 0.4%. But nobody cares. Everybody was watching CS, SVB, etc…

Oxford Economics: ‘Despite the increased stress in the banking system, the Fed remains focused on curbing inflation’;

Moody’s: ‘The Fed is unlikely to raise rates in March, given the turmoil in the banking sector’;

Harris Financial Group: ‘When the Fed raises rates by 5% for a few months, things like SVB happen. The Fed is the cause of the crisis, and it will probably need to cut rates to fix it’.

The market mostly expects that the rate won’t be changed soon.

New Zealand GDP fell for the fourth quarter of 2022 by 0.6%. NZDUSD fell yesterday by 0.77%. The current local trend seems bullish. If NZDUSD breaks 0.61800, it will be time to trade up.

The ECB interest rate decision is expected today at 15:15 GMT+2. The market expects +50 bp – to 3.5%. We have doubts about that, considering the situation in the markets. A lower pace means that EUR may fall.

BTCUSD is stable, fluctuating around the 24500 level. It may move higher. What are your ideas, guys?

XAUUSD bounced back from 50MA and is slightly growing. The situation with the price will depend on the monetary authorities. If there are statements from the officials saying that the condition is stable (putting off the fire), Gold may fall.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later