Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The virus hit all sectors of the global economy and all currencies across the globe. But the starting conditions and fundamentals for each were different. Statistically, therefore, some assets showed little deviation from their previous trajectory while others went to beat their 10-, 20- and even 30-year lows. Let’s check through the board which assets brought the most spectacular performance in 2020.

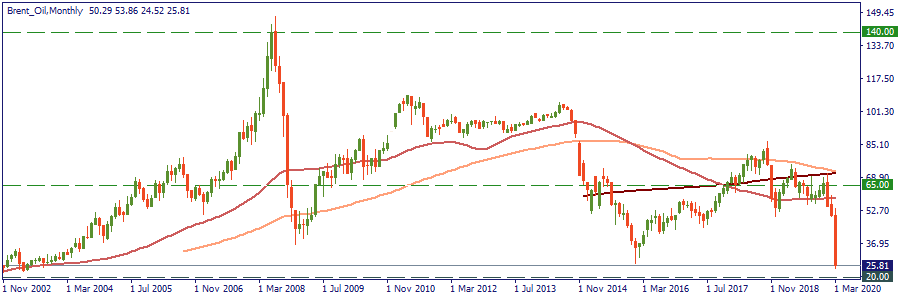

Performance in 2020: -61%.

Nomination “Adding oil into the fire”: this proverb can be literally applied to Russia and Saudi Arabia opening the oil price war amid the virus-hit world economy.

Why it is here: some observers seriously consider $3 per barrel a possible (although a very scary) scenario; even the current $25-30 for Brent and WTI is more than 50% down from where it was just a couple of weeks ago and the prospects are very shady; it brings even more sadness to recognize that Russia and Saudi Arabia de-coupled on March 5 seeing the virus damage all around and caring little of it while due to the virus-reduced demand the price could have gone down there anyways.

Performance against the USD in 2020: -32%.

Nomination “Bottomless”: the Mexican peso has never cost 4 US cents.

Why it is here: Mexican economy is a chronically ill patient, living next to the ever-blooming USA; the US dollar has been appreciating against the MXN all along and probably will always be (as long as things strategically stay as they are), the virus hit just extended the hit and aggravated the position of the peso.

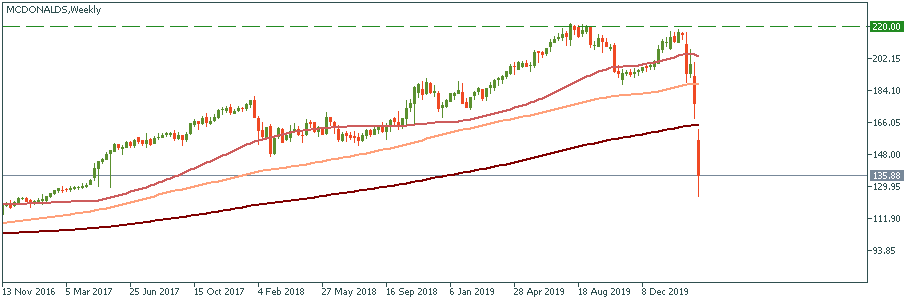

Performance in 2020: -38%.

Nomination “Still loving it?”: McDonald’s belongs to the one of the worst-hit sections of the S&P 500, along with financials and heavy manufacturing.

Why it is here: the 65-year-old corporation used to refer to a new concept of a quick, cheap and joyful lunch with family members and friends; now as the virus imposed the concept of social distancing, this stock had no choice but to neglect its all-time high of $220 reached in August 2019 and re-confirmed as recently as a month ago.

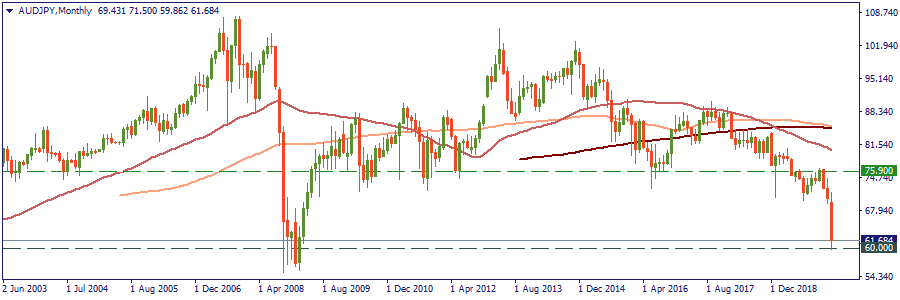

Performance against the JPY in 2020: -21%.

Nomination “12-year lows”: it speaks for itself, the current level of the AUD/JPY is of 2008.

Why it is here: because it is surpassed only by the GBP in terms of how far away the last similar point of the price performance was; there are particular reasons for that though – Australia is an export-oriented country, significantly tied to China, exposed to severe state-wide fires due to climatic change; all of those factors hammer the Australian economy and hence the AUD.

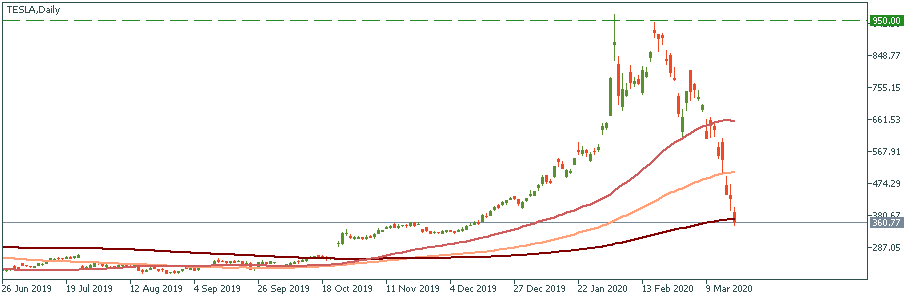

Performance in 2020: -16%.

Nomination “Icarus”: from an all-time high of $950 reached in February, this stock plunged to $360 dropping by 62%.

Why it is here: imagine you had this stock in your portfolio in November 2019; it cost around $350 back then; then you saw it make +200% rise in value and thought “well I’m gonna keep this lucky horse in my collection”; now, you will have to hold your horses.

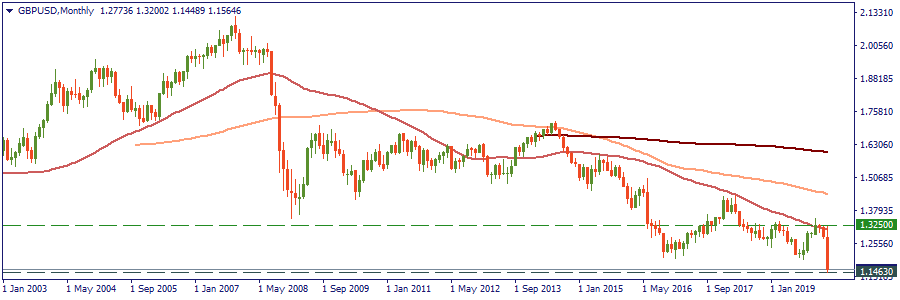

Performance against the USD in 2020: -13%

Nomination “Back to Soviet times”: falling to 1.1463, the GBP/USD got to where it was in 1985.

Why it is here: because 35-year lows don’t happen that often; meaning, yes, the British pound had problems like everyone else now, but erasing 35 years of performance probably was quite unexpected even by the pessimists.

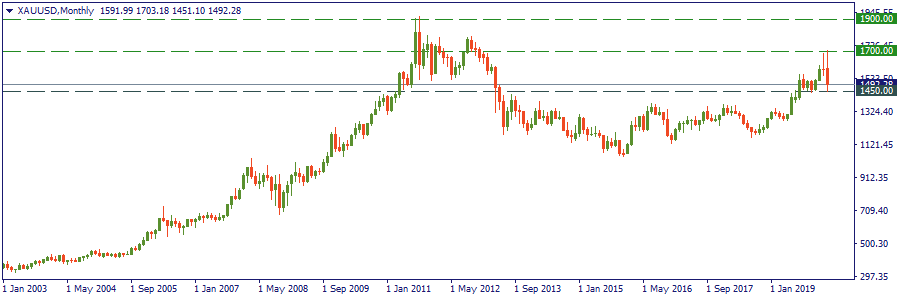

Performance in 2020: -6.4%

Nomination “No, not yet”: from $1700 at the beginning of March it went to test the support of $1450, -14%.

Why it is here: just at the beginning of the month, the precious metal was at the gates of $1700 and was giving all the reason to expect it aim at $1800 and eventually re-fresh high grounds of 2011-2012 – the crisis is around; little did we know that investors decided to nullify gold’s privileges as a safe-haven and dump it as any second-grade asset.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later