The Us Bureau of Labor Statistics will release monthly average hourly earnings, non-farm employment change (NFP), and unemployment rate on June 3, 15:30 MT time (GMT+3).

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The First Oil Decision of 2022

Organization of the Petroleum Exporting Countries (OPEC) is scheduled to meet on January 4.

Organization of the Petroleum Exporting Countries (OPEC) is scheduled to meet on January 4. The meeting will be all day long. OPEC-JMMC meetings are attended by representatives from the 13 OPEC members and 11 other oil-rich nations. They discuss a range of issues regarding energy markets and, most importantly, agree on how much oil they will produce. The meetings are closed to the press, but officials usually talk with reporters throughout the day. A formal statement covering policy shifts and meeting objectives is released after the meetings have concluded.

OPEC on Monday raised its world oil demand forecast for the first quarter of 2022 but left its full-year growth prediction steady, saying the Omicron coronavirus variant would have a mild impact as the world gets used to dealing with the pandemic. OPEC expects oil demand at an average of 99.13 million barrels per day (bpd) in the first quarter of 2022, up 1.11 million bpd from its forecast last month. Some of the recovery previously expected in the fourth quarter of 2021 has been shifted to the first quarter of 2022, followed by a more steady recovery throughout the second half of 2022.

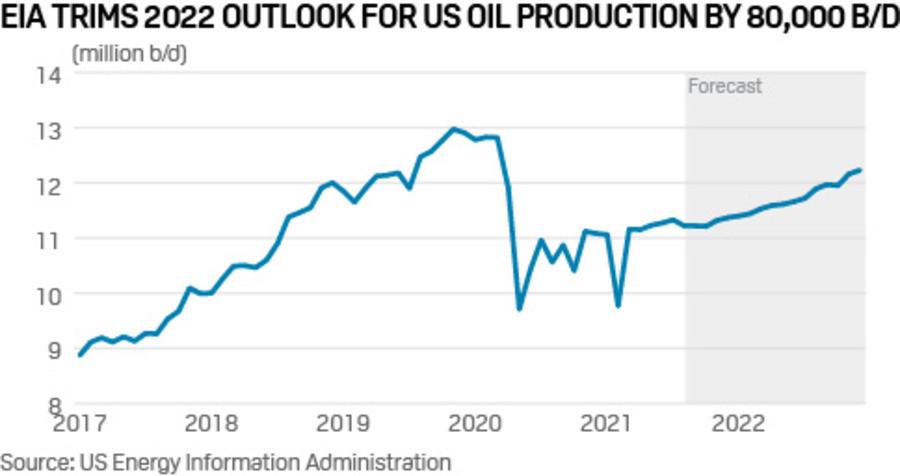

US energy information administration also seeks for increase in demand in 2022. So we can be sure, that OPEC meeting will be hot and help oil to choose the direction for next months.

How to trade on OPEC meeting?

The meeting will affect greatly on Brent and Crude oil. Also, Canadian dollar may move on the news, as the currency is affected by oil prices.

Check the economic calendar

Instruments to trade: XBR/USD, XTI/USD, USD/CAD

The Us Bureau of Labor Statistics will release monthly average hourly earnings, non-farm employment change (NFP), and unemployment rate on June 3, 15:30 MT time (GMT+3).

The Organization of Petroleum Exporting Countries will hold a meeting on June 2.

For a long time, traders considered American Non-farm Payrolls (NFP) the most important release in the market. However, the situation has changed. Now US CPI moves financial markets.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later