Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The outcome of today’s rate decision of the Bank of Canada was not too shocking after the rate cut by the Fed. Still, an announcement of a rate cut by 50 basis points instead of 25 basis points expected by the market was surprising. The shift from 1.75% to 1.25% was a reaction to the weaker outlook amid coronavirus threats.

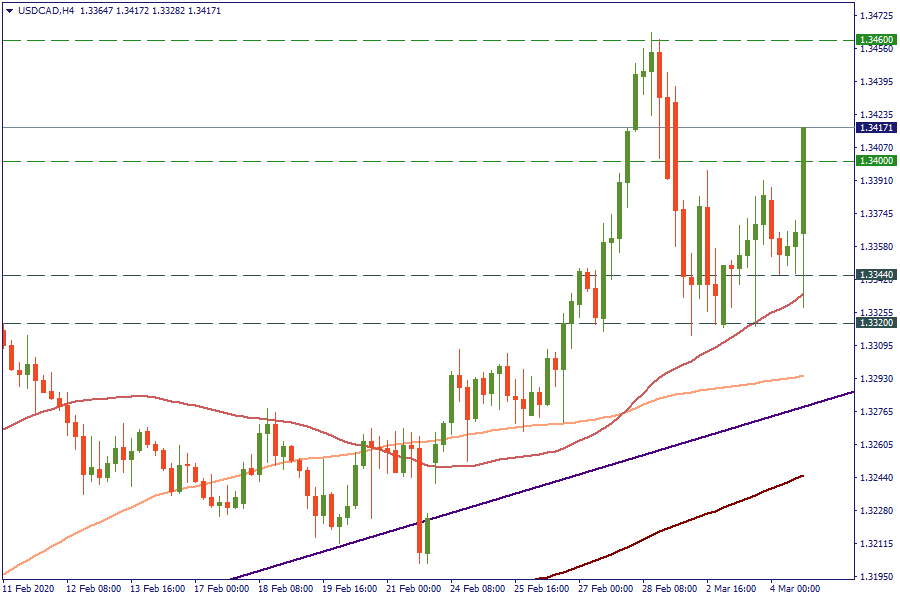

USD/CAD initially spiked above the 1.34 level after the release on H4, opening the way for bulls to the next key resistance at 1.3460. It’s worth mentioning that the trading of a pair has been very volatile within a day, as it has also tested the levels below the 1.3344 support.

CAD/JPY has fallen to the lowest levels since last October. On H4, the pair has tested the 79.95 level. The next support in the focus of bears lies at 79.82.

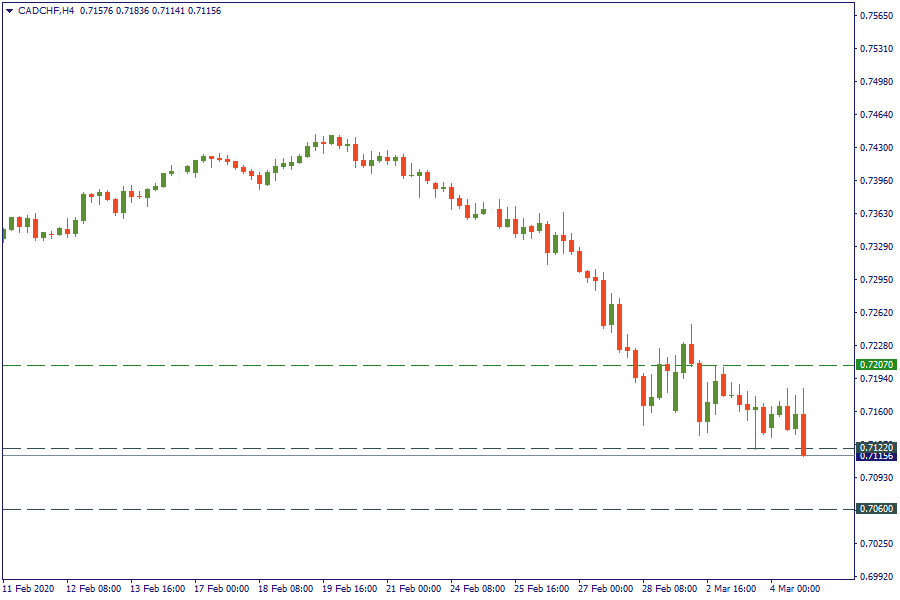

As for CAD/CHF, the pair has tested the lows of May 2017 at 0.7122. If it’s broken, the slide to the 2016 lows at 0.7060 will be expected. Upside momentum is limited by the 0.7207 level.

The central bank did not exclude the possibility to apply more measures if needed. On Thursday, it is recommended to follow the comments by the BOC Governor Stephen Poloz at 19.45 MT time. His speech may contain some details on further actions by the bank.

Let's not forget about the OPEC meeting tomorrow. The decision on oil output may also move the CAD, as it is commodity-linked currency.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later