The most impactful releases of this week will fill the market with volatility and sharp movements.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Another week was full of coronavirus fears, which moved the markets a lot. Let’s consider the best and the worst-performing assets as Monday’s session kicks in.

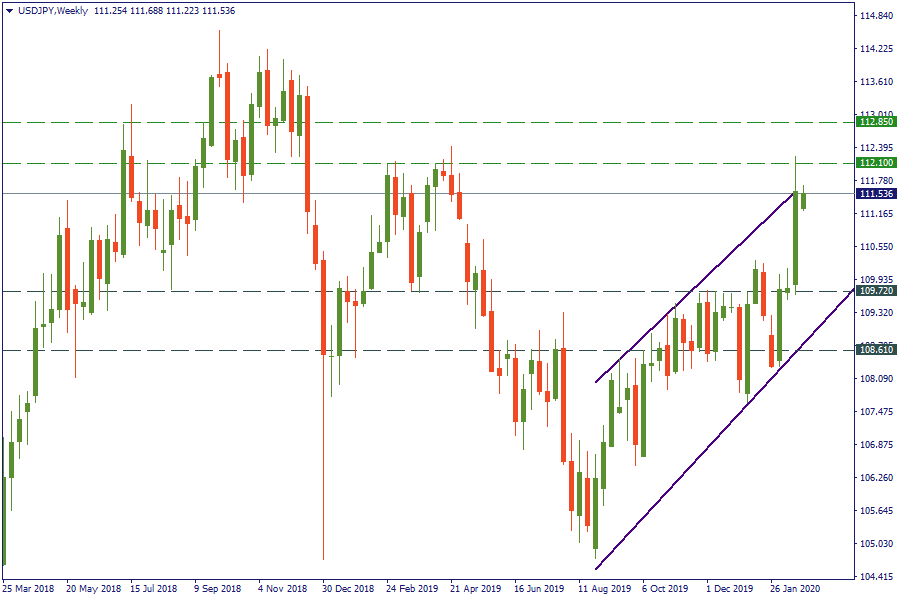

If you are a trader of major currency pairs, look at USD/JPY. The pair rose from the 109.85 level towards the resistance at 112.1. If the USD continues strengthening this week, bulls will break the 112.1 level and target the next resistance at 112.85. On the downside, there is a strong support level at 109.72.

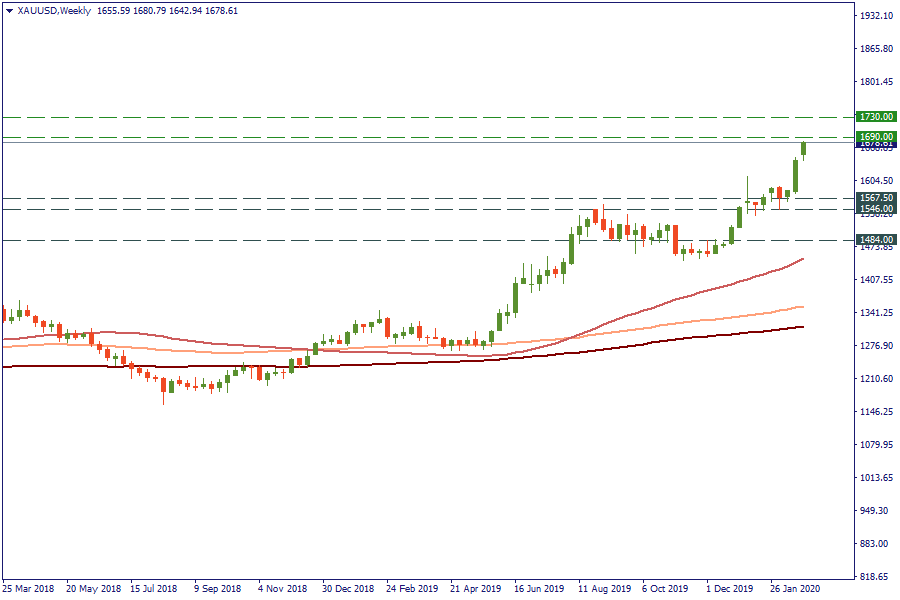

Among commodities, the safe-haven gold, as well as palladium, was the main gainer. The price for gold rose from $1,582 to $1,584 last week and has opened with a gap up today, moving even higher to the $1,690 level. The next key resistance will be placed at the highs of November 2012 at $1,730. In case of a risk-on sentiment, wait for the reversal to $1,567.5.

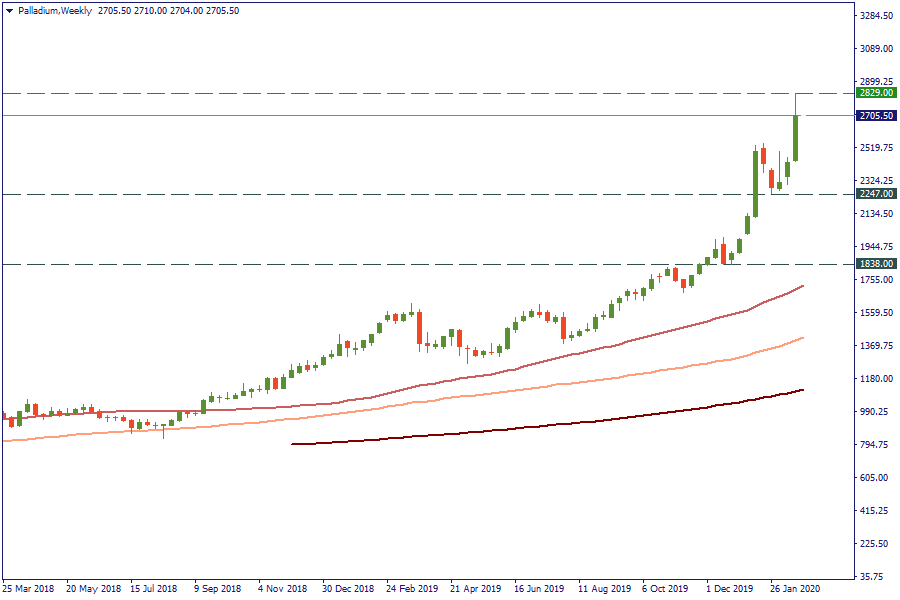

As for palladium, the price for this metal jumped by $385.5 and reached an all-time high at $2,829. The key support level for bears lies at $2,247.

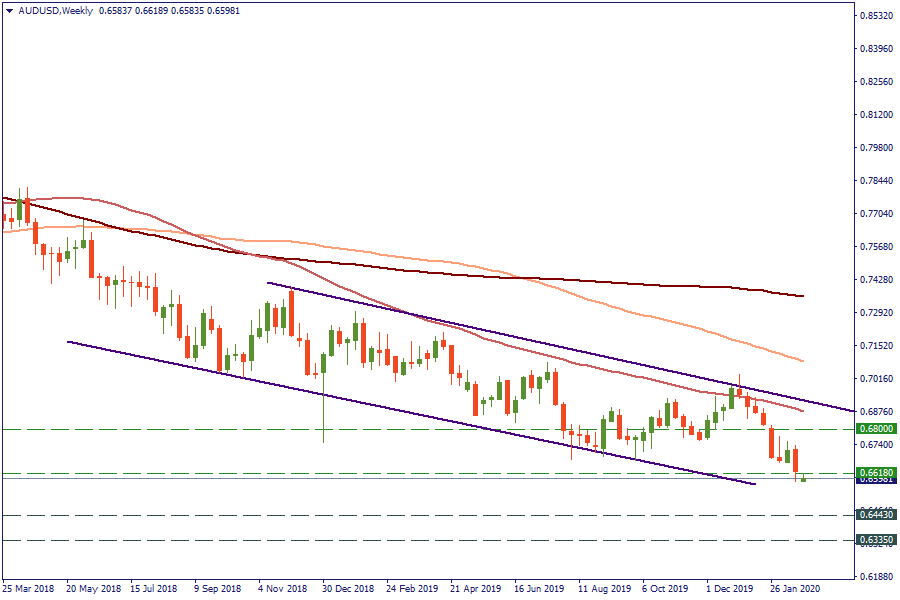

Of course, the Australian and the New Zealand dollars faced pressure amid the risk aversion. The AUD/USD pair was going down and tested the levels below the 0.6618. The next support for the pair lies at 0.6443. Bulls need to push the pair above the 0.6618 level in order to reach the 0.68 level faster.

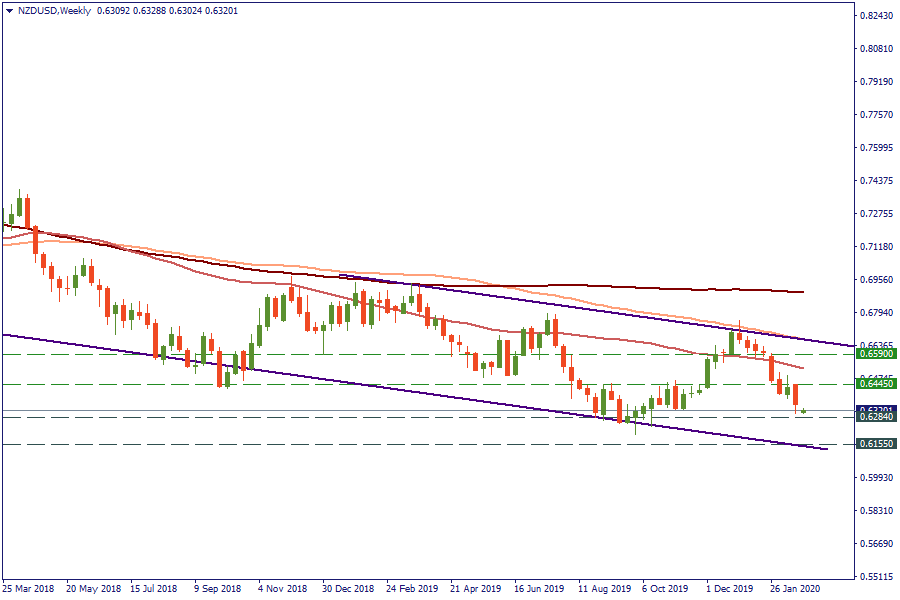

The kiwi was down by 143 pips last week, moving lower t the support at 0.6284. If this level is broken, the next support will lie at 0.6155.

Also, GBP/USD was among the weakest pairs last week. It fell from the opening price of 1.3034 to the lows at 1.2848. The closest support lies at 1.2832. The next one will be placed at 1.2726. The upside momentum will be limited by the 1.3053 level.

The award for the most volatile pairs go also to exotics: USD/MXN and USD/TRY showed some sharp moves last week.

What will be the key movers this week?

Follow the news, check the economic calendar and watch the movement of the assets traded on our platform!

The most impactful releases of this week will fill the market with volatility and sharp movements.

We prepared an outlook of major events of this week. Check it and be ready!

Here you'll find what awaits the market this week, from the CPI release to a possible gold plunge.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later