When is Google's stock split? Alphabet, the parent company of Google, will make the 1:20 split on July 15…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

In the virus-hit global economy, certain market segments have converted into a playground for fierce corporate competition. That is definitely correct for the pharmaceutical sector with the public companies involved in developing the COVID-19 vaccine. Being in the center of investors’ attention, they are gaining value more than other companies. Those which succeed with the vaccine will surely see their stock price fly. FBS offers you to fly with them: below is the list of the recently added pharma stocks - they give you a great opportunity to get extra profits while the rest of the world just starts awakening!

Moderna (MRNA)

Moderna is an American biotechnology company based in Cambridge. While this corporation specializes in transformative medicines based on messenger ribonucleic acid, its stock now specializes in showing an unseen velocity of value growth. Challenging $30 per share when the virus hit, this stock has added more than 100% in value since then. If it grows another 100%, don’t say we didn’t tell you!

Inovio (INO)

Inovio Pharmaceuticals was another promising small-cap biotech stock before the coronavirus pandemic, which traded below $5 per share. Somewhere on the way, it managed to make a leap of 400% up that value - now that you know what it is capable of, grab it while it is at $11!

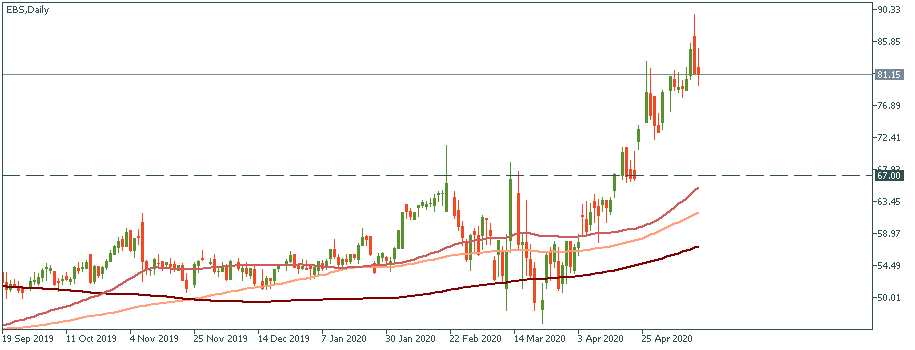

Emergent (EBS)

Emergent BioSolutions is an American multinational specialty biopharmaceutical company headquartered in Gaithersburg, Maryland. It develops vaccines and antibody therapeutics for infectious diseases, opioid overdoses, and provides medical devices for biodefense purposes. After it recovered 100% of its virus losses breaking $67, it went almost straight to the current $84 – a fusion of growth and consistency.

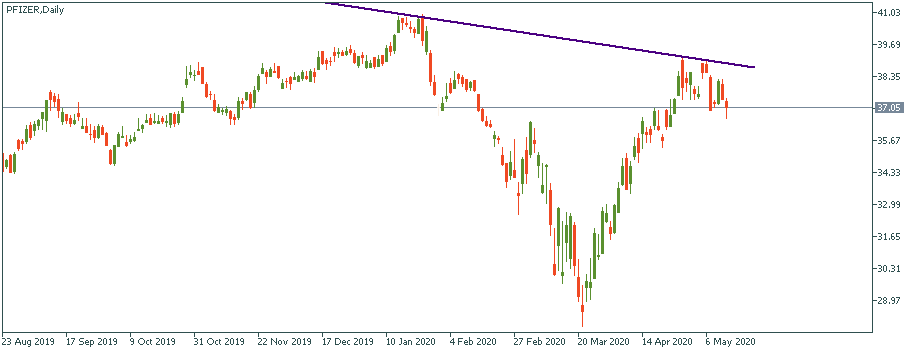

Pfizer (PFE)

One of the world's largest pharmaceutical companies, Pfizer has been in Dow Jones Industrial Average since 2004. Its stock has been in decline since 2018 and currently trades at $38 after recovering from the drop to $28. Clearly, if it does well with the vaccine, the future may start shining again for Pfizer.

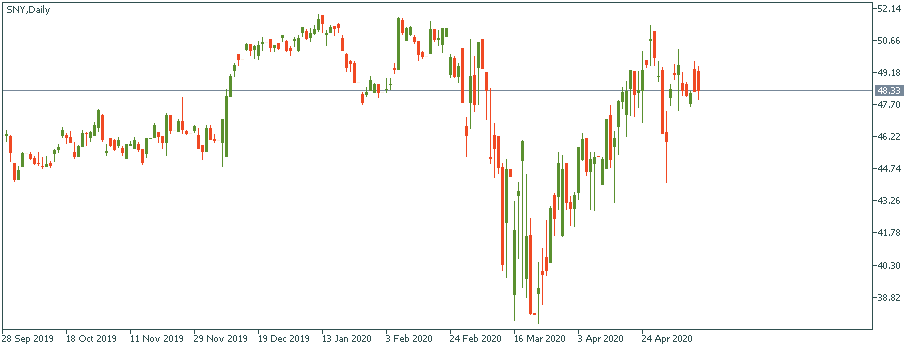

Sanofi (SNY)

Sanofi S.A. is a French multinational pharmaceutical company headquartered in Paris. Sanofi engages in the research, production, and distribution of pharmaceutical products. It was quick to recover almost all its losses and will surely be quick to climb higher if the vaccine is finally developed!

BioNTech (BNTX)

BioNTech SE provides biotechnological solutions. It is headquartered in Mainz, Germany. The Company develops various types of treatments for cancer patients and provides treatment worldwide. Similar to Inovio, it made a vertical leap to +100% of its value and has full potential to repeat it – be there for it!

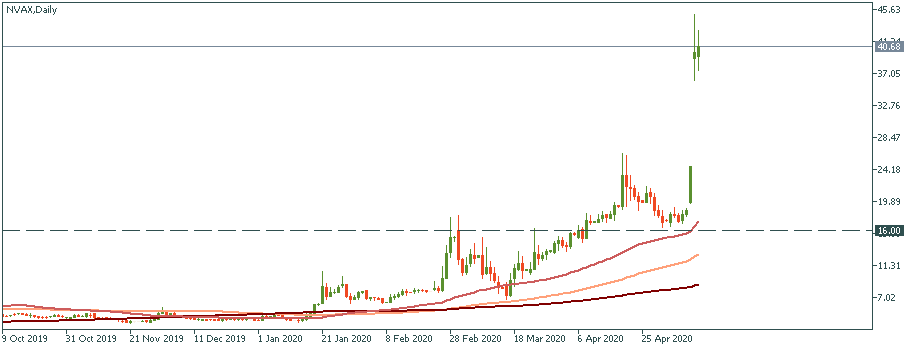

Novavax (NVAX)

Novavax is an American clinical-stage vaccine company headquartered in Gaithersburg, Maryland with additional facilities in Uppsala, Sweden. The company received an $89mln research grant from the Bill and Melinda Gates Foundation for the development of vaccines for maternal immunization – that is surely not for nothing! Trading currently at $25 per share, it was just 50% of it a month ago – don’t miss out on it!

Gilead (GILD)

Gilead Sciences is an American biopharmaceutical company headquartered in Foster City, California. The company focuses primarily on antiviral drugs used in the treatment of HIV, hepatitis B, hepatitis C, and influenza, including Harvoni and Sovaldi. While high volatility of this stock needs to be mentioned, so does its potential for a breakthrough if the COVID-19 vaccine is developed successfully.

When is Google's stock split? Alphabet, the parent company of Google, will make the 1:20 split on July 15…

The bullish movement in the stock market is gaining speed, and Bitcoin ETFs are closer than they might seem. What do we need to know for the next trading week?

On Wednesday, September 22, Microsoft will be holding a product launch. The event starts at 18:00 GTM + 3.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later