The Us Bureau of Labor Statistics will release monthly average hourly earnings, non-farm employment change (NFP), and unemployment rate on June 3, 15:30 MT time (GMT+3).

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Something more Important than NFP

For a long time, traders considered American Non-farm Payrolls (NFP) the most important release in the market. However, the situation has changed. Now US CPI moves financial markets.

For a long time, traders considered American Non-farm Payrolls (NFP) the most important release in the market. However, the situation has changed. Now US CPI moves financial markets.

United States Bureau of Labor Statistics will release monthly CPI and core CPI on December 10, 15:30 GMT+2. The Consumer Price Index measures the average change in prices consumers pay for a basket of goods and services. The CPI statistics cover a variety of individuals with different incomes, including retirees, but do not include specific populations, such as patients of mental hospitals.

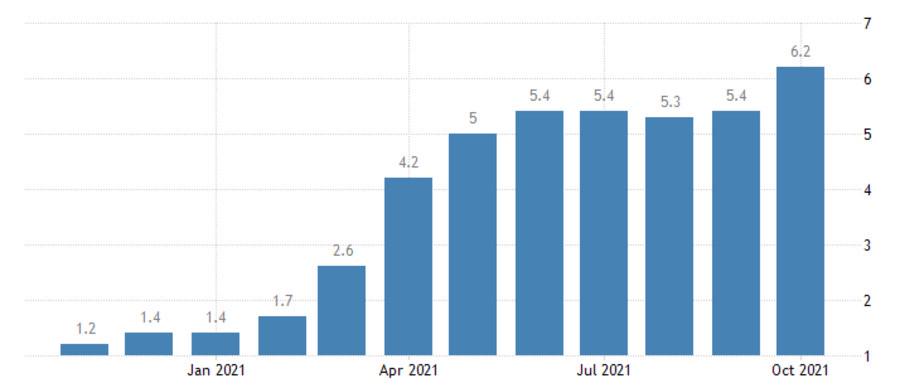

For a decade, the US maintained the inflation rate relatively low (around 1-2%). However, in 2021 it hit 6.2%, a 13-year high.

Moreover, US consumer prices jumped in October at the fastest pace in three decades as inflationary pressures spread further throughout the economy, putting the Biden administration on the defensive and increasing prospects that the Federal Reserve will raise interest rates next year.

Concerns over another wave of Covid-19 may affect tapering plans. But in sight of a relatively slow tapering process and rate hike that is still far away, inflation in the US may reach 10% in several months. Almost every release of CPI has been accompanied by massive movements in USD-related assets and USD currency pairs. For example, last month showed an unusually high increase in inflation. The USD rose versus other currencies and fell against gold. The metal soared 4500 pips after the release.

Due to the importance of CPI data, it may influence gold and USD pairs. Gold is considered a hedge against inflation, but high numbers increase the chance for rate hikes so that the metal may fall against the greenback.

Check the economic calendar

Instruments to trade: XAU/USD, EUR/USD, NZD/USD, USD/JPY.

The Us Bureau of Labor Statistics will release monthly average hourly earnings, non-farm employment change (NFP), and unemployment rate on June 3, 15:30 MT time (GMT+3).

The Organization of Petroleum Exporting Countries will hold a meeting on June 2.

Organization of the Petroleum Exporting Countries (OPEC) is scheduled to meet on January 4.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later